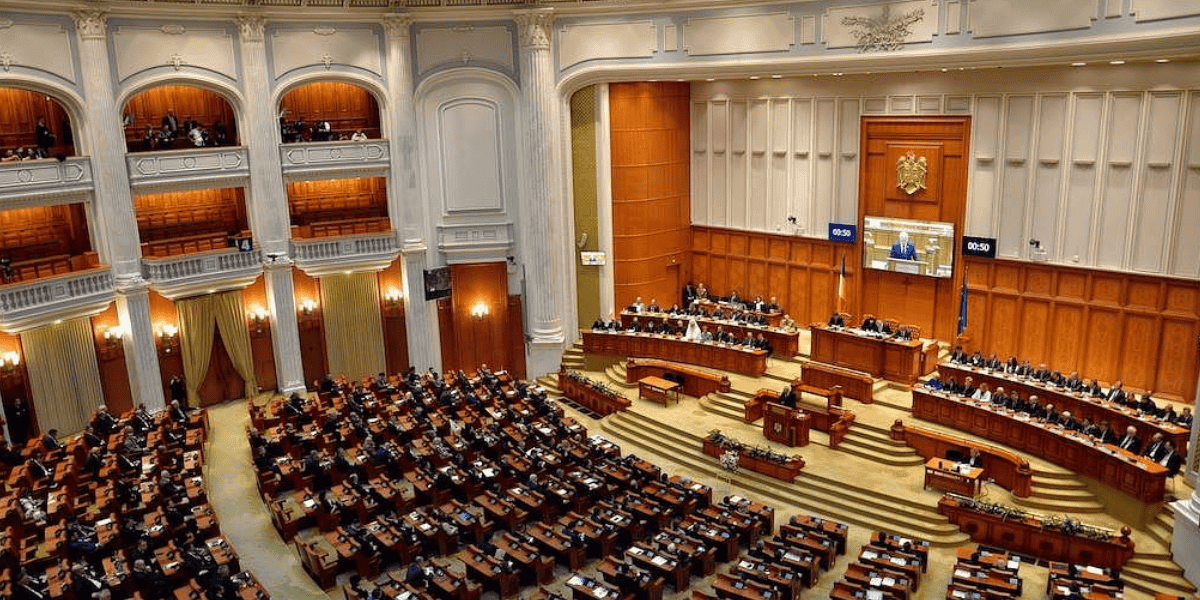

Romania: Parliament approves increases to VAT, bank levy, and dividend tax

The law introduces significant tax reforms, including increased VAT rates, a new reduced VAT rate, higher turnover tax for banks, and an increased dividend tax rate. Romania's parliament has passed the Law on certain fiscal-budget measures on 14

See MoreItaly: Council of Ministers approves draft VAT consolidation code

The new consolidated VAT law has been structured into 18 sections and 171 articles. Italy’s Council of Ministers, in a press release on 14 July 2025, has given preliminary approval to a Legislative Decree aimed at consolidating and reorganising

See MoreBelgium issues clarification on 2026 B2B e-invoicing rules

The Decree mandates the use of structured e-invoicing for B2B transactions between VAT-registered taxpayers, starting in 2026. Belgium has published Decree of 8 July 2025 in the Official Gazette, mandating structured electronic invoicing

See MoreBelgium extends 6% VAT rate for residential demolition and reconstruction pending legal implementation

Due to a delay in the approval of the reform law, the standard 21% VAT rate will apply from 1 July 2025, with a potential adjustment to 6% once the law is enacted. Belgium's Federal Public Service (SPF) Finance announced on 10 July 2025 that the

See MoreNigeria: FIRS enacts e-invoicing system for large taxpayers

Businesses with an annual turnover of NGN 5 billion or more are required to register for e-invoicing, effective August '25. Nigeria’s Federal Inland Revenue Service (FIRS) announced the launch of a national electronic invoicing (e-invoicing)

