Serbia implements pre-filled VAT returns from 2026

Starting January 2026, VAT returns will be pre-filled with data on goods turnover, service trade, imports, and other VAT-relevant transactions. Starting January 2026, VAT returns in Serbia will be pre-filled with data on goods turnover, service

See MoreCosta Rica: DGT publishes guidance on new TRIBU-CR digital tax platform

These resolutions provide guidance on the use of tax forms for VAT and withholding on card transactions, rules for VAT reporting and cross-border digital services, and the authorisation process for applying taxpayer credits in the TRIBU-CR

See MoreSweden: Government proposes simplified business and capital taxation in 2026 budget

The proposed tax measures include business tax credits and simplified forestry and shipping rules, temporary VAT cuts and fraud controls, changes to excise taxes on alcohol and tobacco, permanent tax-free EV workplace charging, and reduced energy

See MoreFinland: Government presents 2026 budget to parliament, proposes reduced corporate taxes

The 2026 budget proposal lowers corporate and CO2 fuel taxes while tightening crypto reporting, adjusting VAT, and raising taxes on vehicles, tobacco, alcohol, and soft drinks. Finland’s government has presented the 2026 budget proposal (HE

See MoreFrance launches e-invoicing directory

The directory serves as a central resource where companies can check which businesses are subject to the e-invoicing mandate, identify their authorised platform providers, and access electronic billing addresses. The French tax administration

See MoreSerbia: MoF updates e-invoicing platform

The SEF version 3.14.0 updates require e-invoices to include delivery dates, ensure transaction dates are not later than issue dates, enforce VAT consistency checks, display totals for reductions and increases in foreign currency, and allow

See MoreRomania gazettes revised VAT reporting requirement

Order No. 2194/2025 has been issued approving the revised format of Romania’s Statement 394 for reporting goods, services, and acquisitions. Romania has published Order No. 2194/2025 in Official Gazette No. 852 of 17 September 2025. This

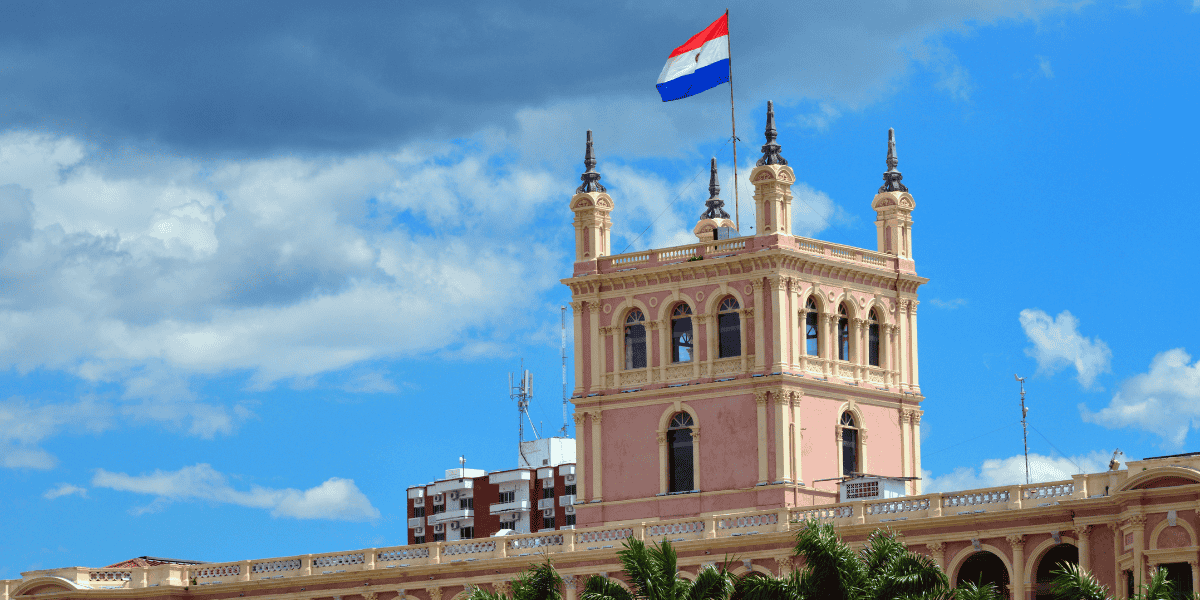

See MoreParaguay introduces tax incentives for electronics manufacturing, digital equipment

Paraguay’s Law No. 7546/2025 boosted investment and jobs in electronics and digital equipment. Paraguay has enacted Law No. 7546/2025, published on 8 September 2025 and effective from 9 September 2025, to promote investment and formal

See MoreEthiopia updates VAT registration rules, expands scope

Ministry of Finance issued Directive No. 1104/2025, requiring certain taxpayers to register for VAT and start collection within 30 days. Ethiopia’s Ministry of Finance issued Directive No. 1104/2025 on 3 September 2025, outlining updated

