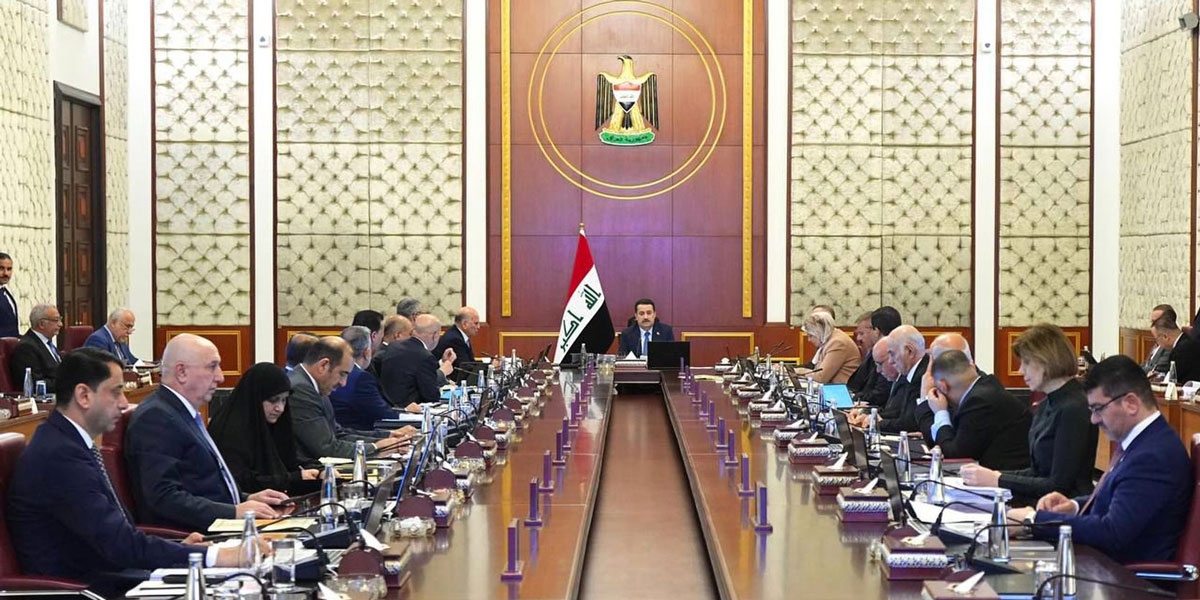

Iraq: Council of Ministers terminate tax treaty negotiations with Croatia

Iraq’s Council of Ministers revoked its authorisation for tax treaty negotiations with Croatia on 1 October 2024. This decision nullifies earlier approvals granted under Decision No. 103 of 2023 and No. 23396 of 2023, which allowed the drafting

See MoreCroatia consults amendments to General Tax Act: Shareholders to be considered as guarantors for failing to file

Croatia’s government has published proposed amendments to the General Tax Act and launched a public consultation. The consultation is set to conclude on 24 October 2024. Once enacted, the amendment will take effect on 1 January

See MoreCroatia launches public consultation on higher short-term rental taxes

Croatia’s government has introduced a higher tax on income generated from short-term rentals as part of a series of amendments to the Individual Income Tax Act. The government has initiated a public consultation about the draft amendments,

See MoreCroatia consults amendments to VAT Act

Croatia’s government initiated a public consultation for draft legislation in which it plans to amend the VAT Act by raising the annual threshold for mandatory VAT registration from EUR 40,000 to EUR 50,000, aligning with the cumulative inflation

See MoreUS, Croatia tax treaty likely by 2025, says US ambassador to Croatia

At a recent seminar on Croatian companies entering the US market, the US Ambassador to Croatia, Nathalie Rayes, announced that the anticipated tax treaty between Croatia and the US could be ratified within 2025. “More than a hundred American

See MoreOECD reports advances on harmful tax practices in Armenia, Bulgaria, Croatia, Eswatini, and Hong Kong

The OECD released an announcement on 27 August 2024 highlighting that jurisdictions have made further progress in addressing harmful tax practices through the implementation of the international standard under BEPS Action 5. This is evidenced by

See MoreCroatia and Egypt tax treaty goes into effect

According to an update from Croatia's Ministry of Foreign and European Affairs, the income and capital tax treaty with Egypt came into force on 16 April, 2024, and will from 1 January, 2025. The treaty covers individual income tax, corporate

See MoreAlbania and Croatia’s social security agreement comes into effect

In a step towards enhancing bilateral relations, Albania and Croatia have officially enacted their first social security agreement Notice No. 7233. Published in the Albanian Official Gazette on 14 May, 2024, the agreement was signed on 2 October,

See MoreTax treaty negotiations successfully conclude between Croatia and Saudi Arabia

Representatives from Croatia and Saudi Arabia successfully concluded negotiations regarding an income tax treaty between the two nations on 15 May 2024. This agreement, a first of its kind, aims to prevent double taxation of income and

See MoreCroatia approves pillar 2 global minimum tax

On 22 December 2023, Croatia announced in the Official Gazette that it approved the Law on Minimum Global Profit Tax. The Croatian Parliament adopted the legislation on 15 December 2023. This law enacts the implementation of the Pillar 2 global

See MoreCroatia announces draft law for pillar 2 global minimum tax

Croatia has published a draft legislation for enforcing the Pillar 2 global minimum tax under Council Directive (EU) 2022/2523 of 14 December 2022. This includes the introduction of the Pillar 2 income inclusion rule (IIR) and the undertaxed

See MoreCroatia announces amendments to profit tax law

On 4 October 2023, Croatia published the Amended Profit Tax Law in the Official Gazette with updated corporate tax rate threshold, withholding tax, tax return and so on. The main changes concerning corporate tax threshold and withholding tax

See MoreCroatia enacts DAC7

On 8 March 2023, the Croatian Official Gazette published Regulation No. 448, which implements the European Union Council Directive on the mandatory automatic exchange of financial account information (AEOI) for digital platform operators

See MoreCroatia joins multilateral agreement for exchange of information on income from digital platform

The OECD has announced that Croatia has signed the Multilateral Competent Authority Agreement on Automatic Exchange of Information regarding Income from Digital Platforms on 15 December 2022. The agreement provides for the automatic exchange of

See MoreCroatia: Tax Administration declares CbC notification deadline

On 11 April 2022, the Tax Administration declared that the notification deadline for submitting Country-by-Country (CbC) report until 2 May 2022. This deadline applies for multinational entities

See MoreCroatia: Finance Ministry decides new interest rate between related parties

The Ministry of Finance announced a new interest rate of 2.68% on loans between related parties for 2022 before the beginning of the tax period in which it is applied. This means that interest is calculated at the rate of 2.68% of the minimum

See MoreCroatia: BEPS MLI enters into force

On 29 June 2021, OECD has published the updated position of signatories’ countries regarding the Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting (MLI). Accordingly, the MLI enters into

See MoreCroatia: Parliament approves second package of measures due to COVID-19

On 7 April 2021, the Croatian Parliament approved all measures proposed by the Government as the second package of measures for the COVID-19 outbreak. Some of the measures are given below: Corporate tax According to the second package, the

See More