Canada: CRA outlines updates to voluntary disclosures program

CRA will implement changes to its Voluntary Disclosures Program, which covers disclosures related to various taxes and charges, including income tax, GST/HST, excise duties, luxury tax, digital services tax, effective 1 October 2025. The Canada

See MoreMexico: Federal Executive Branch presents 2026 Economic Package to Congress, includes indirect tax reforms

Mexico’s Federal Executive Branch submitted the 2026 Economic Package to Congress, proposing major changes to VAT, excise, and income taxes, as well as the federal tax code, which are under review until 31 October 2025. Mexico’s Federal

See MoreChile: SII clarifies eligibility timing for special capital gains on listed shares

Ruling 1750 clarifies that capital gains from selling shares in public companies or mutual funds qualify for the Article 107 special regime only if the shares meet the stock market presence requirement at the time of sale. Chile’s tax

See MoreBrazil: Senate approves tax treaty protocol with India

This protocol is the second modification to the 1988 Brazil-India tax treaty. Brazil’s Senate (the Upper House of the National Congress) gave its approval to ratify a protocol amending the 1988 tax treaty with India on 10 September

See MoreUS,Dominican Republic CbC reporting exchange agreement enters into force

Dominican Republic and US begin automatic CbC report exchange. The Dominican Republic’s Directorate General of Internal Revenue (DGII) announced through Notice 18-25 on 9 September 2025, that a competent authority arrangement with the US for

See MoreMexico: Government proposes raising tariffs on Asian automobiles, steel, textiles

Mexico plans tariff hikes on cars, steel, toys and textiles from China and other Asian countries. Mexico plans to raise import tariffs on cars imported from China and several Asian countries to 50%, the maximum allowed under global trade

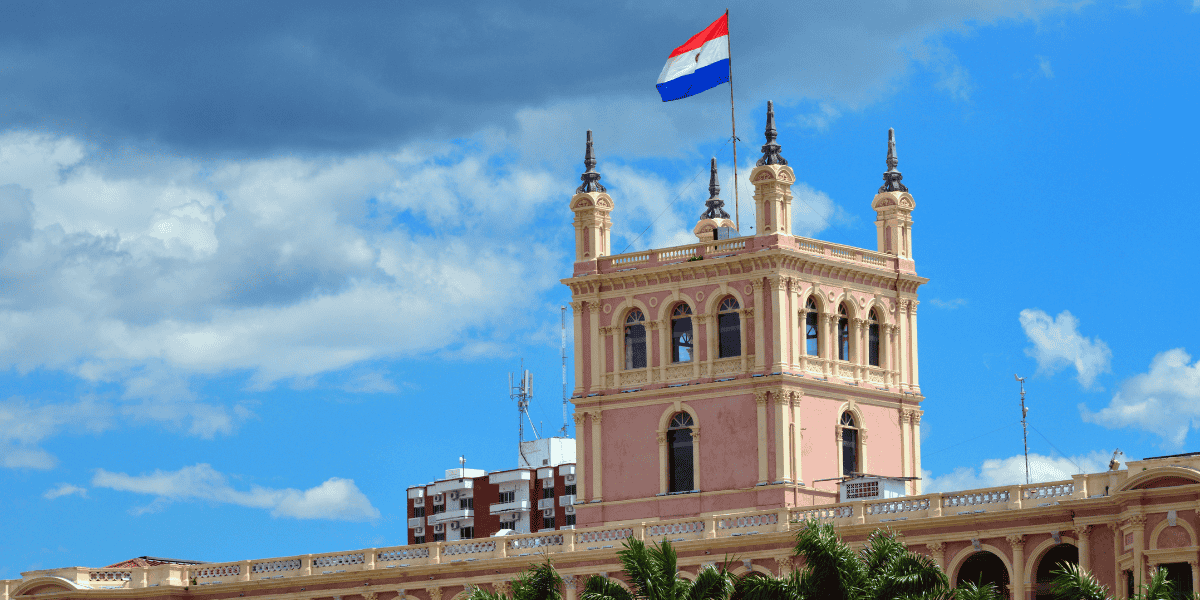

See MoreParaguay unveils new tax incentives for local, foreign investors

Key incentives include exemptions on customs duties, VAT, nonresident income tax, and dividend/profit tax for substantial investments in capital goods, industrial or agricultural production, and large-scale tourism or entertainment projects, subject

See MoreUS: Supreme Court to fast-track Trump tariff case

The US Supreme Court will hear oral arguments in early November 2025 following the Court of Appeals’ upholding of a 28 May ruling that the Trump Administration exceeded its authority to impose broad tariffs under the International Emergency

See MoreChile: SII provides clarification on new VAT Rules for low-value products purchased via remote sellers, online platforms

Ruling No. 1688-2025 states that DPIs selling low-value goods in Chile are not VAT taxpayers, must include all charges in the total price, and can reclaim excess VAT on returned goods after refunding the customer. Chile’s Tax Administration

See MoreMexico to levy tariffs on automotive, manufacturing imports

Mexico may introduce import tariffs on the automotive and manufacturing sectors to address trade imbalances, potentially raising MXN 70 billion in state revenue. Mexico is considering proposing a bill that would impose import tariffs on sectors

See MoreCosta Rica: DGT extends filing deadline for transfer pricing informative statements for 2024

