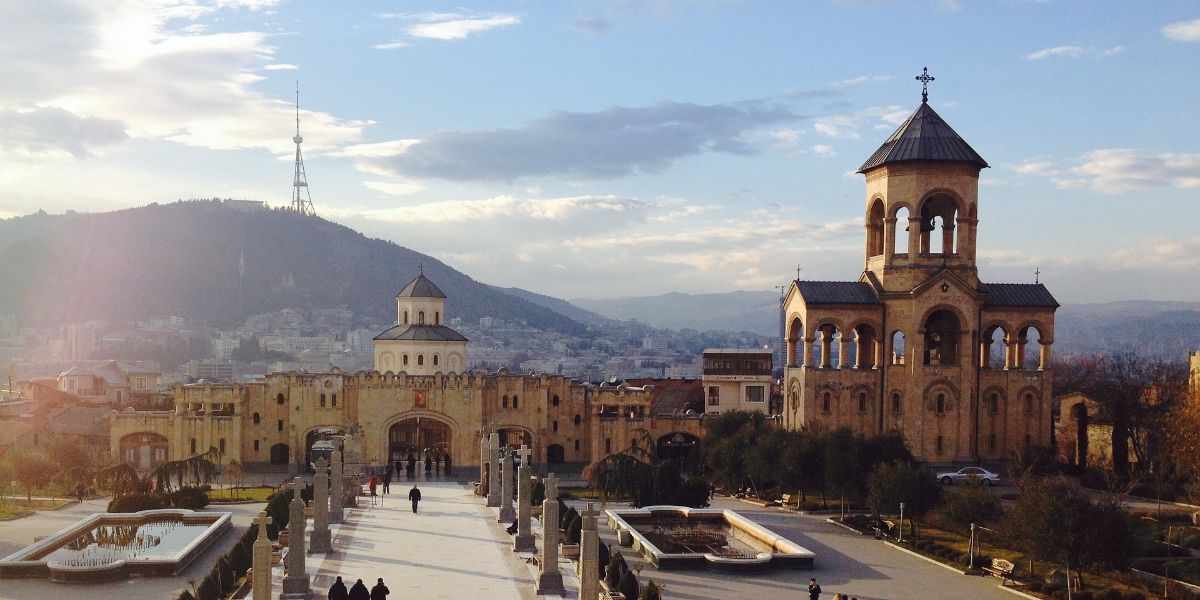

Georgia: Parliament ratifies amending protocol to tax treaty with Luxembourg

The Parliament of Georgia approved the ratification of the amending protocol to the 2007 income and capital tax treaty with Luxembourg on 11 November 2025. The protocol was signed on 3 July 2025 and it updates provisions related to exchange of

See MoreKuwait ratifies amending protocol to tax treaty with Luxembourg

Kuwait has ratified the 2021 amending protocol to its 2007 Income and Capital Tax Treaty with Luxembourg through Decree Law No. 138 of 2025 on 1 September 2025. The protocol was published in the Official Gazette No. 1755 of 7 September

See MoreLuxembourg: Government Council approves updated tax treaty with San Marino

Luxembourg’s Government Council approved protocols updating the tax treaty with San Marino on 31 October 2025. The two countries had signed the amending protocol to their 2006 tax treaty on 14 May 2025. This marks the second amendment to the

See MoreLuxembourg: Government approves key economic, infrastructure reforms

Luxembourg’s Government Council met on 31 October 2025 under Prime Minister Luc Frieden, approving a series of measures to modernise economic activity zones, transport infrastructure, and public sector regulations. Ministers agreed on

See MoreLuxembourg: Government Council approves amendments to tax treaty with Georgia

Luxembourg’s Government Council approved protocols amending the tax treaty with Georgia on 31 October 2025. The two countries had signed the amendment protocol on 3 July 2025, updating the 2007 income and capital tax treaty for the first time

