Hungary: HTA introduces stricter rules for online invoice reporting errors

Starting 15 September 2025, Hungary’s tax authority will tighten online invoice reporting rules, with fines of up to HUF 1,000,000 per invoice for non-compliance. Hungary’s tax authority (HTA) will enforce stricter rules for online invoice

See MoreThailand: Cabinet extends 7% VAT rate until September 2026

Normally, the VAT rate is 10% in Thailand, but it was reduced to 7% as part of economic measures after the 1997 financial crisis. The Thai Cabinet has extended the reduced VAT rate of 7% until 30 September 2026. This announcement was made by

See MoreSlovak Republic: MoF unveils 2026 public finance, tax reform measures

The key tax changes are in the corporate and investment sectors, which face higher taxes: the top corporate license fee rises to EUR 11,520, and the special levy jumps to 15%. Consumption taxes increase, with VAT on sugary/salty foods at 23% and

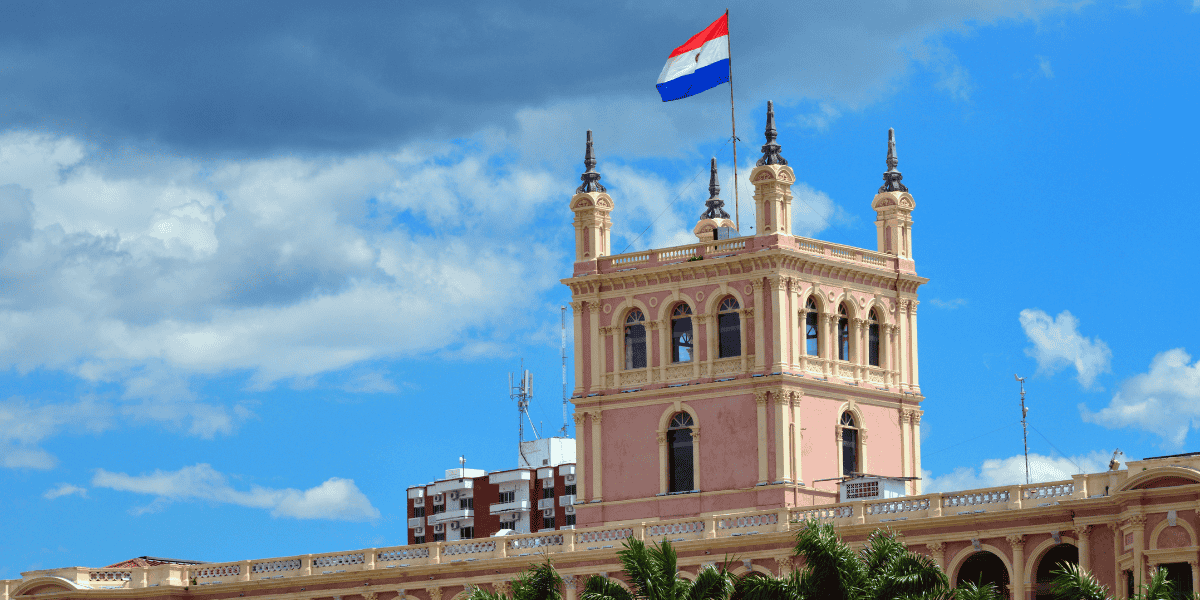

See MoreParaguay unveils new tax incentives for local, foreign investors

Key incentives include exemptions on customs duties, VAT, nonresident income tax, and dividend/profit tax for substantial investments in capital goods, industrial or agricultural production, and large-scale tourism or entertainment projects, subject

See MoreRussia proposes reduced VAT on essential goods

Russia proposes VAT cut on essential food items, children’s products, periodicals, and medical items. The Russian State Duma received draft law No. 1011590-8 on 8 September 2025, proposing a reduction of the value-added tax (VAT) rate from 10%

