Czech Republic confirms defence tax covered by double taxation treaty with Japan

The Czech Republic’s Ministry of Finance has announced, on 5 November 2025, that Japan’s recently introduced Special Corporation Tax for Defence will be recognised under the existing double taxation treaty between the two countries. According

See MoreLiberia: Government announces 2026 draft budget, introduces presumptive corporate income tax

Liberia’s Ministry of Finance and Development Planning delivered the draft national budget for 2026, on 11 November 2025, focusing on fostering an inclusive economy, safeguarding stability, and delivering real, tangible improvements for its

See MoreSri Lanka: MoF unveils 2026 budget, proposes lower VAT and capital allowance thresholds

Sri Lanka’s Minister of Finance, Planning, and Economic Development presented the Budget Speech for 2026 on 7 November 2025, outlining significant tax policy changes—including the alignment of VAT and social security contribution levies across

See MoreUK: HMRC updates transfer pricing guidance

The UK’s HM Revenue and Customs (HMRC) revised its Transfer Pricing Operational Guidance (INTM480000) on 10 November 2025. The update revises the section Searching for comparables: range of results (INTM485120), which sets out HMRC’s approach to

See MoreSlovenia updates corporate income tax rules for investment funds

Slovenia has amended its Corporate Income Tax Act (ZDDPO-2V), with the changes published in the Official Gazette No. 85/2025 on 6 November 2025. The revisions introduce new provisions for investment funds and clarify rules for asset transfers and

See MoreSri Lanka: IRD announces upcoming tax CIT, PIT, IIT deadlines

The Sri Lankan Inland Revenue Department (IRD) has released a "NOTICE TO TAXPAYERS", issuing a gentle reminder to all taxpayers that crucial deadlines for submitting the income tax return and remitting income tax payment and withholding tax payments

See MoreBulgaria: MoF updates transfer pricing rules

Bulgaria’s Ministry of Finance (MoF) issued Ordinance H-3 of 7 November 2025, updating the country’s transfer pricing framework to align with the latest OECD Transfer Pricing Guidelines. The ordinance was published in the State Gazette on 11

See MoreLithuania: Two-thirds of cash registers reports to VMI

Lithuania’s State Tax Inspectorate (VMI) stated on 10 November 2025 that around 75% of cash registers are now transmitting revenue data to i.EKA. Out of 19,000 small business operators, about 15,000 are submitting data, while 13,000 have yet to

See MoreUAE: MoF updates administrative penalties for tax violations

The UAE Ministry of Finance has issued a consolidated version of Cabinet Decision No. 40 of 2017, which outlines administrative penalties for tax law violations, as updated by Cabinet Decision No. 129 of 9 October 2025. The updated decision

See MoreUK: HMRC updates guidance on crypto reporting ahead of 2026 rules

The UK tax authority, His Majesty's Revenue & Customs (HMRC), has revised its guidance on the Crypto Asset Reporting Framework (CARF) on 5 November 2025 within the International Exchange of Information Manual, starting at IEIM800001. From 1

See MoreTaiwan: MoF clarifies inheritance tax rules for farmland in self-benefit trusts

Taiwan’s Southern District National Taxation Bureau of the Ministry of Finance stated that if the settlor of a self-benefit trust transfers agricultural land into a trust during their lifetime, the property left upon their death is the right to

See MoreFinland: MoF consults on proposed amendments to the minimum tax act for large corporate groups

Finland’s Ministry of Finance has launched a public consultation on proposed changes to the Minimum Tax Act on 11 November 2025 to maintain compliance with the EU Minimum Tax Directive (2022/2523). The legislative change would ensure that

See MoreSlovak Republic publishes legislation to enact DAC9, Pillar 2 administrative guidance

The Slovak Republic published Law No. 291/2025 on 21 October 2025 in the Official Gazette on 10 November 2025, implementing Council Directive (EU) 2025/872 of 14 April 2025 (DAC9). DAC9 introduces rules that allow the central filing of the Top-up

