Belarus announces corporate tax reforms for 2026

The Belarus Ministry of Taxes and Duties has announced a wide-ranging package of tax measures affecting companies from 1 January 2026, reshaping corporate taxation, sector-specific rates, and compliance requirements. The changes span corporate

See MoreBelarus, Jordan sign income tax treaty

Belarus and Jordan signed an income tax treaty during the Belarus-Africa Forum in Moscow on 16 December 2025. The agreement seeks to eliminate double taxation on income and prevent tax evasion between Belarus and Jordan. Before the signing,

See MoreBelarus: President authorises tax treaty negotiations with Myanmar

The President of Belarus signed a decree approving a draft income tax treaty with Myanmar on 25 November 2025. The draft agreement provides a framework for Belarus to negotiate with Myanmar and includes provisions to eliminate double taxation on

See MoreBelarus terminates tax treaty with Estonia

The Belarus Ministry of Taxes and Duties, in a notice on 14 November 2025, confirmed that the tax treaty between Belarus and Estonia has been terminated. Signed on 21 January 1997, the Belarus-Estonia tax treaty aimed to prevent double taxation

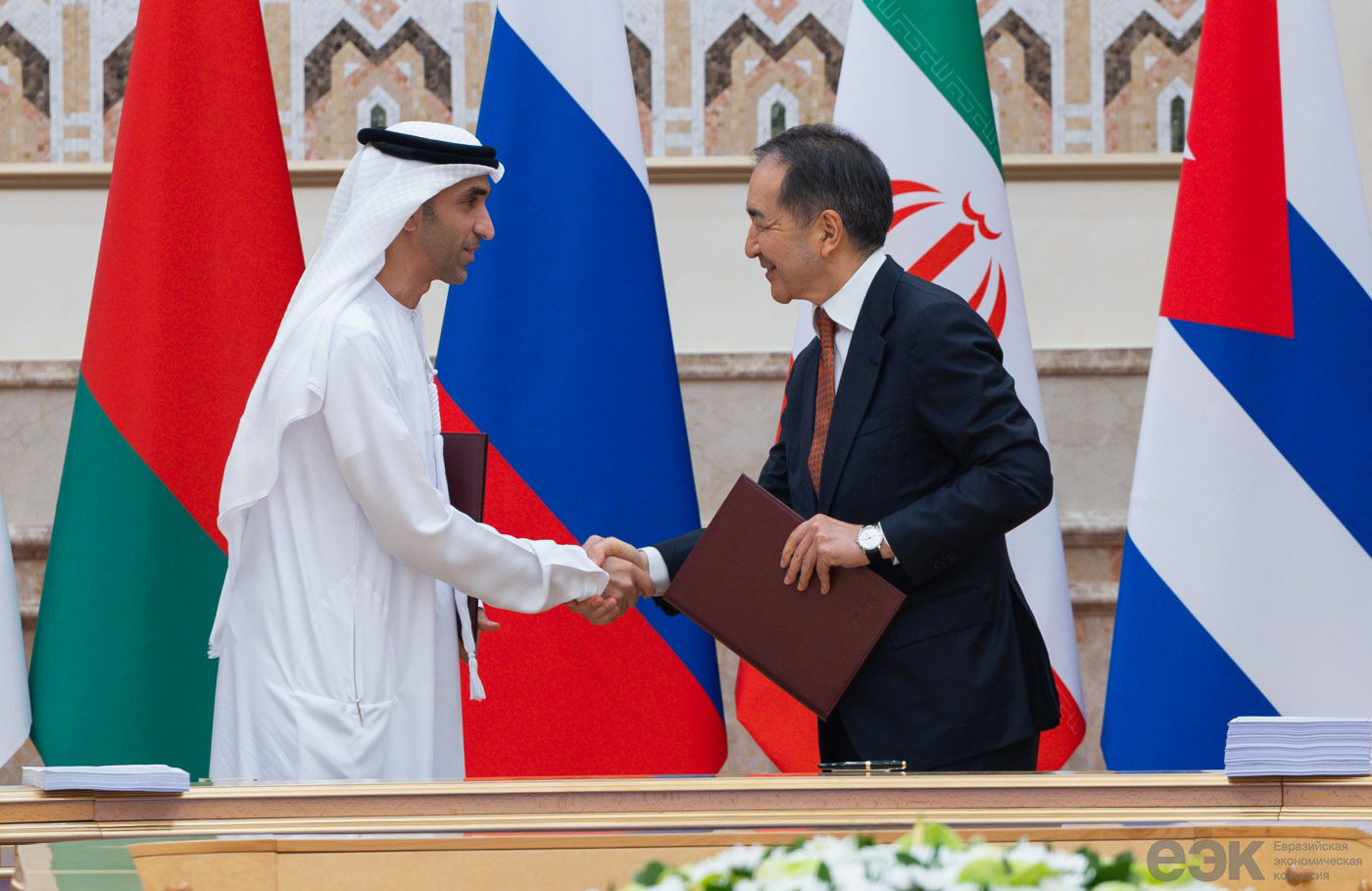

See MoreBelarus, UAE sign free trade in services and investments agreement

The agreement complements the EPA between the Eurasian Economic Union and the UAE, signed on the same day. Belarus and the UAE formalised an agreement in Minsk focusing on free trade in services and investments on 27 June 2025. This agreement

See MoreBelarus, Zimbabwe tax treaty enters into force

The treaty applies from 1 January 2026. The Belarus Ministry of Taxes and Duties announced that the income and capital tax treaty between Belarus and Zimbabwe came into effect on 2 July 2025. Signed on 31 January 2023, this is the first tax

See MoreBelarus: Tax ministry sets FATCA filing deadline for 2024

The Belarus Ministry of Taxes announced the 12 August 2025 deadline for 2024 FATCA filings under the Belarus-US Model 1B Agreement. The Belarus Ministry of Taxes and Duties announced on 7 July 2025 that the deadline for FATCA filing under the

See MoreEurasian Economic Union (EAEU), Mongolia sign temporary FTA

The FTA will be valid for three years, with a mutual option to extend for another three years. The Eurasian Economic Union (EAEU), comprising Armenia, Belarus, Kazakhstan, Kyrgyzstan, and Russia, signed a temporary free trade agreement (FTA)

See MoreFrance issues clarification on Belarus tax treaty suspension

France partially suspended the 1985 tax treaty with Belarus on 8 August 2024. France’s General Directorate of Public Finance has issued updated guidance on 18 June 2025, regarding the 1985 income tax treaty with the former Soviet Union as

