US: IRS announces tax relief to Wisconsin storm, flooding, and mudslides victims

Wisconsin taxpayers now have until 2 February 2026 to file various federal individual and business tax returns and make tax payments. The US Internal Revenue Service (IRS) released WI-2025-04 on 17 September 2025, in which it announced tax relief

See MoreEthiopia updates VAT registration rules, expands scope

Ministry of Finance issued Directive No. 1104/2025, requiring certain taxpayers to register for VAT and start collection within 30 days. Ethiopia’s Ministry of Finance issued Directive No. 1104/2025 on 3 September 2025, outlining updated

See MoreCzech Republic: President signs bill amending rules Pillar 2 rules, updates top-up tax deadlines

The President of the Czech Republic signed a bill amending the Act on Top-Up Taxes, aligning Pillar 2 filing and local tax deadlines with OECD timelines. The President of the Czech Republic, Petr Pavel, signed a bill amending the “Act on Top-Up

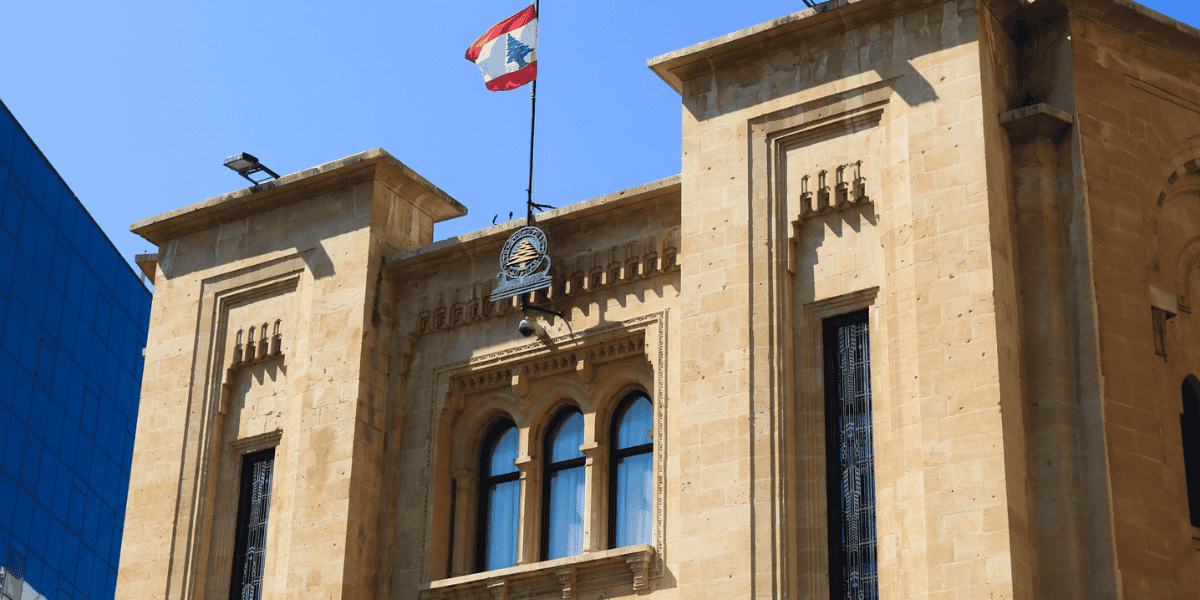

See MoreLebanon: Government tables 2026 budget law draft, introduces amendments to corporate income tax

Lebanon submitted its 2026 Draft Budget Law to the Council of Ministers, proposing wide-ranging reforms across corporate tax, VAT, customs, excise duties, digitalisation, and tax incentives, including stricter deduction rules, and targeted

See MoreMexico: Tax authority publishes updated list of foreign digital service providers registered for tax

Tax authority on 15 September 2025 published an updated list of 268 registered foreign digital service providers. Mexico’s tax authority released an updated list of 268 foreign digital service providers registered for tax purposes on 15

See MoreHong Kong: Government introduces regulatory framework for basketball betting

The new basketball betting legislation is based on the existing system for football betting and takes effect upon publication in the official gazette. The Hong Kong SAR (HKSAR) government enacted the Betting Duty (Amendment) Bill 2025 on 11

See MoreGeorgia expands BEPS MLIs coverage with 22 new tax treaties

Georgia's Parliament Foreign Relations Committee approved ratifying several international agreements, including an update to Georgia's MLI reservations and notifications originally submitted on 29 March 2019. The Foreign Relations Committee of

See MoreUkraine: Parliament considers tax on digital platform income

The draft proposes a 5% individual income tax for qualifying Ukrainian resident sellers. Ukraine’s parliament is reviewing draft law No. 14025 on 9 September 2025, which will tax income earned by individuals through online platforms. The

See MorePoland reduces interest rates on tax arrears, late payments

MOF issued a notice on 12 September updating the interest rates. Poland’s Ministry of Finance (MOF) issued a notice on 12 September 2025 updating the interest rates applicable to tax arrears and late payments. The standard rate will

See MoreRussia: Bank of Russia reduces key interest rate

Further decisions on the key rate will be made depending on the sustainability of the inflation slowdown and the dynamics of inflation expectations. The Bank of Russia announced, on 12 September 2025, a cut to the key interest rate by 100 basis

See MoreUS: Treasury, IRS adds 39 substances to superfund list subject to excise tax

These additions will generally take effect for tax purposes starting 1 January 2026, while the specific effective dates for refund claims under section 4662(e) are detailed individually for each substance. The US Treasury Department and Internal

See MoreKorea (Rep.): National Assembly proposes longer carryforward period for unused tech investment credits

The National Assembly is reviewing a bill to extend investment tax credit carryforwards from 10 to 20 years, effective retroactively from 2026. The Korean National Assembly is considering Bill No. 2212902 which proposes extending the

See MoreFinland: MoF consults DAC9 reporting rules

The consultation is set to conclude on 26 September 2025. Finland’s Ministry of Finance has initiated a public consultation on 15 September 2025 for the implementation of the Amending Directive to the 2011 Directive on Administrative

See MoreAustralia: Treasury consults draft rules for critical minerals production tax incentive

The consultation ends on 10 October 2025. Australia’s Treasury has initiated a public consultation on draft regulations aimed at clarifying elements of the Critical Minerals Production Tax Incentive (CMPTI). The Income Tax Assessment (1997

See MoreUkraine sets deadline for 2024 transfer pricing report, notification

STS has announced the deadline to submit 2024 transfer pricing report and notification of participation in an international corporate group of companies. Regfollower Desk Ukraine’s State Tax Service (STS) announced on 11 September that the

See MoreEU: US framework GILTI, Net CFC Tested Income regimes to operate alongside Pillar 2

The EPRS "At a Glance" note (15 September 2025) reports that under the G7 Statement, US-parented groups will be excluded from Pillar 2’s IIR and UTPR, with US GILTI and Net CFC Tested Income rules applying alongside the global minimum tax

See MoreNetherlands: Government presents 2026 budget, outlines main tax measures

The plan introduces technical updates and minor adjustments to income tax, wage tax, corporate tax, motor vehicle tax, heavy vehicle tax, and environmental taxes. The Dutch government unveiled the 2026 Budget along with the Tax Plan on 16

See MoreOman: OTA launches tax refund services on e-portal for embassies, diplomats

This initiative aligns with Article 87 of the VAT Law and Article 37 of the Excise Tax Law, granting embassies and diplomatic missions the right to request refunds on qualifying goods and services. The Oman Tax Authority (OTA) announced the

See More