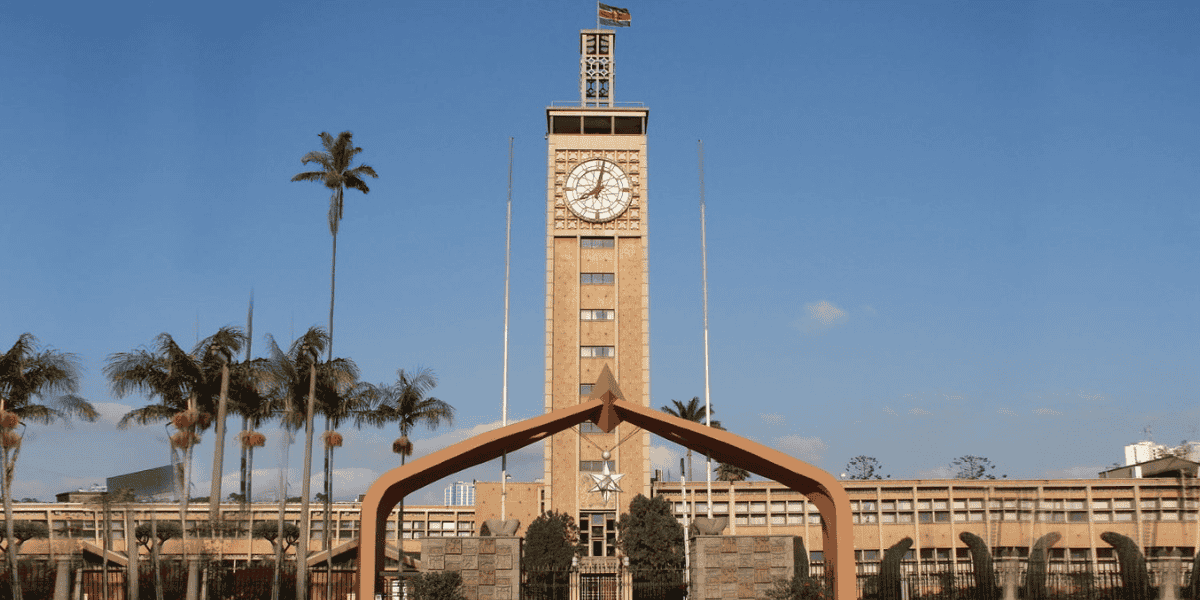

See MoreKenya: KRA to cross-check tax returns against official data sources

The Kenya Revenue Authority announced on 11 November 2025 that, beginning 1 January 2026, it will start cross-checking income and expenses reported in both individual and non-individual tax returns against specific data sources. Validation of

See MoreFinland: MoF reports IMF approves its new fiscal framework

Finland’s Ministry of Finance announced that the International Monetary Fund (IMF) published its statement on the Finnish economy on 10 November 2025. The report praises Finland’s new national fiscal framework. According to the IMF, the

See MoreBrazil: RFB extends deadline for tax settlement programs

Brazil’s Federal Revenue Service (RFB) has extended the deadline for taxpayers to join tax settlement programs under Public Notices RFB No. 4/2025 and 5/2025 on 10 November 2025. The extension was formalised by Ordinance RFB No. 600/2025,

See MoreBrazil to make electronic tax domicile mandatory for all companies from 2026

As part of the Consumption Tax Reform (RTC), Brazil’s Federal Revenue Service announced that all legal entities will be required to use the Electronic Tax Domicile (DTE) as their official communication channel beginning 1 January 2026. Under

See MoreUS: Treasury Department discontinues direct file option for individual tax returns

The US Department of the Treasury issued a report to Congress in October 2025 regarding the replacement of the Direct File program for individual income tax returns. Initially launched during the 2024 tax filing season in 12 states, the program

See More