Netherlands: Government presents second amendment to 2025 Tax Plan to the parliament

The Netherlands government presented the second amendment bill to the 2025 Tax Plan to parliament. Travel expenses deduction for illness Taxpayers can deduct EUR 0.23/km for medical travel and pharmaceutical aids. Taxpayers are also allowed to

See MoreMalta announces new tax measures for 2025 budget

Malta’s finance minister, Clyde Caruana, presented the 2025 budget in the parliament on Monday, 28 October 2024. The 2025 budget includes the following proposed tax measures: Global minimum tax rate Malta has decided to delay the adoption

See MoreUK: 2024-25 budget anticipation results in GBP 300 billion in bond issuance amid tax hikes and borrowing, stocks fall as energy shares slide

UK finance minister Rachel Reeves is expected to announce the highly anticipated 2024-25 budget plan to the parliament today, 30 October 2024. The budget includes the first significant tax hikes in three decades and billions of pounds in

See MoreHungary to amend local and EU tax laws, achieve social and policy objectives

Hungary’s government concluded a public consultation on a draft bill proposing changes to various tax laws on 24 October 2024. The proposal seeks to amend tax laws in response to EU and Hungarian legislation changes, targeting global minimum tax,

See MorePortugal proposes several VAT measures in draft state budget law 2025

Portugal released the state budget law for 2025 (Law No. 26/XVI/1) on 10 October 2024, proposing various VAT measures. The draft Budget Law for 2025 proposes reduced corporate tax rates for companies and SMEs and revised personal income tax rates,

See MoreMorocco: 2025 draft finance law introduces new tax rules for joint ventures and economic groups

Morocco’s Ministry of Finance released the draft Finance Law 2025 on 19 October 2024, proposing various measures for corporate income tax, focusing on taxing joint ventures and economic interest groups. Corporate tax rules change for joint

See MorePortugal proposed reduced corporate tax rates in draft 2025 budget law

Portugal’s Finance Minister submitted the draft Budget Law for 2025 (Draft Law No. 26/XVI/1) to parliament on 10 October 2024, proposing reduced corporate tax rates for companies and SMEs and revised personal income tax rates and other tax

See MoreLatvia approves 2025 Budget draft law: Increase of EUR 583.2 billion projected revenue

Latvia’s Cabinet of Ministers approved the draft law on the 2025 State Budget and the budgetary framework for 2025, 2026 and 2027 with various tax amendments on 15 October 2024. The consolidated national budget revenue for 2025 is planned at

See MoreMalaysia likely to introduce subsidy cuts, new taxes in 2025 budget

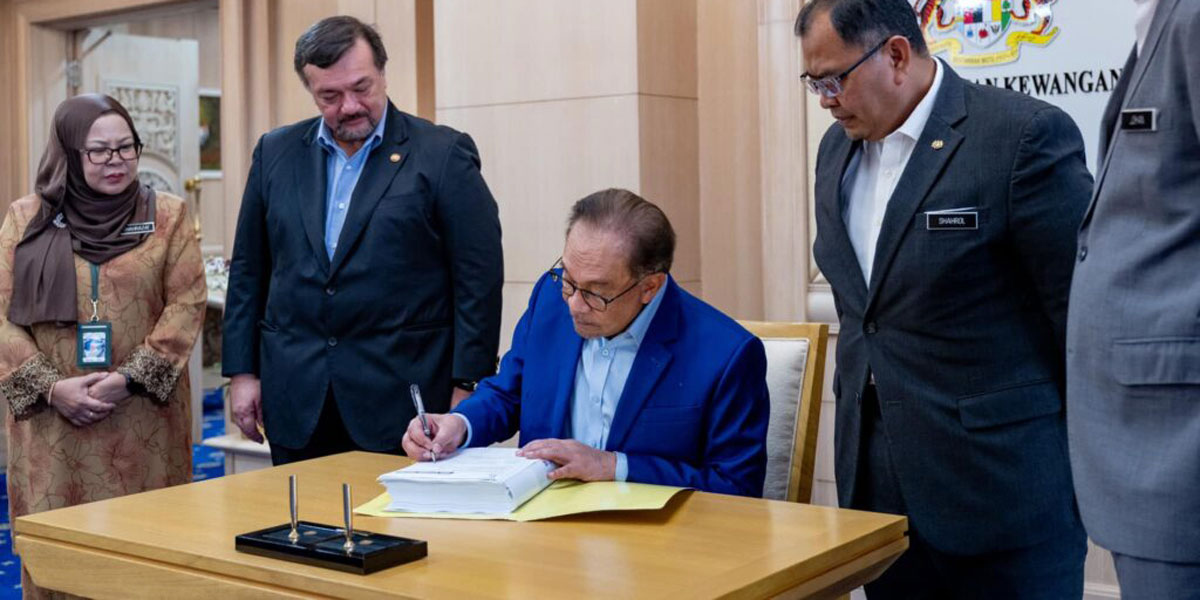

Malaysia’s Prime Minister Anwar Ibrahim will announce the 2025 budget in parliament on Friday, 18 October 2024. Analysts and economists suggest the government is likely to implement additional new taxes and reduce subsidies for its 2025 budget,

See MoreNorway proposes changes to exit taxes in 2025 Budget

Norway’s government has proposed amendments to the exit tax regulations in the National Budget 2025, which was announced on 7 October 2024. In practice, the current exit tax rules function as a tax loophole. The Government wants to close this

See MoreNorway announces 2025 budget, lowers tax and VAT rates

Norway’s government presented the 2025 Budget Bill, on 7 October 2024, with the aim to enhance the financial well-being of Norwegians, strengthen Norway's preparedness against war and crime, and reduce social and geographical

See MoreNigeria presents four tax reform bills to National Assembly

Nigeria’s President presented four bills to the National Assembly outlining measures to revise tax laws and modernise Nigeria’s tax system on 3 October 2024. The bills have been forwarded to the House Committee on Finance for review and

See MoreZambia presents 2025 budget, introduces limited tax measures

Zambia's Ministry of Finance and National Planning Minister Situmbeko Musokotwan presented the 2025 Budget Speech to the National Assembly on 27 September 2024. The budget focuses on revenue generation through limited tax measures without

See MoreNetherlands unveils ESG proposals on 2024 Budget Day

The Netherlands government submitted the 2025 Tax Plan to the lower house of Parliament on 17 September 2024. In addition to various proposals to improve the taxation system, the tax plan includes several proposals related to environmental, social,

See MoreIreland announces 2025 budget, EUR 10.5 billion in tax cuts

Ireland's Department of Finance published the Budget 2025 on yesterday, 1 October 2024. The Irish government's latest budget mentions EUR 10.5 billion in tax cuts and spending increases. Additionally, the budget outlines how the government plans

See MoreFinland presents 2025 Budget proposal to the parliament

Finland’s Ministry of Finance submitted its proposal for the 2025 Budget and other related legislative proposals to the Parliament on 23 September 2024. The budget’s central government expenditure amounts to EUR 88.8 billion and revenue to EUR

See MoreSweden presents Budget Bill 2025

The Swedish government presented its 2025 Budget Bill on 19 September 2024. This year, the government aims to shift its economic policy focus from fighting inflation to investing in long-term growth and security for a more prosperous and safer

See MoreIceland consults for 2025 budget bill

Iceland’s Budget Committee convened on 16 September 2024 to discuss the 2025 Budget Bill, which is now open for public consultation for comments until 3 October 2024. On 13 September 2024, the 2025 Budget Bill was approved in the parliament

See More