See MoreSri Lanka: Inland Revenue announces end of SVAT scheme

The Inland Revenue Department will repeal the SVAT Scheme from 1 October 2025, with September (monthly) and July (quarterly) being the last periods under SVAT, after which standard VAT rules apply. Sri Lanka’s Inland Revenue Department has

See MoreIreland: Irish Revenue revises VAT registration guidance

The guidance provides updates the Tax and Duty Manual Part 38-01-03b, which provides guidelines for VAT registration. Irish Revenue’s eBrief No. 168/25, released on 3 September 2025, updates the Tax and Duty Manual Part 38-01-03b, which

See MoreChile: SII provides clarification on new VAT Rules for low-value products purchased via remote sellers, online platforms

Ruling No. 1688-2025 states that DPIs selling low-value goods in Chile are not VAT taxpayers, must include all charges in the total price, and can reclaim excess VAT on returned goods after refunding the customer. Chile’s Tax Administration

See MorePoland publishes law mandating national e-invoicing system (KSeF)

Poland’s President signed a law on 27 August 2025 mandating the national electronic invoicing system (KSeF). Poland’s government has published legislation establishing a mandatory national e-invoicing system (KSeF) for large taxpayers,

See MoreGermany: MoF unveils draft tax amendment Act 2025

Draft law proposes income tax relief, VAT cuts, and simplifications for nonprofits. The German Ministry of Finance released the draft Tax Amendment Act 2025 on 5 September 2025, proposing tax relief measures for individuals and technical

See MoreSri Lanka: Cabinet approves delay in VAT for non-resident digital service providers

Sri Lanka delays VAT implementation from 1 October 2025 to 1 April 2026 for compliance purposes. Sri Lanka’s Cabinet has approved a postponement of the Value Added Tax (VAT) on digital services supplied by overseas companies to local

See MoreTanzania: TRA introduces 16% VAT on B2C online payments

The Tanzania Revenue Authority (TRA) has announced that a reduced VAT rate will apply to B2C online purchases made through banks or approved electronic payment platforms, effective 1 September 2025. TRA will implement a new VAT rate of 16%

See MoreArgentina: ARCA introduces flexible schedule for advance VAT payments

General Resolution 5750 lets VAT-registered taxpayers under the “IVA Simple” system apply advance VAT payments in the current return or within the next five months. Argentina’s tax authority (ARCA) has published General Resolution 5750 in

See MoreFinland: Government announces 2026 budget measures

The 2026 budget proposal includes reduced corporate tax rates, tightened crypto reporting requirements, adjusted VAT rates, and cuts to CO2 fuel taxes, as well as increased taxes on vehicles, tobacco, alcohol, and soft drinks. Finland’s

See MoreRomania: Government gazettes small business VAT scheme

The law raises the VAT exemption threshold for small businesses to RON 395,000, with the SME scheme ceasing once national or EU turnover exceeds EUR 100,000. Romania’s government has published Government Ordinance No. 22 (GO No. 22/2025) in

See MoreDenmark announces 2026 Finance Bill, proposes reduced electricity and excise tax reliefs

The 2026 Finance Bill includes an electricity tax cut, excise duty removal on food products, VAT abolition on books, and tax adjustments for rural properties. Denmark’s government presented the 2026 Finance Bill on 29 August 2025, proposing tax

See MoreColombia: MoF proposes major tax reforms for 2026 budget

The proposed 2026 budget legislation introduces significant reforms to corporate surtax, VAT, personal income tax, net wealth tax, and capital gains tax, with new tax rules for crypto-asset transactions. Colombia’s Ministry of Finance submitted

See MorePoland: Government adopts 2026 budget law, increases corporate tax for banks

The draft 2026 budget law increases the corporate tax rate for the banking sector, a rise in the VAT exemption threshold from PLN 200,000 to PLN 240,000, and a 15% hike in excise rates on alcoholic beverages. Poland's government has adopted the

See More