Malawi: MoF presents 2025-26 mid-year budget review, to introduce Minimum Alternate Tax

Malawi’s Ministry of Finance, Economic Planning, and Decentralisation (MoFEPD) presented the 2025-26 Mid-Year Budget Review Statement to the National Assembly on 21 November 2025. The 2025-26 Mid-Year Budget Review Statement proposes various

See MoreOman: OTA issues draft e-invoicing data dictionary

The Oman Tax Authority (OTA) has released the draft e-invoicing data dictionary to selected taxpayers ahead of the August 2026 rollout. It defines standard data elements, validation rules, and code lists for all transaction types across B2B, B2C,

See MoreGhana: Parliament approves Value Added Tax Bill 2025

Ghana’s Parliament has passed the Value Added Tax 2025 on 27 November 2025. The purpose of the Bill is to revise and consolidate the framework governing the Value Added Tax. Presenting the Finance Committee’s report to Parliament, the

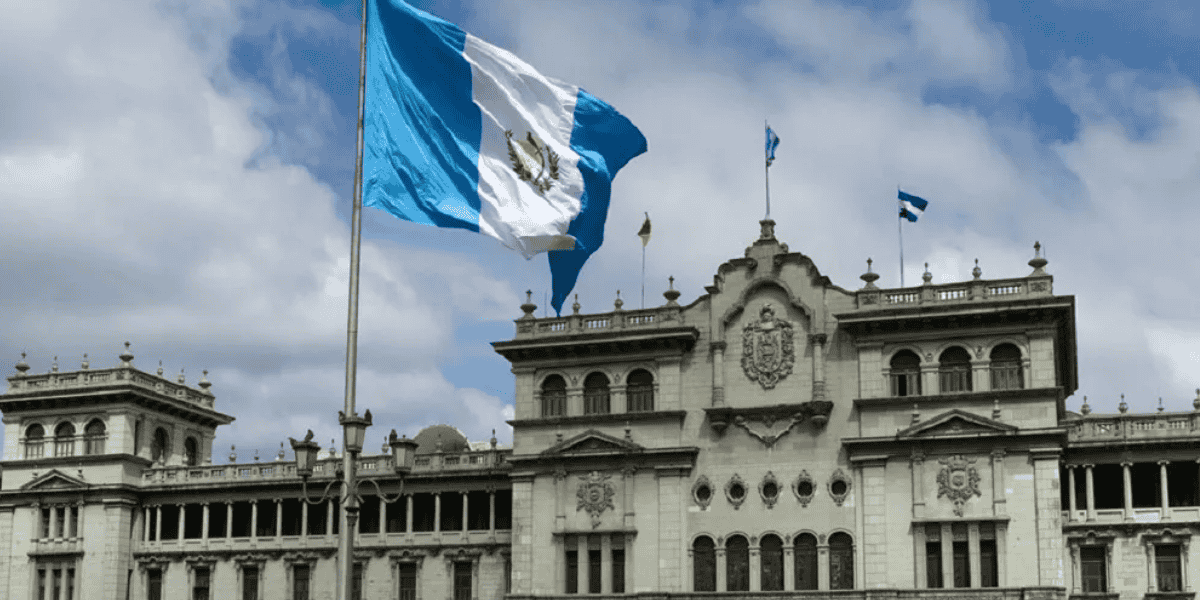

See MoreGuatemala revises regulations on tax credit offsets, refund procedures

Guatemala issued Decree No. 17-2025 in the Official Gazette, introducing amendments to the Tax Code, the Value Added Tax Law, and the Law on Legal Provisions for Strengthening Tax Administration. Decree 17-2025 establishes a new law intended to

See MorePortugal: Parliament approves 2026 budget, lowers corporate tax rates

Portugal’s parliament has approved the new 2026 Budget Bill on 27 November 2025. The Bill will proceed to presidential promulgation, followed by the formal publication of the law. The main tax measures of the 2026 Budget Bill are the reduced

See MoreIreland: Revenue updates guidance on territorial scope of VAT Groups

Irish Revenue issued eBrief No. 216/25 on 19 November 2025, providing new and updated guidance on the territorial scope of VAT Groups. The updates aim to clarify how VAT Groups operate in Ireland and which entities can be included under

See MoreZimbabwe: Government announces 2026 budget, proposes digital services withholding tax

Zimbabwe’s Ministry of Finance, Economic Development, and Investment Promotion (MoFEDIP) has presented the 2026 national budget to the Parliament on 27 November 2025, proposing higher VAT rates and digital service withholding taxes. The

See MoreRussia: President signs 2026-28 federal budget laws, introduces higher VAT rates

Russian President Vladimir Putin signed the laws on the federal budget for 2026 and the planning period of 2027–2028, as well as the laws amending the Budget and Tax Codes and outlining the specific rules for implementing the budget system in

See MoreUAE details fines for e-invoicing violations

The UAE Ministry of Finance has detailed penalties for violations of the country’s Electronic Invoicing System under Cabinet Decision No. 106 of 2025. The Decision, approved by the UAE Cabinet and presented by the Minister of Finance, follows a

See MoreUK: Government releases 2025 budget, mandates VAT e-invoicing from 2029

The UK government published Budget 2025 on 26 November 2025, introducing various measures to improve digital tax administration. One key measure is the requirement for all VAT invoices to be electronic from 1 April 2029. The shift to e-invoicing

See MoreSweden plans temporary VAT cut on food to ease costs

Sweden’s Ministry of Finance released a draft proposal to lower the VAT on food from 12% to 6% for a limited period. This announcement was made on 25 November 2025. The measure aims to make grocery bills more affordable for all households,

See MoreRussia: State Duma approves 2026 tax code amendments

Russia’s State Duma has approved amendments to the Tax Code introducing key tax measures for 2026. Draft Law No. 1026190-8 passed its third and final reading on 20 November 2025. Under the changes, the standard VAT rate rises from 20% to 22%.

See MoreRussia expands VAT exemptions for precious metal banking transactions

Russia has introduced new VAT relief measures for banking operations involving precious metals following the publication of Federal Law No. 417-FZ on 17 November 2025. The law adds two categories of transactions to the list of VAT-exempt

See MoreGeorgia implements several tax code modifications for 2026, strengthens transfer pricing rules

Georgia has issued Law No. 1061-IVМС-XIМП dated 12 November 2025 in the Official Gazette, introducing several amendments to the Georgian Tax Code. The amendments introduce targeted incentives for agriculture, capital markets, construction, and

See MoreBelgium: Government reaches deal on multi-annual budget for 2026, raises corporate tax

Belgium’s government reached a budget agreement for 2026 on 24 November 2025 after months of tense negotiations, Prime Minister Bart De Wever announced. Following a Christmas deadline he set for his five-party coalition, he reached a deal that

See MoreFrance: National Assembly rejects first part of 2026 Finance Bill

France’s National Assembly rejected the revenue (tax) section of the 2026 Finance Bill on 22 November 2025. A general vote held the previous day resulted in the Bill being rejected at its first reading after several weeks of public debate, with

See MoreRussia: MoF to introduce 2026 VAT measures for marketplace sales

Russia’s Ministry of Finance has clarified that taxpayers using the simplified taxation system can sell goods on marketplaces without paying VAT, and such transactions do not constitute a tax violation. This announcement was made on 21 November

See MoreAngola: National Assembly approves 2026 budget, proposes several tax law modifications

Angola’s parliament has approved the General State Budget for 2026 on 19 November 2025, introducing amendments to several tax laws. The key amendments are: Corporate Tax Reforms Electronic filing mandate: General and simplified regime

See More