Russia updates tax information exchange list

Russia’s Federal Tax Service (FTS) has updated its lists of jurisdictions for tax information exchange, effective 31 December 2024. The new changes were announced through two decrees, No. IED-7-17/914 and IED-7-17/916, published on 20 December

See MoreUS: Treasury, IRS finalise digital asset reporting rules

The US Treasury Department and Internal Revenue Service (IRS) has published a document (TD 10021) finalising final regulations regarding information reporting by brokers that regularly provide services effectuating certain digital asset sales and

See MoreIceland announces CbC reporting requirements, deadline for FY 2024

The Icelandic Directorate of Internal Revenue has issued Notice No. 1676/2024, outlining the for country-by-country (CbC) reporting requirements for multinational enterprises for the 2024 fiscal year. As per the notice, entities subject to CbC

See MoreKazakhstan expands transfer pricing monitoring for cross-border transactions

Kazakhstan has expanded its list of goods, works, and services subject to transfer pricing monitoring. The updated list includes new items such as coal, lignite, hydrogen, polymers, raw aluminium, iron and steel products, various grains like rice

See MoreLithuania updates CbC reporting rules for MNEs

Lithuania’s tax authority has revised its Country-by-Country (CbC) reporting requirements for multinational enterprises (MNEs), effective from 21 November 2024. All notifications must now be submitted electronically via the "Mano VMI"

See MoreFrance updates guidelines on royalties declaration under DAC7

French tax authorities clarified that companies managing copyright royalties and inventor rights require companies to include the beneficiary's date of birth in declarations when the recipient is an individual residing in another EU Member State.

See MoreDominican Republic extends CbC reporting deadline

The Dominican Republic's Directorate General of Internal Revenue (DGII) issued Notice 26-2024 on 2 January 2024, extending the deadline for the submission of Country-by-Country (CbC) reports for 2023 fiscal year to 31 January 2025. The MNE

See MorePoland sets base and margin rates for transfer pricing

Poland has published Notice No. 1105 in the Official Gazette on 21 December 2024, setting the base interest rates and margin interest rates for transfer pricing in individual and corporate income taxes. The regulation establishes base interest

See MoreBrazil: Revenue authority publishes updated guidance on commodities transfer pricing

Brazil’s revenue authority (Receita Federal) has issued new guidelines for Normative Instruction RFB No. 2246 of 30 December 2024, outlining rules for companies regarding the management of transfer pricing for transactions that involve commodities

See MoreMalaysia updates transfer pricing guidelines, audit framework

Malaysia’s Inland Revenue Board (IRB) has updated transfer pricing guidelines and transfer pricing audit framework. The transfer pricing guidelines have been updated in accordance with the amendments made to section 140A, the introduction of

See MoreRussia updates CbC reporting jurisdictions

The Russian Federal Tax Service (FTS) has updated its list of jurisdictions for automatic exchange of country-by-country (CbC) reports, effective 31 December 2024. The revised list comprises 45 states and 10 territories, compared to the previous

See MoreAustralia gazettes instrument regarding Taxation Administration (Country by Country Reporting Jurisdictions) Determination 2024

The Australian Official Gazette, on 17 December 2024, published a legislative instrument for CbC reporting jurisdictions by the Taxation Administration for the year 2024. This instrument includes the list of CbC reporting jurisdictions along with

See MoreKorea (Rep.): National Assembly passes 2024 Tax Law Amendment Bill

The South Korean National Assembly approved the 2024 Tax Law Amendment Bill on 10 December 2024. The amendments will affect various tax regulations which include: Deferral of Crypto Gains Tax The bill introduces a two-year deferral on the

See MoreOECD introduces new tools to simplify transfer pricing (Amount B)

The OECD has announced the launch of new tools to streamline the implementation of Amount B under Pillar One aimed at simplifying transfer pricing rules. Amount B under the Two-Pillar Solution to Address the Tax Challenges of the Digitalising

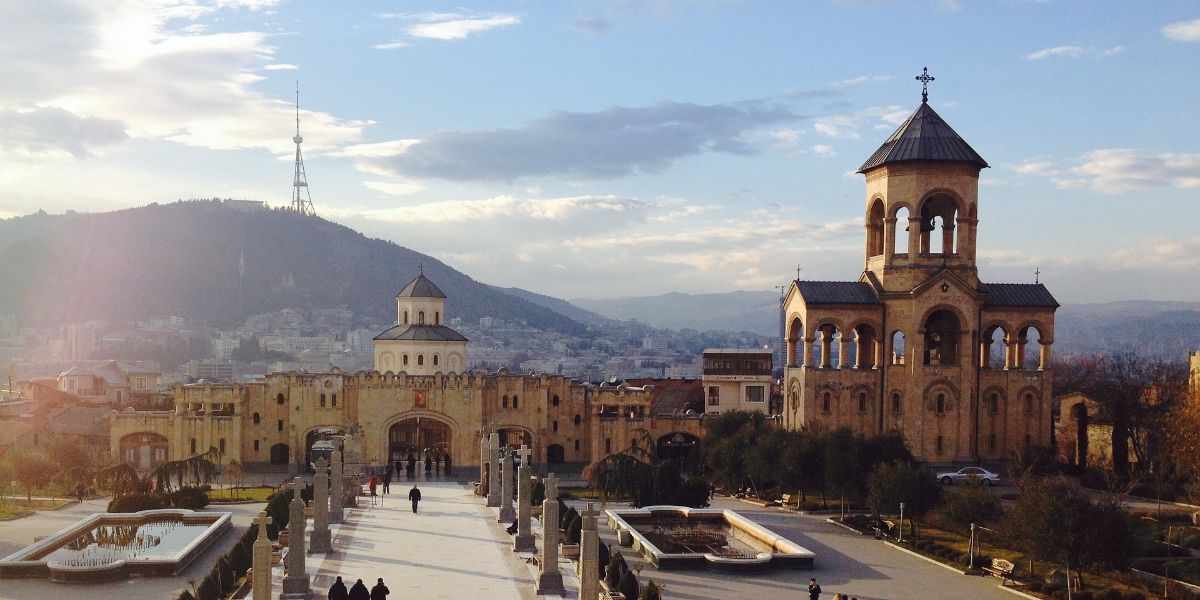

See MoreGeorgia amends transfer pricing regulations for 2025

Georgia’s Ministry of Finance has announced that it has amended its international controlled transaction regulations through Order No. 331 (issued on 2 October 2024) to align with the latest OECD Transfer Pricing Guidelines. The amendment also

See MoreSwitzerland: SIF updates AEOI jurisdictions list, changes status of Belize

The Swiss State Secretariat for International Finance (SIF) released an updated list of jurisdictions participating in the automatic exchange of information (AEOI) on financial accounts on 17 December 2024. Recent updates include a change in

See MoreAustralia announces jurisdictions for public CbC reporting

Australia has published the Taxation Administration (Country by Country Reporting Jurisdictions) Determination 2024, listing jurisdictions for public Country-by-Country (CbC) reporting on 12 December 2024. Notably, Liechtenstein has been excluded

See MoreUS: Treasury, IRS clarify stance on OECD’s simplified transfer pricing rules

The US Treasury Department and the Internal Revenue Service (IRS) released Notice 2025-04, “Application of the Simplified and Streamlined Approach under Section 482”, on 18 December 2024, clarifying the US government’s stance on using the

See More