November 24, 2025

The Government of the Federation of Bosnia and Herzegovina, acting on a proposal from the Federal Ministry of Finance, adopted...

November 24, 2025

Lithuania’s tax authorities have published a commentary on 18 November 2025, detailing how legal entities undertaking major manufacturing or data-service...

November 21, 2025

The tax treaty between France and Moldova signed on 15 June 2022, officially entered into force on 23 April 2024....

November 21, 2025

The Colombian Government has formally submitted a bill to create a new customs sanctions regime, fulfilling requirements set by the...

November 21, 2025

France is considering a two-year grace period for its upcoming B2B e-invoicing and e-reporting requirements. Amendment n° I-1028 to the...

November 21, 2025

Ecuador has removed the UAE from its list of tax havens under Resolution No. NAC-DGERCGC25-00000037, published in the Official Registry...

November 21, 2025

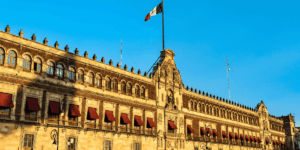

Mexico’s Tax Administration Service (SAT) has opened two new Tax Service Modules (MST) in Tulum, Quintana Roo, and Tekax, Yucatán,...

November 21, 2025

France’s public finances authority has clarified the applicable Value Added Tax (VAT) rate for successive deliveries of prepared food products...

November 21, 2025

Saudi Arabia’s Zakat, Tax and Customs Authority (ZATCA) has urged VAT-registered businesses with goods and services revenues over SAR 40...

November 21, 2025

Sweden’s Ministry of Finance (MoF) submitted a bill to the Council on Legislation on 20 November 2025 proposing updates to...

November 21, 2025

The Irish Revenue has updated its Tax & Duty Manual on Electronic Tax Clearance (eTC) under eBrief No. 215/25 on...

November 21, 2025

France announced on 19 November 2025, a postponement of the definitive abolition of the Cotisation sur la Valeur Ajoutée des...

November 21, 2025

Russia’s State Duma has approved in its third reading a wide-ranging tax policy bill introducing new personal income tax (PIT)...

November 19, 2025

Liechtenstein’s Parliament (Landtag) confirmed the approval of the income tax treaty with Montenegro on 7 November. Liechtenstein and Montenegro signed...

November 19, 2025

Ecuador has issued Executive Decree No. 191, introducing new rules for the advance payment of income tax on undistributed profits....

November 19, 2025

The Parliament of Georgia approved the ratification of the amending protocol to the 2007 income and capital tax treaty with...

November 19, 2025

Cambodia’s General Department of Taxation (GDT) announced, on 30 October 2025, that the implementation of Prakas No. 496 MEF on...

November 19, 2025

Estonia gazetted amendments to the Motor Vehicle Tax Act on 12 November 2025, introducing new tax reductions for parents and...