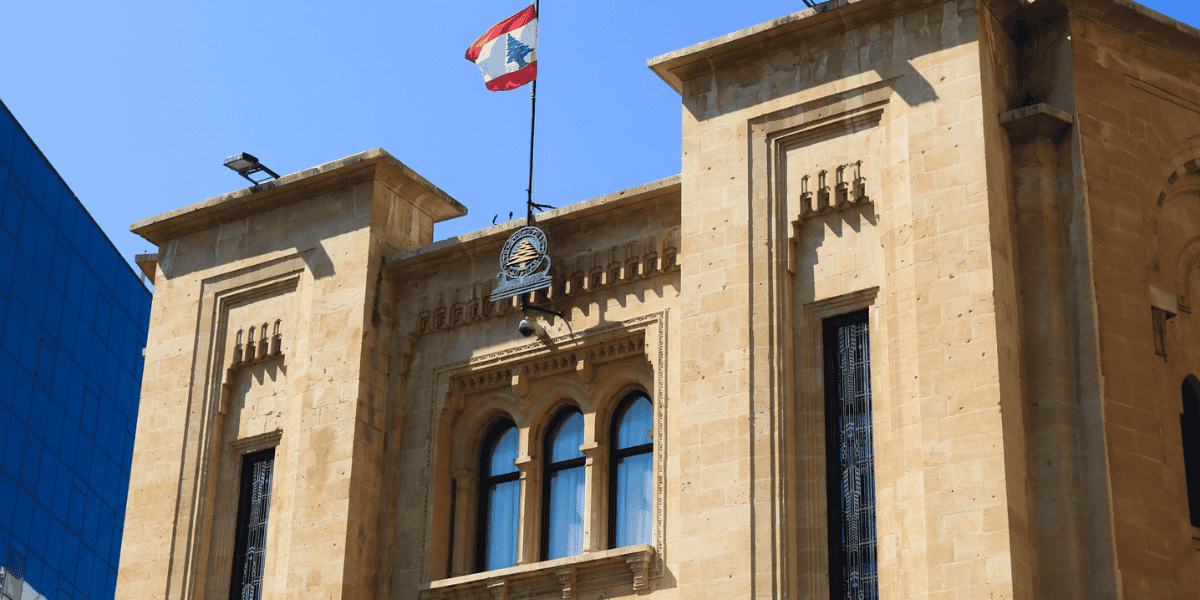

See MoreLebanon: Government tables 2026 budget law draft, introduces amendments to corporate income tax

Lebanon submitted its 2026 Draft Budget Law to the Council of Ministers, proposing wide-ranging reforms across corporate tax, VAT, customs, excise duties, digitalisation, and tax incentives, including stricter deduction rules, and targeted

See MoreMexico: Tax authority publishes updated list of foreign digital service providers registered for tax

Tax authority on 15 September 2025 published an updated list of 268 registered foreign digital service providers. Mexico’s tax authority released an updated list of 268 foreign digital service providers registered for tax purposes on 15

See MoreBahrain: NBR updates transportation VAT guidelines

The Transportation Guide is for general information purposes only. It reflects the NBR’s current views but does not carry legal authority. The Bahraini National Bureau for Revenue (NBR) published an updated version of the Value Added Tax (VAT)

See MoreSweden: Government considers reducing VAT on dance events in 2026 budget

The government plans to reduce the VAT rate for admission to dance events to 6% from the existing 25%. The Swedish government, in a press release on 13 September 2025, announced plans to lower the VAT rate for dance events as part of its 2026

See MoreBelgium: FPS clarifies new rules on mandatory e-invoicing

The Royal Decree of 8 July 2025, published on 14 July 2025, establishes the regulatory framework for structured e-invoicing in Belgium, building on the Law of 6 February 2024. Belgium's Federal Public Service (FPS) Finance published a notice on

See MoreFrance simplifies e-invoicing rules

France eases e-invoicing and e-reporting rules ahead of the 2026-27 deadline. The French government has announced new simplification and easement measures for mandatory e-invoicing and e-reporting, ahead of the 2026-27 compliance deadline. The

See MoreGermany: Government approves 2025 draft tax amendment act

The draft bill proposes tax relief for individuals and other technical changes to tax laws and will proceed through approval by the Bundestag and Bundesrat. Germany’s Federal Cabinet (Bundesregierung) has approved the draft of the Tax Amendment

See MoreRomania gazettes new VAT return form to reflect updated rates

The updated form with the new VAT rates will be required for the VAT return due on 25 September 2025. Romania’s government has published Order No. 2.131 of 2 September 2025 in the Official Gazette on 8 September 2025, approving the update to

See MoreMexico: Federal Executive Branch presents 2026 Economic Package to Congress, includes indirect tax reforms

Mexico’s Federal Executive Branch submitted the 2026 Economic Package to Congress, proposing major changes to VAT, excise, and income taxes, as well as the federal tax code, which are under review until 31 October 2025. Mexico’s Federal

See More