See MoreHungary updates tax rates on retail, financial entities, and insurance sectors

Act LIV of 2025 introduces updated tax rates, increased VAT thresholds, and new regulations across retail, financial, insurance, and energy sectors, along with enhanced R&D deductions. Hungary has published Act LIV of 2025 in the Official

See MoreRomania 2025–28 tax reforms include increased VAT, dividend tax

The proposed draft bill aims to simplify VAT rates from three (19%, 9%, and 5%) to two, starting 1 August 2025. Romania’s government submitted an amended draft bill to parliament on 4 July 2025, proposing changes to the VAT provisions of the

See MoreOECD: VAT receipts boost tax revenue in Asia-Pacific

The report states that tax revenues in the Asia-Pacific rose for a third straight year in 2023 due to higher VAT receipts. The OECD has released the Revenue Statistics in Asia and the Pacific 2025 report on 8 July 2025, which reveals that tax

See MoreItaly clarifies VAT split-payment exemption effective date for listed companies

Italy has abolished the VAT split-payment system for FTSE MIB-listed companies, effective 1 July 2025. Italy has abolished the VAT split-payment system requirement for companies listed on the FTSE MIB index, as per Decree-Law No. 84 of 17 June

See MoreTanzania enacts 2025-26 budget measures, includes new transfer pricing penalty

The measures will apply from 1 July 2025, unless otherwise specified. Tanzania's Finance Act 2025 was enacted on 30 June 2025, implementing tax measures from the 2025-26 Budget Speech with some adjustments to the initially announced

See MoreSpain announces 2024 VAT refund deadline

Spanish and EU businesses have until 30 September 2025 to claim VAT and IGIC refunds for 2024, subject to applicable procedures and reciprocity conditions. Spanish companies and foreign businesses have until 30 September 2025 to claim refunds for

See MorePoland gazettes Act increasing VAT exemption threshold

The Act increases the VAT exemption threshold from PLN 200,000 to PLN 240,000 from 2026. Poland published the Act of 24 June 2025 in the Official Gazette on 7 July 2025, raising the VAT exemption threshold from PLN 200,000 to PLN 240,000,

See MoreSri Lanka to introduce 18% VAT on cross-border digital services

Sri Lanka will implement an 18% VAT on foreign digital services supplied to local consumers starting October 2025. Sri Lanka will implement an 18% Value Added Tax (VAT) on digital services supplied by non-resident companies to local consumers,

See MoreVietnam enacts new VAT law

The new VAT law introduces 0% VAT for certain NTZ/EPE services, expanded non-cash payments, updated VAT credit/refund rules, and new seller declaration requirements, replacing parts of prior VAT guidance. Vietnam issued Decree 181/2025/ND-CP and

See MoreUK: Online marketplaces responsible for VAT on sales by foreign sellers

HMRC has confirmed that online marketplaces must account for VAT on goods sold by overseas businesses when the items are located in the UK at the time of sale. The UK’s HM Revenue & Customs (HMRC) issued guidance on 20 June 2025 confirming

See MorePoland published final schema FA_VAT (3) and KSeF 2.0 API documentation

Poland's Council of Ministers approved a draft law mandating the National e-Invoicing System (KSeF), pending parliamentary review and expected enactment by July 2025. Poland announced that the final schema, FA_VAT (3), will supersede the

See MoreVietnam extends VAT reduction until 2026

The National Assembly has extended the 2% VAT cut for eligible goods and services from 1 July 2025 to 31 December 2026. Vietnam’s National Assembly passed Resolution No. 204/2025/QH15 on 17 June 2025, extending the reduced VAT rate of 8% (down

See MoreEgypt amends VAT law to broaden tax base and target key sectors

The amended VAT law focuses on expanding the tax base, addressing sectoral imbalances, and improving fiscal sustainability, while maintaining the current VAT rate. Egypt’s House of Representatives approved a series of amendments to VAT Law

See More