Belgium extends Pillar 2 supplementary tax return deadline

Belgium’s Federal Public Service (SPF) Finance has announced, on 17 November 2025, an extension to the filing deadline for the annual supplementary national tax return. The law of 19 December 2023 (concerning the introduction of a minimum tax

See MoreArgentina: CBU declaration can now be made from the ARCA mobile app

Argentina's tax and customs agency (ARCA) announced that its ARCA mobile app now allows users to register their Uniform Bank Code (CBU) on 10 November 2025. This mobile app will make it easier and faster for citizens to manage payments under the

See MoreEstonia calls for Pillar 2 tax flexibility for small EU economies

Estonia announced a call for flexibility in implementing the Pillar 2 global minimum tax during a recent EU finance ministers’ meeting on 13 November 2025, the Ministry of Finance said. The country is among five EU member states that have

See MoreGermany: Bundestag approves Pillar 2 amendments

Germany’s lower house of parliament (Bundestag) approved the second revised draft of a law amending domestic Pillar 2 rules and related measures on 13 November 2025. The legislation, formally titled “Law to Amend the Minimum Tax Act and

See MoreCambodia to introduce 20% capital gains tax from 2026

Cambodia’s General Department of Taxation issued Notification No. 34236 on 30 October 2025, confirming that a 20% capital gains tax (CGT) will take effect on 1 January 2026. The tax will apply to six types of assets: leases, investment assets,

See MoreUS: New York weighs corporate tax hike as budget gaps deepen

New York Governor Kathy Hochul is considering whether to raise corporate taxes as the state confronts a sizable budget gap intensified by expected federal funding cuts, a source reported on 14 November 2025. While no proposal has been finalised,

See MoreAlgeria: MoF announces extended deadlines for global income tax, wealth tax filing declarations

Algeria’s Directorate General of Taxes under the Ministry of Finance has issued Circular No. 69/MF/DGI/LF.2025 on 10 November 2025, notifying taxpayers and tax offices of updated filing deadlines introduced by the Finance Law for 2025 for filing

See MoreSlovenia: Government endorse amendments to draft 2026-27 budget implementation act, includes corporate tax increases

During a correspondence session on 15 November 2025, Slovenia’s government endorsed proposed amendments to the draft Act on the Implementation of the Budgets of the Republic of Slovenia for 2026 and 2027. The revisions were prepared in response

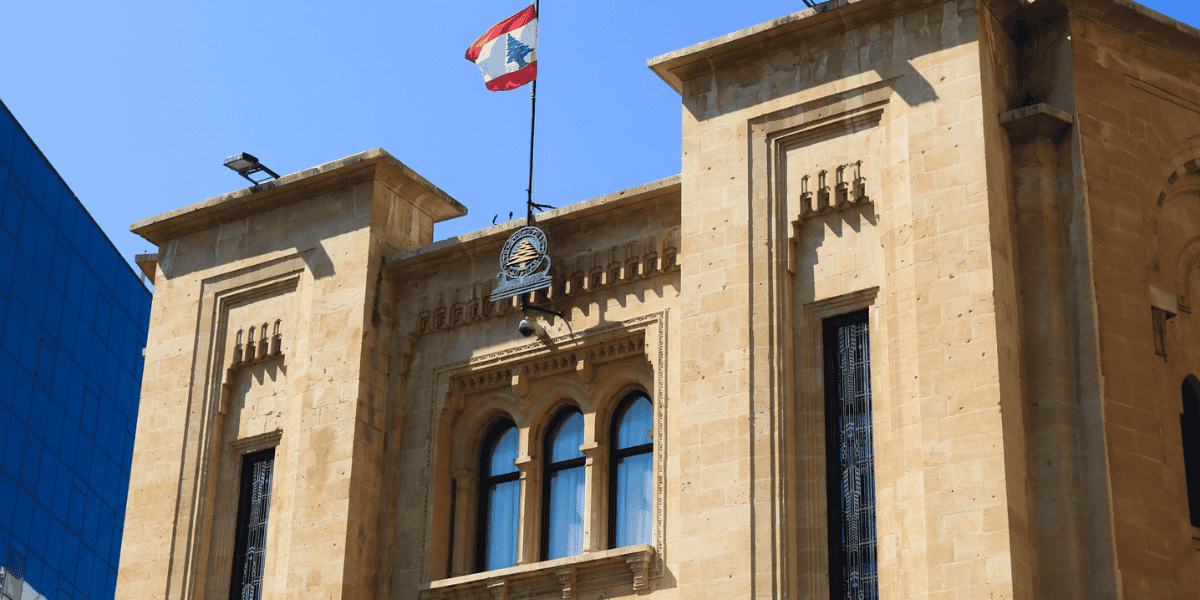

See MoreLebanon: MoF extends CIT, income tax deadlines for 2023–24

Lebanon’s Ministry of Finance (MoF) issued Decision No. 899/1 and related measures on 29 October 2025, extending key filing and payment deadlines for corporate income tax (CIT) and income tax obligations for fiscal years 2023 and 2024. The

See MoreRomania: ANAF consults Globe Information Return (GIR), notification

Romania’s tax authorities (ANAF) have launched a public consultation on a draft order regarding the approval of the format and content of the forms for the GloBE Information Return (GIR) and the Notification of the obligation to submit the GIR,

See MoreBrazil: Senate passes corporate minimum tax, dividend withholding measures

Brazil’s Senate passed Bill 1087/25 on 5 November 2025, which includes various tax measures for companies regarding corporate minimum tax and withholding tax. The tax measures are as follows: Reduction rules for minimum tax Bill 1087/25

See MoreItaly gazettes decree on global minimum tax return, payments

Italy’s government has published the Decree of 7 November 2025 from the Ministry of Finance in the Official Gazette on 10 November 2025. The Decree of 7 November 2025 establishes the filing and payment requirements for the global minimum tax,

See MoreTaiwan: NTBCA rolls out online portal for mandatory tax payments

Taiwan’s National Taxation Bureau of the Central Area (NTBCA) has announced, on 13 November 2025, that taxpayers whose taxes have been transferred to the Administrative Enforcement Agency for compulsory execution may now pay their taxes

See MoreTurkey: Revenue Administration cuts late payment, deferred tax interest rates

Turkey’s Revenue Administration announced on 13 November 2025 that it had reduced both the monthly interest on late tax payments and the annual interest on deferred taxes. Under Presidential Decision No. 10556, the monthly interest rate for

See MoreAustralia: ATO issues guidance for private groups seeking to claim debt deductions

The Australian Taxation Office has released guidance on 14 November 2025, offering practical tips for private groups seeking to claim debt deductions. When preparing a tax return, private groups must make sure they check if the thin

See MoreUK: HMRC clarifies which business expenses are deductible when calculating corporate tax

The UK’s HM Revenue & Customs (HMRC) issued guidance on 11 November 2025, explaining which business expenses companies can deduct when calculating their corporate tax. The guidance confirmed that businesses can deduct revenue expenses, also

See MoreBrazil extends tax payment deadlines for Rio Bonito do Iguacu, Parana

Brazil’s Federal Revenue Service (RFB) has issued an Ordinance on 13 November 2025, extending the deadlines for the payment of federal taxes, including instalment payments, and fulfilling ancillary obligations. The measure also suspends

See MoreLithuania: Parliamentarians propose corporate tax amendments to boost green investments

Lithuania’s members of the parliament submitted draft amendments to the Corporate Income Tax Law (Project No. XVP-260) on 11 November 2025, aiming to expand investment incentives and extend relief periods until 2030. The draft includes a

See More