Sri Lanka becomes member of global forum on tax transparency, information exchange

As a new Global Forum member, Sri Lanka will benefit from the induction programme, a comprehensive multi-year capacity-building programme aimed at helping new members implement and benefit from the above-mentioned standards. The OECD announced

See MoreOECD publishes revised Tax Debt Management Maturity Model report

The update helps tax administrations assess their maturity, support strategic discussions, compare anonymised peer data via a heat map, and connect with advanced-practice peers through OECD-facilitated consent. The OECD's Forum on Tax

See MoreBolivia: SIN extends deadline for e-invoicing for select taxpayers

The new deadline for issuing e-invoices has been moved to 31 March 2026. Bolivia’s tax authority (SIN) has published Resolution RND 102500000036 in the Official Gazette on 11 September 2025, announcing an extension for taxpayers in groups 9

See MoreNigeria mandates withholding tax on interest from short-term securities

FIRS announced that interest from short-term securities investments will now be subject to withholding tax. Nigeria’s Federal Inland Revenue Service (FIRS) issued a public notice on 17 September 2025, mandating withholding of tax on interest

See MoreOECD report highlights AI applications in tax administration

The OECD released a report analysing trends, challenges, and policies in public-sector AI use across 11 core government functions, with a particular focus on tax administration. The OECD released a report titled “Governing with Artificial

See MoreHong Kong: Chief Executive delivers 2025 policy address, includes tax incentives for strategic industries, and digital investments

The Hong Kong government plans to introduce legislative changes in early 2026 to enhance preferential tax regimes and attract more funds, family offices, and carried interest, reinforcing its role as a global financial hub. Hong Kong’s Chief

See MoreUzbekistan: Parliament considers proposal to implement Islamic banking

The draft law will provide a legal framework for Islamic banking in Uzbekistan, enabling the establishment of Islamic banks and windows, curbing the hidden economy, and attracting foreign investment in line with international Islamic finance

See MoreSouth Africa: SARS consults customs rules for transfer pricing adjustments

The consultation is set to conclude on 3 October 2025. The South African Revenue Service (SARS) has initiated a public consultation regarding draft changes to the rules under sections 40, 41, and 120 of the 1964 Customs and Excise Act, relating

See MoreUS: Federal Reserve reduces benchmark rates to 4.00%-4.25%

The Federal Reserve cut interest rates by 0.25%, which brings the benchmark rate to 4.00%-4.25%. The US Federal Reserve has reduced interest rates on Wednesday, 17 September 202, for the first time since December in response to concerns about

See MoreAustralia: ATO releases official form to revoke thin capitalisation test elections

The form enables eligible entities to revoke a previously made thin capitalisation test choice, including the group ratio or third-party debt tests. The Australian Taxation Office (ATO) released the official form for revoking thin capitalisation

See MorePoland: MoF consults on draft corporate tax reform to address tax gaps

The deadline for submitting comments is 26 September 2025. Poland’s Ministry of Finance has initiated a public consultation on 16 September 2025 regarding the draft amendments to the Corporate Income Tax (CIT) framework. The proposed

See MoreUS: House Republicans call on President Trump to advocate ending UK DST

The letter mentions that, since 2020, the UK Digital Services Tax has collected over USD 3 billion, diverting economic profit from American innovators and workers to foreign coffers. US Congressman Ron Estes (R-Kansas) led 21 of his colleagues in

See MoreIndonesia: Central bank again cuts interest rate to 4.75%

Bank Indonesia (BI) previously cut its benchmark interest rate by 25 basis points to 5.00% on 20 August 2025. Indonesia's central bank, Bank Indonesia (BI), has announced its sixth interest rate cut since starting its easing cycle in September

See MoreHong Kong: HKMA cuts interest rate to 4.50%

The Hong Kong Monetary Authority (HKMA) cut its base rate by 25 basis points to 4.50%, following the US Federal Reserve’s move. Hong Kong's central bank, the Hong Kong Monetary Authority (HKMA), has reduced its base interest rate by 25 basis

See MoreCanada: Central bank cuts interest rate to 2.50%

Bank of Canada lowered interest rate amid economic slowdown Canada’s central bank, the Bank of Canada, lowered its key interest rate by 25 basis points to 2.50% on Wednesday, 17 September 2025, marking its first rate cut since March. The

See MoreSri Lanka: IRD issued notice on ATPS tax credit verification

IRD urged taxpayers to check 2020–21 ATPS credits. The Sri Lankan Inland Revenue Department (IRD) issued a Notice No. PN/PYMT/2025-01 on 10 September 2025, called on taxpayers to verify tax credits linked to payments made under the

See MoreGreece: AADE announces B2B e-invoicing launch for large businesses

Greece set B2B e-invoicing mandatory from February 2026 with early adoption incentives. The Greek Public Revenue Authority (AADE) announced the official dates when businesses must start issuing electronic invoices (e-invoices) for

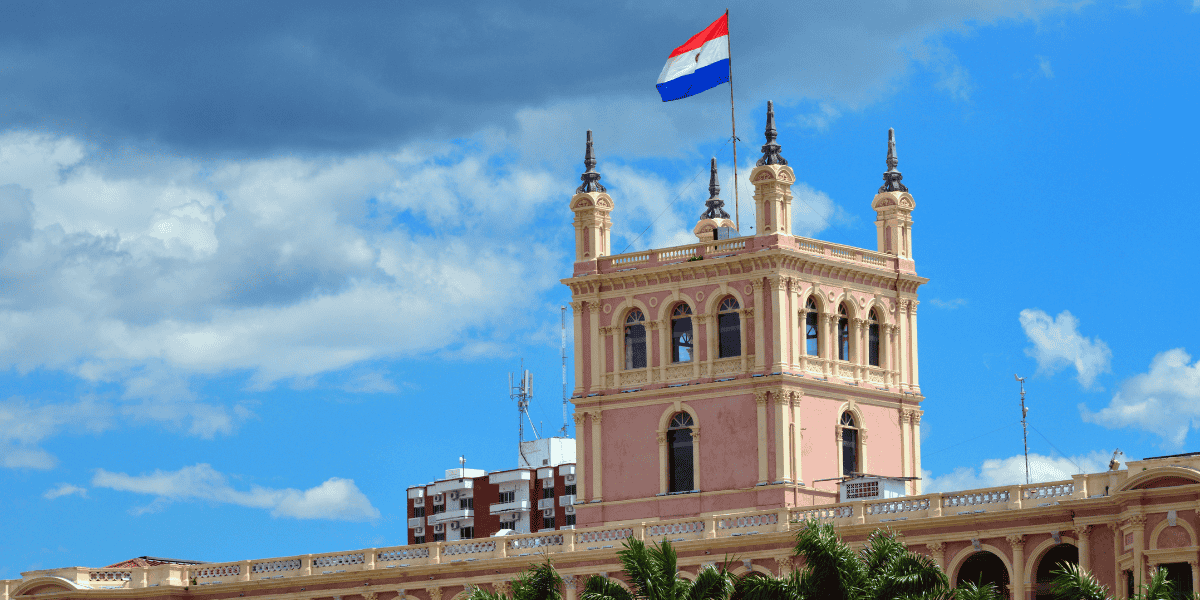

See MoreParaguay introduces tax incentives for electronics manufacturing, digital equipment

Paraguay’s Law No. 7546/2025 boosted investment and jobs in electronics and digital equipment. Paraguay has enacted Law No. 7546/2025, published on 8 September 2025 and effective from 9 September 2025, to promote investment and formal

See More