Resolution MH-DGT-RES-0043-2025 extends the initial transitional deadline to 31 March 2026 for the 2024 fiscal year. Costa Rica’s Tax Administration (DGT) has published Resolution No. MH-DGT-RES-0043-2025 in the Official Gazette on 5

See MoreUS: Trump administration revises tariff exemptions, introduces trade incentives via executive order

Effective from 8 September 2025, the changes affect Annex II of the "Liberation Day" tariff policy. The US has revised its "Liberation Day" tariff exemptions under a new Executive Order signed by President Donald Trump on 5 September 2025. The

See MoreChile: SII issues guidance on reduced tax rates and advance payments for SMEs

The reduced income tax rates take effect on 1 January 2025, and the reduced PPM rates apply from August 2025 to December 2027. Chile’s Tax Administration (SII) has published Circular SII No. 53-2025 on its website on 3 September 2025, outlining

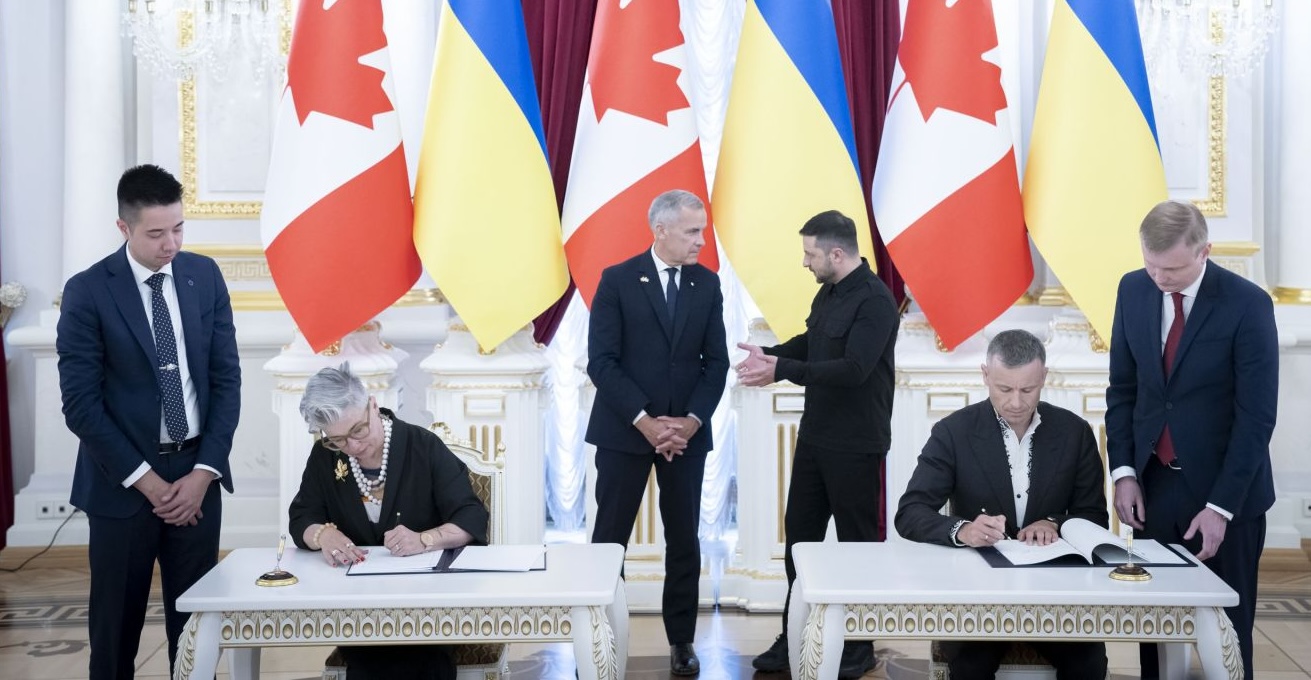

See MoreCanada, Ukraine sign agreement on mutual administrative assistance in customs matters

This agreement aims to address customs violations amid growing bilateral trade between the two countries. Canada and Ukraine signed an agreement on mutual administrative assistance in customs matters on 24 August 2025. The signing took place

See MoreUS: IRS issues USD 162 million in fines for fraudulent tax credit claims promoted on social media

The IRS warns taxpayers about rising social media scams promoting the misuse of tax credits, such as the Fuel Tax Credit and the Sick and Family Leave Credit, which have led many to file invalid returns and face denied refunds and penalties. The

See MoreBrazil: Congress completes ratification of tax treaty with Colombia

Signed on 5 August 2022, Brazil and Colombia signed their first agreement to eliminate double taxation on income and prevent tax evasion. Brazil’s Congress has issued Legislative Decree No. 193 on 2 September 2025, approving the ratification of

See MoreUS: Trump signs executive order advancing trade agreement with Japan

The executive order sets a 15% tariff on Japanese imports to the U.S., replacing the previous 35% rate, retroactive to 7 August 2025, while eliminating tariffs on civilian aerospace goods, metals (aluminium, copper, steel), and automobiles and

See MoreMexico: President to impose tariffs on China

President Claudia Sheinbaum announced that her government may impose tariffs on imports from countries without trade agreements, including China, under the "Plan Mexico" initiative. Mexican President Claudia Sheinbaum stated on 4 September 2025

See More