Hungary releases 2024 audit plan with targets transfer pricing

Hungary's National Tax and Customs Administration (NAV) has released its audit strategy for the 2024 calendar year, highlighting transfer pricing as its key area of focus among other sectors. The new transfer pricing reporting obligation introduced

See MoreCyprus announces updates to its transfer pricing FAQs

On 28 March 2024, the Cyprus Tax Department released the updated version of its English-language Frequently Asked Questions (FAQs) on transfer pricing. The FAQs present the questions and the corresponding answers as published on the Tax

See MoreUkraine revises form and procedures for county-by-country (CbC) reports

The State Tax Service of Ukraine released updates to the form and procedures for preparing country-by-country reports. Among the main changes to the procedure for filling out the country-by-country report of the international group of companies

See MorePoland: Parliament passes public CbC reporting legislation

The Polish Parliament has passed a law implementing public Country-by-Country (CbC) reporting in accordance with the requirements of Directive (EU) 2021/2101. This legislation establishes a public reporting threshold for companies with annual

See MoreEstonia: Preliminary bill for public CbC reporting submitted to parliament

On 12 February 2024, a draft bill was introduced to the Estonian Parliament to incorporate the EU Public Country-by-Country (CbC) Reporting Directive into Estonian legislation. The parliament acknowledged there are a limited number of companies that

See MoreGermany: MOF issues updated draft guidance on virtual currency transactions

On 6 March 2024, the German Ministry of Finance (MOF) released revised draft guidance concerning the compliance and documentation criteria for transactions involving virtual currency and tokens. This comes after the issuance of a final decree in May

See MoreNetherlands releases decision on public CbC reporting

On 1 March 2024, the Netherlands released the Decision of February 14, 2024, concerning the enforcement of the Directive (EU) 2021/2101. As previously stated, the Netherlands approved a law for public CbC reporting in December 2023 to partially

See MoreNigeria: FIRS shifts e-platform for transfer pricing and CbC reporting notifications

Nigeria’s Federal Inland Revenue Service (FIRS), in a notice to taxpayers and the general public, announced the transitioning of the electronic platform for filing transfer pricing returns and country-by-country (CbC) reporting notifications from

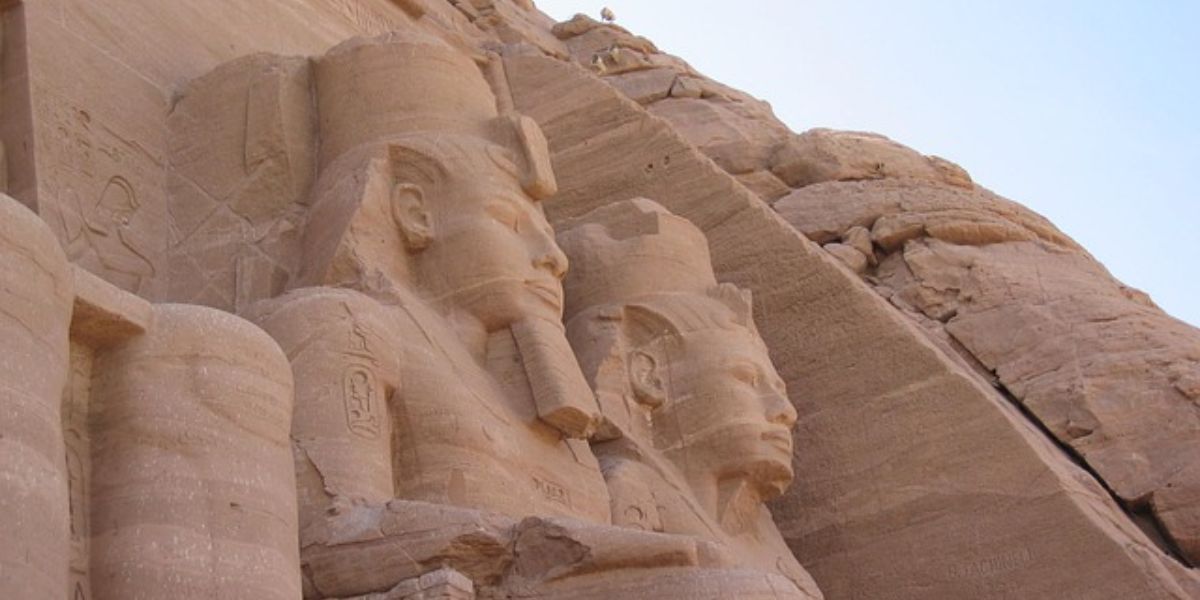

See MoreEgypt raises materiality threshold for master file and local file for 2024

On 15 February 2024, Egypt published the Ministerial Decree No. 52 of 2024 in the Official Gazette, providing updated transfer pricing documentation requirements for Egyptian taxpayers. This decree came into effect on 22 February 2024. In this

See MoreAustralia holding public consultation on updated public CbC reporting legislation

On 12 February 2024, the Australian Treasury announced it is conducting an additional public consultation regarding implementing new requirements for publishing selected tax information on a Country-by-Country (CbC) basis or public CbC reporting.

See MoreEgypt preparing draft for new income tax law

Egypt’s Minister of Finance for Tax Policy and Reforms has announced plans to draft a new iteration of the Income Tax Law. The details of the new law has been fully published, but the main proposals of the new law include: A focus on

See MoreEstonia passes draft law for delaying pillar 2 global minimum tax and public CbC reporting

On 8 February 2024, Estonia's Ministry of Finance, in a release announced that it passed the draft legislation to postpone the implementation of the Pillar 2 global minimum tax until the year 2030. Until that time, the companies that fall within the

See MoreCyprus revises thresholds for transfer pricing documentation

On 1 February 2024, the Cyprus Tax Department released updated thresholds regarding the requirement for taxpayers to prepare a Cyprus Local File for intercompany transactions covered by Section 33 of the Income Tax Law (ITL). These revised

See MoreBelgium implements public country-by-country reporting (CbCR)

On 26 January 2024, Belgium announced the introduction of public country-by-country reporting (CbCR) in the Official Gazette. The new law aligns with the EU Directive 2021/2101 or the EU Public CbCR Directive. On 1 December 2021, the European

See MoreDominican Republic: DGII enables e-portal for CbC reports submission

On 12 January 2024, the Directorate General of Internal Revenue (DGII) in the Dominican Republic released Notice 01-2024, notifying the availability of the reporting portal for Country-by-Country (CbC) reports. The obligation for Country-by-Country

See MoreMalta issues guidelines for transfer pricing rules

On 19 January 2024, Malta's Commissioner for Revenue published Guidelines in relation to the Transfer Pricing Rules. These guidelines are issued in terms of Article 96(2) of the Income Tax Act (Chapter 123 of the Laws of Malta) and are to be read in

See MoreItaly announces new deadline for transfer pricing documentation

On 12 January 2024, Italy published the Legislative Decree no. 1/2024 in the Official Gazette. The Decree details the simplification and rationalization of certain tax rules, including introducing a new tax calendar. From 2 May 2024, taxpayers

See MoreUkraine introduces CbC reports filing for the first time

On 11 January 2024, the State Tax Service of Ukraine, in a release announced it has introduced Country-by-Country (CbC) reporting for the parent companies of the international groups of companies for the first time in the country. The CbC reporting

See More