Zambia advances 2025 tax reform, proposes 1% minimum alternative tax for businesses

Key proposals include a 1% MAT on turnover, 15% to 20% withholding tax on government securities, and excise duty hikes on cigarettes, alcohol, sugary drinks, and betting services. Zambia's National Assembly has advanced the Income Tax

See MoreIndonesia: Chief Economic Minister says 19% US tariff may take effect before 1 August

Trump imposed a 19% tariff on Indonesian goods as part of a new trade agreement, effective 1 August Indonesia's Chief Economic Minister, Airlangga Hartarto, announced on 21 July 2025 that the 19% tariff on Indonesian goods entering the US could

See MorePakistan: FBR extends deadline for sales tax integration with e-invoicing system

FBR has announced a one-month extension for sales tax-registered businesses to integrate their systems with its electronic invoicing platform. The Federal Board of Revenue (FBR) of Pakistan has granted an additional one-month extension for

See MoreBrazil: Federal Supreme Court Justice reinstates financial transaction tax increase

Federal Supreme Court Justice Alexandre de Moraes has reinstated Decree No. 12.499 with retroactive effect from 11 June 2025 after failed government-National Congress conciliation. Brazil's Federal Supreme Court Justice Alexandre de Moraes

See MoreAustralia: ATO issues guidance on GST treatment of container deposit scheme refunds

The ATO clarified that entities offering value in exchange for scheme refunds may be liable for GST. The Australian Taxation Office (ATO) issued guidance on 15 July 2025, regarding GST treatment for material recovery facility operators

See MoreHungary updates tax rates on retail, financial entities, and insurance sectors

Act LIV of 2025 introduces updated tax rates, increased VAT thresholds, and new regulations across retail, financial, insurance, and energy sectors, along with enhanced R&D deductions. Hungary has published Act LIV of 2025 in the Official

See MoreUS: Sales tax applies to resold goods under Trump tariffs, says SSTGB

The SSTGB confirmed that sales tax applies to tariffs on imported goods resold in its 24 member states. The Streamlined Sales Tax Governing Board (SSTGB) has confirmed that sales tax applies to tariffs on imported goods, including those recently

See MoreTanzania enacts 2025-26 budget measures, includes new transfer pricing penalty

The measures will apply from 1 July 2025, unless otherwise specified. Tanzania's Finance Act 2025 was enacted on 30 June 2025, implementing tax measures from the 2025-26 Budget Speech with some adjustments to the initially announced

See MoreBrazil: AGU appeals suspension of financial transaction tax hike

The AGU argues that the Executive Branch has constitutional authority to adjust IOF rates and claims the National Congress violated the separation of powers by suspending presidential decrees. Brazil's Attorney General's Office (AGU) appealed to

See MoreEU: European Commission proposes measures to curb carbon leakage in exports

The proposal, set for finalisation by end-2025, aims to protect at-risk producers from carbon leakage and ensure equal treatment of all goods within EU trade. The European Commission has announced plans to introduce a new measure to address the

See MoreAustralia: ATO announces FX Rates for year ending June 2025

The ATO has updated its foreign exchange rate guidance, including monthly rates for July 2024 to June 2025. The Australian Taxation Office (ATO) has updated its guidance on foreign exchange rates, incorporating rates for the financial year ending

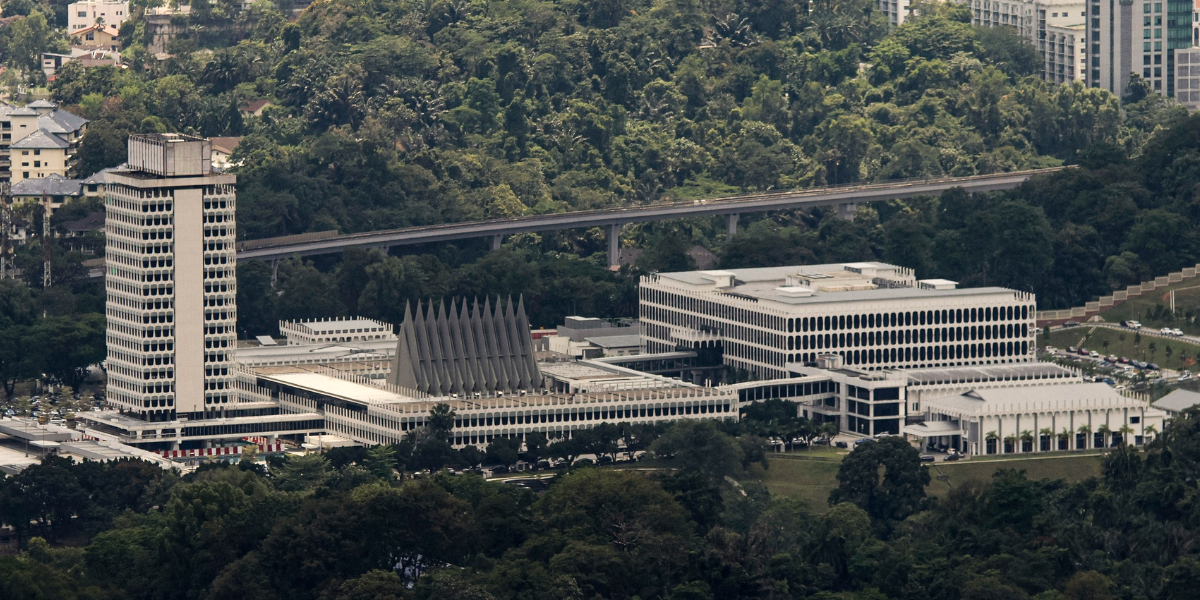

See MoreMalaysia imposes anti-dumping duties on iron and steel from China, South Korea, and Vietnam

Import duties ranging from 3.86% to 57.90% are imposed on galvanized iron and steel coils or sheets from these countries. Malaysia’s Ministry of Trade and Industry has announced provisional anti-dumping duties on certain iron and steel imports

See MoreUS: Maryland clarifies 3% sales tax rules for multi-state it services

The 3% sales and use tax takes effect on 1 July 2025. The Comptroller of Maryland has released Technical Bulletin (TB) 54, offering comprehensive guidance for buyers and vendors on complying with the expanded 3% sales tax on data, IT, and

See MoreFrance, Kenya and allies push global airline ticket tax to fund climate adaptation

A coalition including France, Kenya, Barbados, and others aims to expand air travel taxes to raise billions for climate resilience in developing countries ahead of the 2025 UN climate summit. A coalition of countries including France, Kenya,

See MoreDenmark proposes amendments to property tax rules

The consultation addresses proposed changes to property tax rules, including retroactive preliminary assessments and loan scheme adjustments, and closes on 21 August 2025. Denmark launched a public consultation on a draft bill proposing technical

See MoreCanada announces legislation to ensure carbon rebates for small businesses are tax-free

The draft legislation ensures that all Canada Carbon Rebates for Small Businesses are provided tax-free. Canada's Department of Finance announced on 30 June 2025 that Carbon Rebates for small businesses will be tax-exempt, enabling eligible

See MoreMalaysia exempts imported fruits from sales and service tax

Malaysia exempts imported apples, oranges, mandarin oranges, and dates from sales tax as part of revised sales and service tax changes aimed at easing living costs and supporting small businesses. Malaysia's Ministry of Finance revised the Sales

See MoreUS: Florida aligns with federal IRC, ends business rent tax

Governor Ron DeSantis signed a bill that enacts a USD 1.3 billion tax relief package that updates Florida’s tax code conformity to January 2025 and repeals the business rent tax from October 2025. Florida Governor Ron DeSantis signed House Bill

See More