France: National Assembly approves digital services tax hike

The measure, outlined in amendment N° I-CF1827, targets large digital platforms. The Finance Committee of the French National Assembly approved an amendment to the 2026 Finance Bill raising the digital services tax (DST) from 3% to 15% on 22

See MoreColombia: DIAN updates foreign exchange reporting rules

DIAN issues Resolution 230 of 2025, updating quarterly reporting rules for foreign exchange operations. Colombia's National Tax and Customs Directorate (DIAN) issued Resolution 230 on 20 October 2025, amending Article 2.2.5 of Resolution 180 of

See MoreUS: Iowa retains corporate tax rates for 2026

The 2026 corporate income tax rates will remain the same as corporate income tax rates for tax years beginning in 2024 and 2025. The Iowa Department of Revenue issued an Order 2025-02 on 21 October 2025 regarding corporate income tax rates for

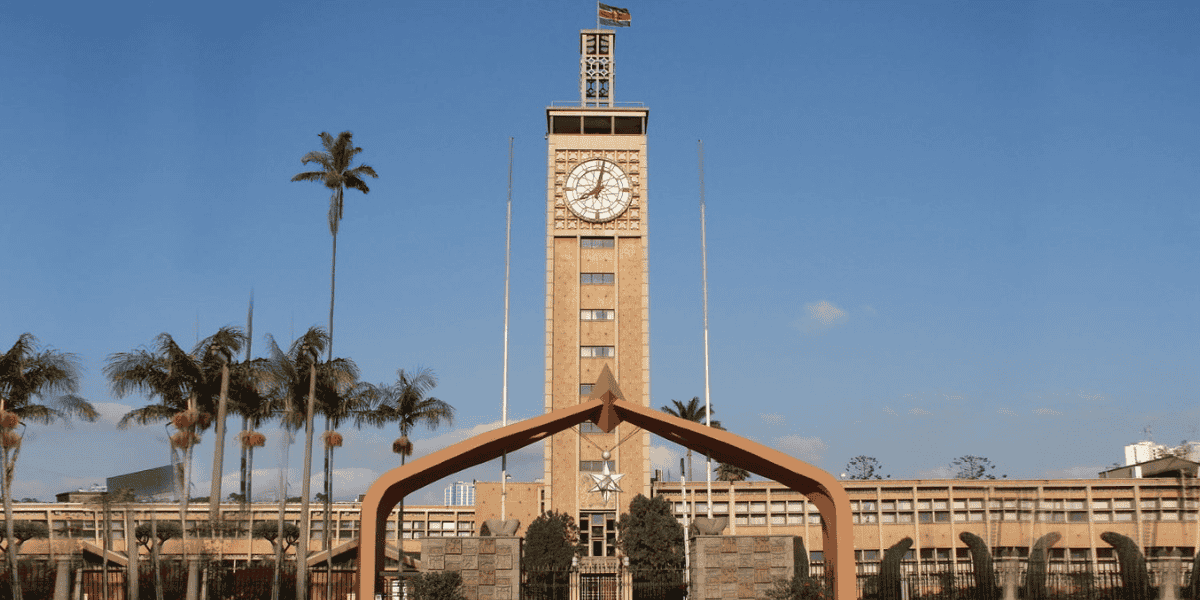

See MoreKenya: KRA announces tax compliance certificate (TCC) enhancements

To obtain a TCC, taxpayers must be registered in eTIMS/TIMS, file and pay all taxes on time, settle outstanding liabilities or have an approved payment plan, and maintain VAT compliance. The Kenya Revenue Authority (KRA) issued a public notice on

See MoreMalaysia: Customs department amends service tax rules, introduces new exemptions

Malaysia’s Customs Department will implement revised service tax policies with additional exemptions from 1 July 2025, following the Ministry of Finance’s announcement of expanded SST regulations. Malaysia’s Customs Department has revised

See MoreIsrael: MoF issues draft law to implement global Pillar 2 rules

This draft legislation outlines the framework for establishing a local minimum tax on multinational corporations, ensuring alignment with international agreements to implement a global minimum tax. Israel’s Ministry of Finance has taken a

See MoreLithuania: MoF presents draft budget, expands list of corporate tax exempt entities

Lithuania’s 2026 draft Budget proposes halting the planned increase in CO2 excise duty on diesel and introducing a corporate tax exemption for the National Development Bank. Lithuania’s Ministry of Finance has presented the 2026 draft Budget

See MoreEuropean Commission unveils 2026 work programme, signalling withdrawal of key tax proposals

EU unveiled 2026 plan on 21 October 2025 to boost sovereignty, security, and competitiveness. The European Commission has presented its 2026 work programme, outlining a series of initiatives aimed at strengthening Europe’s sovereignty,

See MoreUK: HMRC reminds taxpayers of 2024–2025 self-assessment tax year deadline

HMRC has reminded taxpayers to prepare for the upcoming self-assessment deadline, noting that payments and return submissions must be completed on time to avoid penalties and interest. The UK’s HM Revenue & Customs (HMRC) reminded

See MoreUN: Tax Committee sets four-year agenda with focus on developing countries, AI, green taxation

The 31st session of the UN Committee of Experts on International Cooperation in Tax Matters was held In Geneva from 21 to 24 October 2025. This was the first meeting of the newly-appointed membership of the Committee, consisting of 25 tax experts

See MoreEU: European Commission releases 2026 work programme

The 2026 Work Programme contains detailed plans to boost the EU’s competitiveness, security, and resilience under its 2024–2029 strategic agenda. The European Commission announced its 2026 Commission Work Programme on 21 October 2025, in

See MoreUS: IRS releases guidance on credit, refund limits for employee retention credits

The FAQs discuss the limitation generally, when a claim is considered to be timely filed, and what appeals rights are available if an ERC claimed on a return is disallowed. The US Internal Revenue Service (IRS) has announced the issuance of the

See MoreSingapore updates guidance on deductible business expenses

IRAS updates business expense guidance, detailing new deductible and non-deductible items and clarifying rules for employee transport reimbursements. The Inland Revenue Authority of Singapore (IRAS) has revised its guidance on business expenses,

See MoreZambia: ZRA introduces 10% excise duty on gaming, betting

Revenue Authority introduced a 10% excise duty on gaming and betting, effective from September 2025, with payments due by the 15th of the following month. The Zambia Revenue Authority (ZRA) has confirmed the introduction of a 10% excise duty on

See MoreUAE: MoF publishes list of recognised commodity reporting agencies

MoF listed 13 approved agencies for trading qualifying commodities. The UAE Ministry of Finance (MoF) published Ministerial Decision No. 230 of 2025 on 22 October 2025, listing the recognised reporting agencies for trading qualifying

See MoreSingapore: IRAS updates GST error correction guidance with new FAQs

IRAS updates GST F7 guidance, clarifying when minor errors need not be corrected. The Inland Revenue Authority of Singapore (IRAS) has updated its guidance on correcting errors in Goods and Services Tax (GST) returns through Form F7, adding six

See MoreIndonesia: Central bank maintains key interest rate

Bank Indonesia will continue monitoring the transmission effectiveness of accommodative monetary policy, economic growth, and inflation, as well as rupiah exchange rate stability, to consider further room for BI-Rate reductions. Indonesia’s

See MoreAustria: Parliament approves temporary investment allowance increase

Parliament approved a temporary increase in the investment allowance for ecological assets between November 2025 and December 2026. The Austrian National Council (Nationalrat) approved a draft bill, on 15 October 2025, introducing a temporary

See More