Russia: State Duma passes major tax reform bill, introduces sector-specific measures

Russia’s State Duma has approved in its third reading a wide-ranging tax policy bill introducing new personal income tax (PIT) benefits, expanding support for families and participants in the Special Military Operation (SMO), and revising several

See MoreOECD publishes 2025 Update to Model Tax Convention

The OECD published the 2025 Update to the OECD Model Tax Convention on 19 November 2025, incorporating the changes approved by the OECD Council on 18 November 2025. The update reflects the latest developments in international taxation and offers

See MoreFinland announces BEPS MLI implementation for tax treaty with Argentina

Finland issued Notice 51/2025 on 3 November 2025, announcing that the Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting (MLI) will enter into force for its 1994 income and capital tax treaty

See MoreOECD highlights tax simplification to strengthen certainty and economic growth

The OECD has released a report titled “Enhancing Simplicity to Foster Tax Certainty and Growth” on 18 November 2025. Taxation of cross-border business activity is inherently complex for taxpayers and governments. Taxpayers operating across

See MoreGhana: MoF presents 2026 budget, proposes VAT reforms

Ghana's Ministry of Finance has presented the 2026 Budget Speech to parliament on 13 November 2025, introducing various tax measures, including VAT reforms. The key tax measures are as follows: VAT reforms Ghana's government is proposing

See MoreRussia: State Duma approves key tax policy bill, introduces incentives for businesses and individuals

Russia’s State Duma approved in its second reading of a bill outlining major directions of the country’s tax policy, incorporating proposals from businesses and government agencies, and implementing directives from the President and Government

See MoreUK: HMRC urged large businesses to review of management expenses

The UK’s tax authority, HMRC has written to holding companies with overseas subsidiaries urging them to review the tax treatment of management expenses claimed where those expenses may benefit a connected party. The letters are part of an

See MoreBolivia: Chamber of Deputies considers 2026 state budget proposal

Bolivia’s Executive Branch has submitted the 2026 General Budget Bill to the Chamber of Deputies on 31 October 2025, outlining a series of targeted tax incentives to reduce the cost of public debt operations conducted in foreign capital

See MorePoland secures boost in EU 2026 budget for key development programmes

The EU Council and the European Parliament announced that negotiations on the 2026 EU budget were concluded on 15 November 2025. The agreed budget allocates additional funding to several Polish priorities, including border security, transport

See MoreCanada: DoF introduces legislation to implement 2025 budget, includes tax incentives for capital investments

Canada’s Department of Finance announced the introduction of Bill C-15, Budget 2025 Implementation Act, No. 1, on 18 November 2025. It is an important first piece of legislation to advance key Budget 2025: Canada Strong priorities. Bill C-15

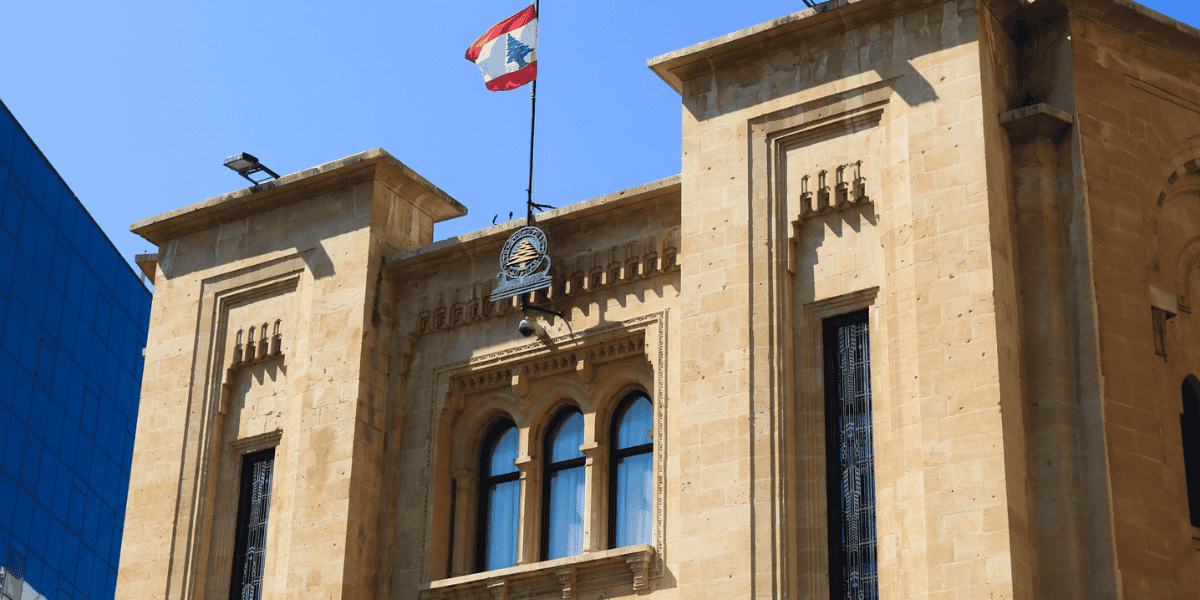

See MoreLebanon: Ministry of Finance clarifies electronic communication procedures

The Ministry of Finance (MoF) has introduced new procedures for taxpayers to communicate with its departments electronically. The decision, dated 1 October 2025 (Decision No. 843/1), requires submissions via email for a range of tax-related

See MoreJapan: FSA considers defining cryptocurrencies as financial products

Japan’s Financial Services Agency (FSA) is planning new regulations that would treat 105 cryptocurrencies, including bitcoin and ethereum, as financial products subject to insider trading rules. Under the proposal, exchange operators would need

See MoreOECD releases 2025 report on tax administration highlighting growing role of AI

The OECD has published a report titled “Tax Administration 2025: Comparative Information on OECD and other Advanced and Emerging Economies,” on 17 November 2025, providing internationally comparative data on tax systems and administration across

See MoreOECD publishes report on recent trends in taxes on energy use, carbon pricing

The OECD published a report titled “Effective Carbon Rates 2025: Recent Trends in Taxes on Energy Use and Carbon Pricing”, which provides insights into how countries are implementing carbon taxes, emissions trading schemes, and fuel excise

See MoreEU Parliament endorses BEFIT corporate tax framework

The European Parliament has approved Legislative Resolution No. P10_TA(2025)0268 on the Business in Europe Framework for Income Taxation (BEFIT) on 13 November 2025. The resolution introduces a unified framework for corporate taxation across the

See MoreRussia: Ministry of Finance proposes removing UAE from offshore zones list

Russia’s Ministry of Finance has proposed removing the UAE from its Special List of jurisdictions considered offshore zones for the period 2024 to 2026. The list covers countries and territories with preferential tax regimes or limited

See MoreTaiwan: Tax Authority clarifies rules for claiming losses on damaged assets

Taiwan’s National Taxation Bureau of the Southern Area outlined rules for claiming losses on damaged assets. Southern Taiwan recently faced torrential rains, causing flooding in low-lying areas. The National Taxation Bureau of the Southern

See MoreBelgium expands tax-neutral rules to simplify sister mergers

Belgium’s Chamber of Representatives approved a law extending the country’s tax-neutral treatment to simplified sister mergers on 23 October 2025. The legislation, based on the EU Mobility Directive (2019/2121), amends the Income Tax Code and

See More