IMF Annual Meetings: Regional Economic Outlook – Sub-Saharan Africa

On 25 October 2024 the IMF presented the latest regional outlook for Sub-Saharan Africa. The report notes that the region is making economic progress, but macroeconomic vulnerabilities are persistent. Countries in the region are trying to implement

See MoreUN: Resolution on Negotiating Committee for Framework Convention for International Tax Cooperation

On 14 October 2024 a Resolution was drafted by Nigeria on behalf of the Africa group at the UN, to adopt the terms of reference for the UN Framework Convention on International Tax Cooperation. The draft Resolution referred to the work of the Ad Hoc

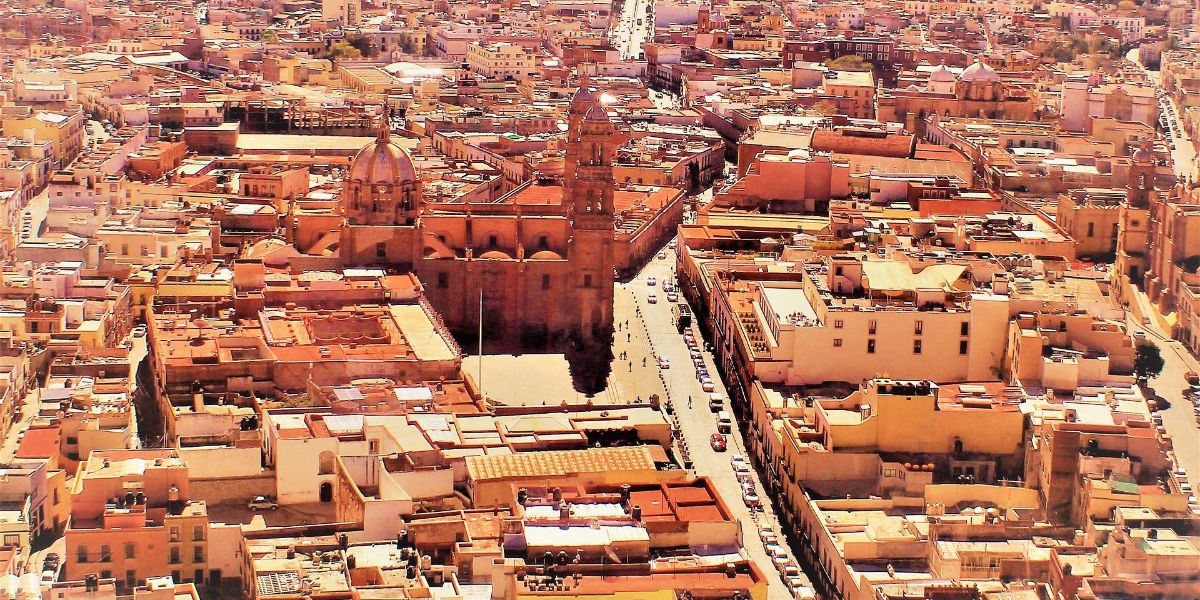

See MoreMexico introduces new withhold income tax, VAT obligations for crowdfunding platforms

The Mexican tax administration (SAT) released the Second Resolution of Modifications to the Miscellaneous Fiscal Resolution for 2024 on 11 October 2024, which mandates that crowdfunding platforms provide specific information to the SAT concerning

See MoreAustria: Appointment of alternative Pillar Two taxpayer due by December

The appointment of an alternative Pillar Two taxpayer in Austria, for taxpayers operating on a calendar year basis, is required to be submitted to the relevant tax office by 31 December 2024. Evidence of this appointment must be uploaded to

See MoreGermany publishes final guidance on mandatory e-invoicing

The German Ministry of Finance has published the final guidance on mandatory e-invoicing on 15 October 2024. The principles of the guidance are to be applied to all sales made after 31 December 2024. As established by the Growth Opportunities

See MoreLatvia updates list of tax havens, removes Antigua and Barbuda

Latvia announced an updated list of low-tax and tax-free jurisdictions in the Official Gazette on 23 October 2024. This list, derived from the latest EU list of non-cooperative jurisdictions, notes the removal of Antigua and Barbuda, effective 1

See MoreUS: IRS announces 2025 tax inflation adjustments

The US Internal Revenue Service (IRS) released IR-2024-273 on 22 October 2024 about the annual inflation adjustments for tax year 2025. The Revenue Procedure 2024-40 provides detailed information on adjustments and changes to more than 60 tax

See MoreItaly gazettes decree on Pillar Two substance-based income exclusion

Italy published the Decree of 11 October 2024 in the Official Gazette on 23 October 2024, which addresses reducing the taxable base relevant to the global minimum tax. Earlier, Italy’s Ministry of Economy and Finance announced the Decree of 11

See MoreUS: IRS and Treasury release final rules for advanced manufacturing investment credit

The US Department of the Treasury and the Internal Revenue Service (IRS) announced in the IR-2024-275, on 22 October 2024, the final regulations that provide guidance regarding the implementation of the Advanced Manufacturing Investment Credit,

See MoreUS: Treasury, IRS relieves tax-exempt organisations from CAMT form filing for 2023 tax year

The US Department of Treasury and the Internal Revenue Service (IRS), in a release – IR-2024-277, granted a filing exception for tax-exempt organisations on 23 October 2024; they do not have to file Form 4626, Alternative Minimum Tax –

See MoreBrazil grants tax exemption for countries with major investments

Brazil now allows countries to seek exclusion from being classified as offering favorable taxation or a privileged tax regime if they make significant investments in Brazil, helping national development, starting 18 October 2024, issued in Decree

See MoreSouth Africa considers incentivising local manufacturing of electric and hybrid vehicles

South African President, Cyril Ramaphosa, announced that he is considering the introduction of tax rebates or subsidies to encourage local manufacture of electric and hybrid vehicles on Thursday, 17 October 2024. "Consideration must be given to

See MoreEgypt unveils tax incentives to simplify compliance, boost economic growth

Egypt’s Minister of Finance, Ahmed Kouchouk, during a press conference, unveiled a new package of tax incentives in an attempt to simplify tax procedures and enhance economic productivity on Wednesday, 11 September 2024. The incentives include

See MoreUS: IRS introduces pass-through compliance unit in large business divisions

The US Internal Revenue Service (IRS) announced the new pass-through field operations unit announced last fall that has officially started work in its Large Business and International (LB&I) division to more efficiently conduct audits of

See MoreGermany issues Notification Form for minimum tax group under Pillar Two rules

The German Federal Ministry of Finance released a notification form for the parent entity of German minimum tax groups subject to the Pillar Two global minimum tax rules on 17 October 2024. The notification for the parent entity of the minimum

See MoreBolivia: “Twelfth Taxpayer Group” to adopt online billing

Bolivia’s tax authority, Servicio de Impuestos Nacionales, released guidance RND No. 102400000025 on 10 October 2024 detailing the 12th group of taxpayers required to update and implement digital billing systems. Beginning 1 March 2025, the

See MoreSlovak Republic approves corporate tax and VAT rate changes, introduces financial transaction tax

The Slovak Republic government enacted a bill on 18 October 2024 to improve the state’s public finances by amending several tax measures and introducing a new financial transaction tax. Corporate tax rates The corporate tax rate has been

See MoreUS: FinCEN clarifies public utility exemption for reporting beneficial ownership

The US Treasury Department's Financial Crimes Enforcement Network (FinCEN) issued a final rule that clarifies the public utility exemption within the beneficial ownership information reporting rule. The final rule was published in the Federal

See More