The treaty between India and Romania which was signed on 8 March 2013 generally applies from 1 January 2014 for Romania and from 1 April 2014 for India. From this date, the new treaty generally replaces the India – Romania Income Tax Treaty in 1987.

Related Posts

Romania: Emergency Ordinance targets R&D, green tech, strategic investments

Romania has published Emergency Ordinance No. 8 of 24 February 2026 in the Official Gazette, which introduced a comprehensive package of fiscal and investment measures aimed at supporting economic recovery. Emergency Ordinance no. 8/2026

Read More

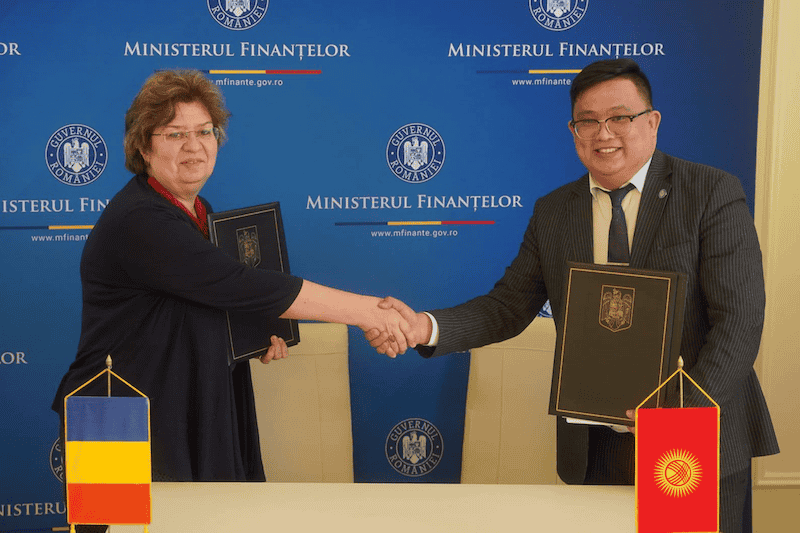

Kyrgyzstan, Romania agree on income tax treaty

Kyrgyzstan's Ministry of Economy and Commerce announced on 27 February 2026 that officials from Kyrgyzstan and Romania reached an agreement in principle on a new income tax treaty during negotiations held in Bucharest from 23 to 26 February 2026.

Read More

Romania: MoF launches blockchain-based fiscal receipt system to combat tax fraud

Romania’s Ministry of Finance, in a press release on 26 February 2026, announced that it is rolling out BF-CHAIN, an innovative project using blockchain technology to revolutionise how fiscal receipts from electronic cash registers are managed and

Read More

Romania mandates GloBE information return, notification requirements

Romania published Order No. 218, issued by the National Agency for Fiscal Administration (ANAF) on 16 February 2026, in its Official Gazette on 24 February 2026. The order sets out the official templates and procedural rules for two key forms

Read More

US: Department of Commerce to rule on solar import duties from India, Indonesia, Laos

The US Department of Commerce is expected to announce a preliminary ruling on 23 February 2026 on whether it will impose anti-subsidy duties on solar cells and panels from India, Laos, and Indonesia. This follows after a coalition of US solar

Read More

Romania: ANAF to revise withholding tax reporting requirements

Romania’s tax authority, the National Agency for Fiscal Administration (ANAF), has issued an Order No. 179/2022 on 16 February 2026 to modify the reporting requirements for Form 205, the "Informative Declaration on Withholding Tax and Investment

Read More