Singapore: Second Finance Minister outlines key provisions of Income Tax (Amendment) Bill, Multinational Enterprise (Minimum Tax) Bill

Singapore's Second Minister for Finance, Indranee Rajah, presented the Income Tax (Amendment) Bill and the Multinational Enterprise (Minimum Tax) Bill during their second reading in Parliament, on 14 October 2024, with the aim to modernise

See MoreColombia clarifies Significant Economic Presence rules under corporate income tax regulations

The Colombian tax authority (DIAN) has released new guidance on how companies should interpret the concept of Significant Economic Presence (SEP) under the country’s corporate income tax rules. In Ruling 713, issued on 28 August 2024, DIAN

See MoreUS: IRS rules section 246(b) tax limit applies to GILTI, FDII income

The US Internal Revenue Service (IRS) Office of Chief Counsel (OCC) has released a memorandum (AM 2024-002) that examines how the taxable income limitation under the Internal Revenue Code (IRC) section 246(b) applies to both IRC section 951A global

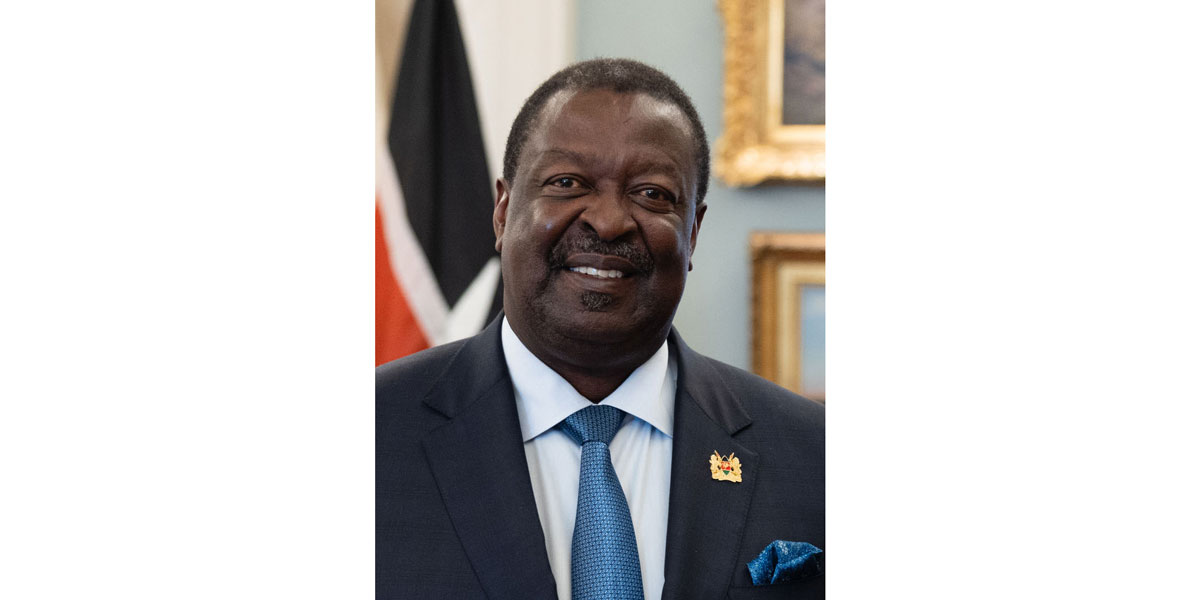

See MoreKenya: KRA to leverage AI and tech to promote tax compliance

The Kenya Revenue Authority (KRA) Commissioner General (CG) HE Dr Musalia Mudavadi plans to use artificial intelligence (AI), the Internet of things (IoT), big data, and blockchain to improve tax administration, enhance transparency, and tackle tax

See MorePoland to introduce cash grants amid potential impact of Pillar Two on investment zone incentives

Poland's Ministry of Development and Technology (MRiT) announced plans to reform the country's incentives system by introducing cash grants linked to investment profitability. The cash grant incentive regime aims to maintain Poland's

See MoreSlovak Republic presents draft bill to amend Pillar Two rules

The Slovak Republic’s government presented a draft bill to the Parliament, on 11 September 2024, to amend the Pillar Two global minimum tax rules enacted on 8 December 2023. The proposed amendments cover financial accounting standards for

See MoreMalaysia revises e-invoicing rules, implementation dates

The Inland Revenue Board of Malaysia (IRBM) released updated guidelines on the new electronic invoicing (e-invoicing) requirements on 4 October 2024. These include the new e-Invoice Guideline (Version 4.0) and e-Invoice Specific Guideline (Version

See MoreSaudi Arabia introduces new real estate transaction tax regulations

Saudi Arabia has released updated regulations for its real estate transaction tax (RETT) system, published in the Official Gazette on 11 October 2024. The new rules implement a 5% tax on all real estate disposals, applying to properties without

See MoreLithuania proposes stricter penalties for failing to submit tax information

The Lithuanian Ministry of Finance has published a draft law on 9 October 2024, amendments to the Code of Administrative Offences, aimed at imposing administrative penalties for failure to submit required information. These changes are designed to

See MorePortugal proposed reduced corporate tax rates in draft 2025 budget law

Portugal’s Finance Minister submitted the draft Budget Law for 2025 (Draft Law No. 26/XVI/1) to parliament on 10 October 2024, proposing reduced corporate tax rates for companies and SMEs and revised personal income tax rates and other tax

See MoreMexico publishes guidance for tax incentives for key sectors in Yucatan’s industrial zones

The Mexican government has published guidelines for granting tax incentives to taxpayers engaged in productive economic activities within the Progreso I and Mérida I industrial welfare zones (industrial parks) in Yucatán state on 26 September

See MoreDominican Republic consults repeal of tax exemptions on financial transactions

The Dominican Republic’s Directorate General of Internal Revenue has introduced an online consultation forum regarding the proposed rule to repeal the previous administrative exemption granted to specific sectors about the 0.15% excise tax on

See MoreUS: IRS grants six-month filing extension for Exempt Organisation Business Income Tax Return

The US Internal Revenue Service (IRS) has granted certain applicable entities that are making an elective payment election a six-month automatic extension of time to file an original or superseding Form 990-T, Exempt Organisation Business Income Tax

See MoreMalaysia exempts capital gains tax on share disposal for restructuring, IPOs

Malaysia’s Ministry of Finance (MoF) announced gazette orders exempting capital gains tax (CGT) on the capital gains or profits from the sales of shares during company restructuring and initial public offering (IPO) restructuring

See MoreRussia clarifies transfer pricing rules for foreign entities with permanent establishments

Russia’s Ministry of Finance (MOF) has issued a guidance letter No. 03-12-12/1/59174 clarifying the transfer pricing obligations for controlled transactions involving foreign legal entities operating through permanent establishments (PEs) in

See MoreTaiwan publishes guidance on deductible interest rates for low or no interest loan

Taiwan’s National Taxation Bureau of the Northern Area (NTBNA), under the Ministry of Finance,stated that, if a company borrows money to pay interest on the one hand, but does not charge interest on the loan money on the other hand, or the

See MoreAustralia: ATO consults new restructuring, thin capitalisation, debt deduction creation rules

The Australian Taxation Office (ATO) launched a public consultation on Practical Compliance Guideline (PCG) 2024/D3 - Restructures and the new thin capitalisation and debt deduction creation rules on 9 October 2024. The ATO has published the

See MoreTaiwan clarifies withholding tax rules

Taiwan's Ministry of Finance has released a notice detailing the revised withholding tax rules, which were approved on 7 August 2024 and will come into effect on 1 January 2025. To enhance the protection of the rights and interests for tax

See More