Czech Republic: Chamber of Deputies passes law amending employer reporting and tax regulations, introduces 150% R&D allowance

The bill is now awaiting the president’s signature. The Czech Republic’s Chamber of Deputies (Lower House of Parliament) passed a new law on 10 September 2025, introducing significant changes to employer reporting and tax regulations,

See MoreGreece publishes 2023 preferential tax jurisdictions

Under Greek law, preferential tax regimes are those with a corporate tax rate equal to or less than 60% of Greece’s rate for legal persons or permanent establishments. The Greek Public Revenue Authority (AADE) issued Decision No. A.1125 on 9

See MoreTurkey restricts simple method in business taxation

Certain businesses in metropolitan areas must use the real tax method from 2026. The Turkish government issued Presidential Decision No. 10380, published in the Official Gazette on 9 September 2025, introducing changes to business taxation under

See MoreOECD updates BEPS Action 5 transparency framework on tax rulings

OECD updated BEPS Action 5 rules with new peer review terms and XML Schema for 2027. The OECD released a set of revisions to the BEPS Action 5 minimum standard on the spontaneous exchange of information on tax rulings (the “transparency

See MoreEstonia updates motor vehicle tax, registration rules

Estonia launches a new motor vehicle tax from 1 January 2025, covering various vehicles with rates based on age, weight, and emissions. The Estonian President approved amendments to the Motor Vehicle Tax Act and updates to the Traffic Act on 9

See MoreSouth Africa: National Treasury withdraws amendment on hybrid equity instruments

National Treasury has retracted its proposal to amend the definition of “hybrid equity instrument” in section 8E of the Income Tax Act following industry concerns. South Africa's National Treasury confirmed that the proposal in the 2025 draft

See MoreAustralia: ATO announces GIC, SIC rates for Q2 2025-26

From 1 October 2025, the GIC annual rate will be 10.61%, and the SIC annual rate will be 6.61%. The Australian Taxation Office (ATO) announced the general interest charge (GIC) rates and shortfall interest charge (SIC) rates for the second

See MoreAustralia: Treasury consults on amendments to PPRT

The deadline for submitting feedback is 3 October 2025. Australia’s Treasury has issued a draft legislation for consultation under the Treasury Laws Amendment Bill 2025 to implement one of the key recommendations from the government’s 2017

See MoreAustralia: Treasury consults proposed tax concessions for alcohol producers

The deadline for submitting feedback is 22 September 2025. Australia’s Treasury has released draft legislation for consultation on proposed tax relief measures for alcohol producers as part of its 2025–26 Budget commitments. Higher rebate

See MoreAustralia: NSW Government to extend build-to-rent (BTR) tax concessions indefinitely

The draft legislation would make the 50% land tax reduction for build-to-rent properties permanent and grant stamp duty and land tax concessions to eligible foreign developers. Australia’s New South Wales (NSW) Government has introduced draft

See MoreAustralia: ATO consults on top 100 GST program changes

The deadline to submit comments is 29 September 2025. The Australian Taxation Office (ATO) has opened a consultation on 8 September 2025 regarding updates to its Top 100 Goods and Services Tax (GST) program. These changes are aimed at high

See MoreSlovak Republic: MoF unveils 2026 public finance, tax reform measures

The key tax changes are in the corporate and investment sectors, which face higher taxes: the top corporate license fee rises to EUR 11,520, and the special levy jumps to 15%. Consumption taxes increase, with VAT on sugary/salty foods at 23% and

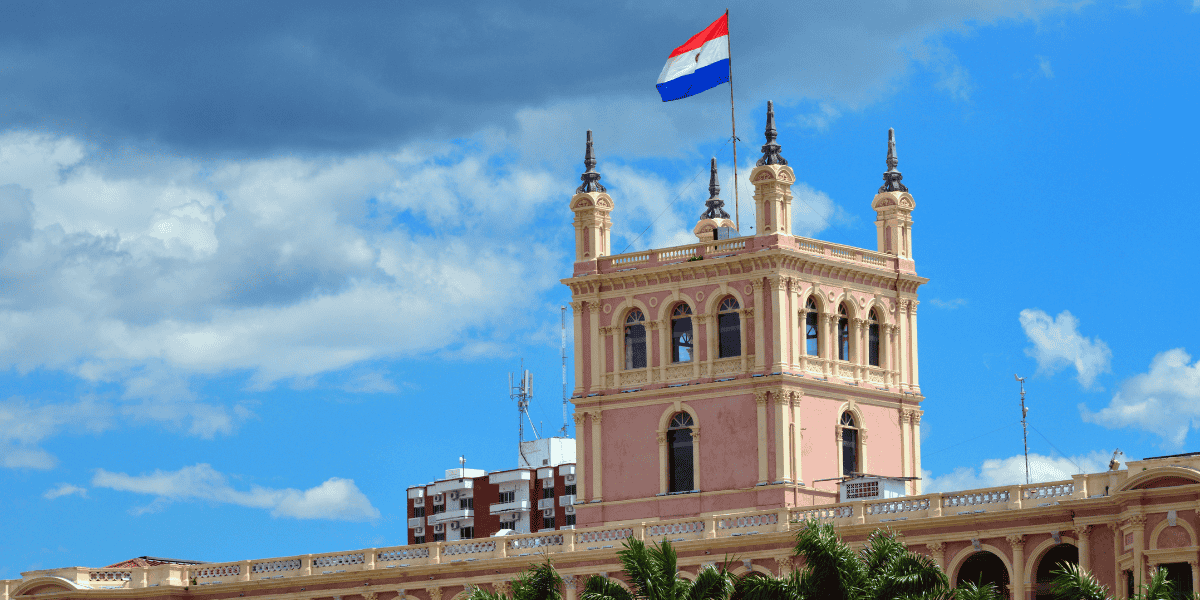

See MoreParaguay unveils new tax incentives for local, foreign investors

Key incentives include exemptions on customs duties, VAT, nonresident income tax, and dividend/profit tax for substantial investments in capital goods, industrial or agricultural production, and large-scale tourism or entertainment projects, subject

See MorePhilippines introduces tax reforms targeting large-scale metallic mining activities

Republic Act No. 12253 takes effect on 20 September 2025, affecting large-scale metallic mining contractors 150 days later, with implementing rules to be issued within 90 days. The Philippines has published Republic Act No. 12253, an Act

See MoreNigeria gazettes tax reform acts, updates corporate and minimum effective tax rates

The Nigeria Tax Act 2025 and the Nigeria Tax Administration Act 2025, which will take effect on 1 January 2026, as well as the Nigeria Revenue Service (Establishment) Act 2025 and the Joint Revenue Board (Establishment) Act, which came into force on

See MorePortugal updates blacklist of favourable tax jurisdictions

Portugal delists Hong Kong, Liechtenstein, and Uruguay from its tax blacklist. Portugal has issued Ordinance No. 292/2025/1 on 5 September 2025, introducing changes to the list of jurisdictions considered to have privileged tax regimes under

See MoreTaiwan: MoF revises annual sales threshold for offshore e-service tax registration

Taiwan’s Ministry of Finance has set a new TWD 600,000 annual sales threshold for offshore electronic service providers to register for tax. Taiwan’s Ministry of Finance has announced guidance on the yearly sales threshold required for

See MoreRussia proposes reduced VAT on essential goods

Russia proposes VAT cut on essential food items, children’s products, periodicals, and medical items. The Russian State Duma received draft law No. 1011590-8 on 8 September 2025, proposing a reduction of the value-added tax (VAT) rate from 10%

See More