Ecuador: SRI extends VAT, withholding tax filing deadlines for Imbabura taxpayers

The Internal Revenue Service of Ecuador (SRI) has issued Resolution NAC-DGERCGC25-00000033, extending the deadlines for filing September 2025 Value Added Tax (IVA) and Withholding at the Source (retenciones en la fuente) returns, including their

See MoreLatvia considers reducing VAT for select foods, publications

Latvia is considering reducing the VAT rate for select food items and publications under the 2026 state budget. As such, Latvia will introduce a 12% VAT rate for selected food products from 1 July 2026 to 30 June 2027. This would include all

See MoreChile: Tax Authority updates IVA rules for digital platform operators

RF Report The Chilean Tax Authority (Servicio de Impuestos Internos, SII) issued Resolution Ex. SII No. 145-2025 on 16 October 2025, setting out the obligations of digital platform operators with residence or domicile in Chile regarding Value

See MoreFrance: Tax Authority clarifies VAT rate on biocontrol macro-organisms

RF Report The French tax authorities issued a rescript BOI-RES-TVA-000227 on 29 October 2025, clarifying the value-added tax (VAT) treatment for pollinating macro-organisms used in organic farming, gardens, green spaces, and public

See MoreRomania updates RO E-VAT compliance notice

Regfollower Desk Romania has published Order No. 2394/2025 in the Official Gazette No. 977 on 23 October 2025, updating the RO e-VAT Compliance Notice form originally introduced under Order No. 6234/2024 by the President of the National Authority

See MorePortugal mandates parent entity responsible for reporting, paying group’s consolidated VAT

Regfollower Desk Portugal’s parliament has enacted Law No. 62/2025, published in the Official Gazette on 27 October 2025, establishing a Value Added Tax (VAT) Group regime. The parent entity is responsible for reporting and paying the

See MoreTunisia: Government to widen scope of mandatory e-invoicing under 2026 Finance Bill

Regfollower Desk Tunisia's government has proposed significant updates to its electronic invoicing (e-invoicing) framework under the 2026 Finance Bill, announced on 14 October 2025. At present, the obligation applies only to B2G transactions

See MoreSlovak Republic enacts public finance consolidation measures for 2026

The 2026 public finance package introduces a sharply increased minimum corporate tax for large companies, raises VAT on high-sugar and high-sodium foods, and limits VAT deductions on motor vehicles to 50% between 2026 and 2028. Regfollower

See MoreTaiwan: NRNTB mandates e-invoicing requirements for sales returns, purchase returns, discounts

Taiwan businesses must issue and upload electronic credit notes for returns or discounts to comply with tax rules. Regfollower Desk The National Taxation Bureau of the Northern Area (NRNTB) in Taiwan, a regional branch of the Ministry of

See MoreColombia consults unified withholding tax for electronic payments

The draft decree will align the withholding tax rate applied to electronic payments and payments made with debit and credit cards Colombia’s Ministry of Finance has launched a public consultation on 23 October 2025 regarding a draft decree that

See MoreChile: SII clarifies offshore software tax exempt from non-resident income tax

Offshore software licenses in Chile exempt from income tax, VAT applies. The Chilean Tax Administration (SII) has clarified the tax treatment of software licensing services provided from abroad. According to Ruling No. 2066-2025 on 16 October