See MoreEstonia gazettes law terminating tax treaty with Belarus

The termination act enters into force on 1 July 2025. Estonia has published law in its Official Gazette on 21 June 2025 to terminate the 1997 income tax treaty with Belarus, with the termination act entering into force on 1 July 2025. To

See MoreEstonia: Parliament approves termination of tax treaty with Belarus

The bill has now been sent to the President for ratification. The Estonian parliament passed a law to terminate the 1997 income and capital tax treaty with Belarus on 18 June 2025. The move follows Belarus’s suspension of key treaty

See MoreEstonia moves to terminate tax treaty with Belarus

Estonia has formally ended its 1997 tax treaty with Belarus, which could be terminated as early as 1 January 2026. Estonia’s government has approved a draft law to terminate its 1997 tax treaty with Belarus on 29 May 2025. The move follows

See MoreBelarus updates tax guidance for foreign permanent establishments

The Belarus Ministry of Taxes and Duties has published Letter No. 4-2-21/01461 of 18 April 2025 on taxing foreign organisations operating in Belarus through a permanent establishment. The letter replaces Letter No. 4-2-21/00850 of 20 March 2024, and

See MoreEstonia terminates tax treaty with Belarus

Estonia’s government submitted a draft law to terminate the 1997 tax treaty with Belarus on 24 March 2025. This follows after Belarus suspended key articles of the treaty, including dividends, interest, and capital gains; effective from 1 June

See MoreBelarus ratifies trade and investment agreement with China

Belarus' House of Representatives approved the ratification of a trade and investment agreement with China on 10 January 2025, following its submission by the Council of Ministers in December 2024. Originally signed in Minsk on 22 August 2024, the

See MoreBelarus and Jordan to negotiate tax treaty

Belarus’s President Alexander Lukashenko has authorised the negotiation and signing of an income tax treaty with Jordan on 11 February 2025. The agreement seeks to eliminate double taxation on income and prevent tax evasion between the two

See MoreLithuania moves to terminate 1995 tax treaty with Belarus

Lithuania issued Law No. XV-103 in the Official Gazette on 22 January 2025. Earlier, the Lithuanian government approved a draft law to terminate the 1995 tax treaty with Belarus on 13 November 2024. This decision comes after Belarus suspended

See MoreUK: HMRC announces suspension of tax treaty with Belarus

The UK HMRC has announced that the 2017 tax treaty with Belarus will be suspended on 6 April 2025, for income tax and capital gains tax, and on 1 April 2025, for corporation tax and other taxes. This announcement was made by UK HM Revenue &

See More