See MoreLuxembourg, Montenegro tax treaty comes into force

The income and capital tax treaty between Luxembourg and Montenegro entered into force on 1 October 2025. Under the agreement, dividends are taxed at 5% if the recipient company holds at least 10% of the distributing company's capital, and 10% in

See MoreLuxembourg: Government introduces bill to enhance fiscal stability, encourage investments in green infrastructure

The bill seeks to enhance fiscal stability, promote continued workforce participation, and encourage investments in energy-efficient housing. The Luxembourg government submitted a bill to the Chamber of Deputies on 15 October 2025 aimed at

See MoreLuxembourg: MoF presents 2026 state budget to Chamber of Deputies, proposes fiscal measures to bolster innovation-driven investments

The 2026 budget focuses on strengthening its financial centre through tax reforms and tech investments, while expanding incentives and support measures for SMEs and start-ups to boost innovation and entrepreneurship. Luxembourg's Minister of

See MoreSan Marino ratifies amending protocol to tax treaty with Luxembourg

The protocol will take effect once both countries have exchanged ratification instruments and will apply from 1 January of the year following its entry into force San Marino issued Council Decree No. 120 on 26 September 2025, ratifying the

See MoreSan Marino: Parliament ratifies tax treaty protocol with Luxembourg

San Marino’s Parliament approved the 2006 tax treaty protocol with Luxembourg to curb double taxation. San Marino's parliament approved the ratification of the protocol to the 2006 income and capital tax treaty with Luxembourg on 15 September

See MoreLuxembourg clarifies collective investment vehicle rules

Luxembourg Tax Authorities clarify which investment funds qualify as ‘Collective Investment Vehicles’ under Article 168quater (2) LITL, outlining conditions for widely held, diversified and regulated entities. The Luxembourg Tax Authorities

See MoreLuxembourg: Government proposes bill to enforce DAC9, align Pillar Two with OECD standards

DAC9 introduces new rules for sharing top-up tax information and filing obligations under the Pillar Two GMT Directive (Directive (EU) 2022/2523). Luxembourg’s government submitted a draft bill to the parliament to implement Council Directive

See MoreLuxembourg proposes permanent carried interest tax regime

Bill No. 8590 aims to establish a permanent tax framework for carried interest and strengthen Luxembourg’s position in asset management. The Luxembourg Government submitted Bill No. 8590 on 24 July 2025 to the Chamber of Deputies, introducing

See MoreLuxembourg approves draft laws on Pillar Two, crypto reporting

The approved draft laws transpose DAC 8 and DAC 9, introducing new crypto reporting obligations and implementing Pillar Two top-up tax information exchange, among others. Luxembourg’s Government Council approved a series of draft laws and

See MoreLuxembourg, Moldova amending protocol to tax treaty enters into force

The protocol aligns the agreement with OECD and BEPS standards. Moldova's State Tax Service announced that the amending protocol to the 2007 income and capital tax treaty with Luxembourg has entered into force on 14 July 2025. The protocol

See MoreGeorgia, Luxembourg sign protocol to amend 2007 tax treaty

Georgia and Luxembourg signed their first amending protocol to the 2007 tax treaty on 3 July 2025, with entry into force ratification. Georgia and Luxembourg signed a protocol amending their 2007 income and capital tax treaty on 3 July 2025. This

See MoreLuxembourg ratifies tax treaty protocol with Argentina

Luxembourg ratifies 2024 protocol amending 2019 tax treaty with Argentina through Law of 4 July 2025, published on 9 July 2025. Luxembourg published the Law of 4 July 2025 in the Official Gazette on 9 July 2025, approving the ratification of the

See MoreLuxembourg ratifies tax treaty with Oman

Luxembourg has ratified its income and capital tax treaty with Oman, following parliamentary approval and publication in the Official Gazette. Luxembourg published the Law of 4 July 2025 in the Official Gazette on 7 July 2025, formally ratifying

See More