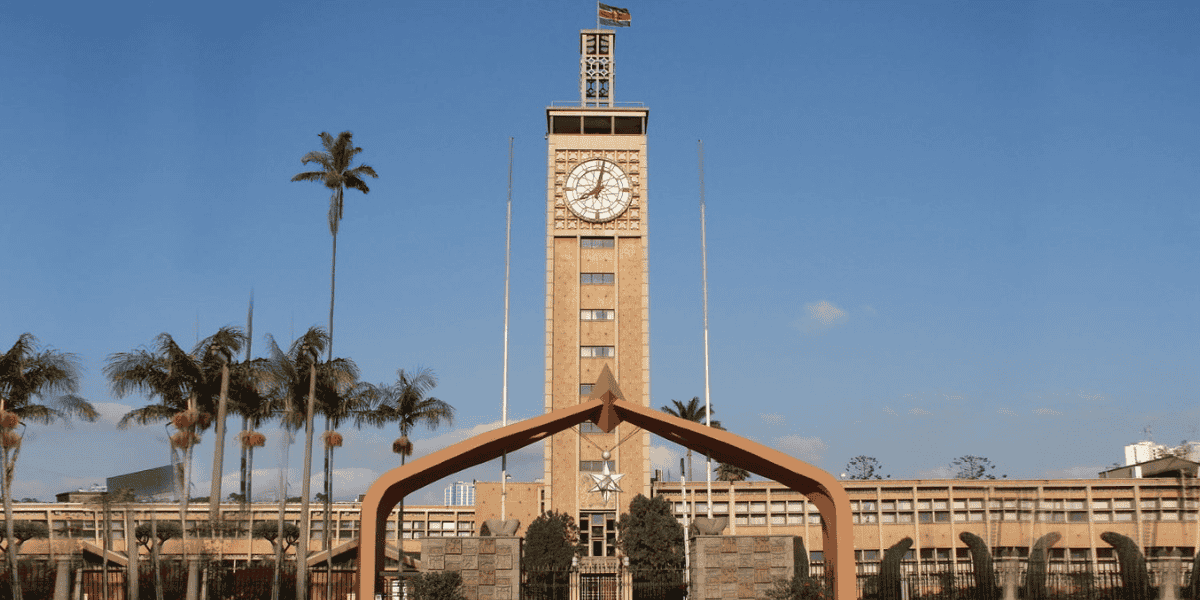

See MoreKenya: KRA announces tax compliance certificate (TCC) enhancements

To obtain a TCC, taxpayers must be registered in eTIMS/TIMS, file and pay all taxes on time, settle outstanding liabilities or have an approved payment plan, and maintain VAT compliance. The Kenya Revenue Authority (KRA) issued a public notice on

See MoreSingapore: IRAS updates GST error correction guidance with new FAQs

IRAS updates GST F7 guidance, clarifying when minor errors need not be corrected. The Inland Revenue Authority of Singapore (IRAS) has updated its guidance on correcting errors in Goods and Services Tax (GST) returns through Form F7, adding six

See MoreColombia: DIAN closes businesses for electronic invoice non-compliance

DIAN closed 47 Bogotá businesses in October for failing to issue electronic invoices and meet tax obligations. Colombia’s Tax Authority (DIAN) continues to strengthen its control measures in the capital. As part of the operations carried out

See MoreItaly: MoF releases 2026 VAT split-payment company lists

Under the split-payment system, buyers pay suppliers only the taxable amount, while the VAT portion is transferred directly to a designated VAT account. Italy's Department of Finance has released updated lists of companies required to comply with

See MoreSaudi Arabia: ZATCA urges businesses to file Q3 VAT returns

ZATCA urged Saudi businesses to file Q3 VAT returns on time. The Saudi Arabian Zakat, Tax and Customs Authority (ZATCA) has urged businesses subject to Value Added Tax (VAT), with annual goods and services revenues exceeding SAR 40 million, to

See MoreHungary: Parliament reviews Autumn Tax Package measures

Hungary’s draft autumn tax package, presented on 14 October 2025, proposes adjustments across corporate, VAT, insurance, retail, and advertisement taxes—including R&D incentives, global minimum tax compliance, reduced VAT on beef,

See MoreGermany: MOF updates B2B e-invoicing guidance

Germany updated rules for mandatory B2B e-invoicing effective from 31 December 2024. The German Ministry of Finance (MOF) issued a second administrative guidance on mandatory e-invoicing for domestic B2B supplies, effective for transactions after

See More