OECD publishes the third batch of updated transfer pricing country profiles

The OECD has published updated transfer pricing country profiles for 25 jurisdictions, adding new profiles for Cabo Verde, Guatemala, Thailand, the UAE, and Zambia. The OECD has released a new batch of updated transfer pricing country profiles on

See MoreNetherlands: MoF consults on tax measures for cross-border transactions

The consultation ends on 1 December 2025. The Netherlands Ministry of Finance initiated a public consultation on 20 October 2025 on a draft legislation outlining tax-related accompanying measures for cross-border transactions. The proposed

See MorePoland: MoF announces amendments to sugar, gaming tax

The proposed law aims to raise the sugar tax on sweetened and energy drinks and increase the flat-rate income tax on contest and lottery winnings from 10% to 15%. Poland's government has announced a draft law regarding changes to the Public

See MoreHong Kong: IRD issues updated guidance on Pillar 2 e-filing requirements for in-scope group members

This update is particularly significant for Hong Kong's minimum tax framework, as mandatory e-filing will apply to years of assessment starting on or after 1 April 2025. Hong Kong’s Inland Revenue Department has released updated guidelines on

See MoreAustralia: ATO releases updated guidance on transitional CbC safe harbour rules for global and domestic minimum tax

The updated guidance will help taxpayers determine whether the transitional CBC reporting safe harbour applies and how it may simplify their Pillar Two compliance obligations. The Australian Taxation Office (ATO) has released updated Global and

See MoreHungary: NAV publishes final QDMTT advance payment form on ONYA platform

The 24GLBADO form is required for reporting and paying the QDMTT advance under the country’s implementation of Pillar 2 global minimum tax rules. Hungary's National Tax and Customs Administration (NAV) has published the 24GLBADO form on the

See MoreArgentina: ARCA extends deadline for accessing income tax payment facility

The new deadline is set at 28 November 2025. Argentina's tax authority (ARCA) has announced an extension for taxpayers to join the payment facility regime on 22 October 2025, aimed at regularising income tax balances, including adjustments for

See MoreItaly: MoF releases 2026 VAT split-payment company lists

Under the split-payment system, buyers pay suppliers only the taxable amount, while the VAT portion is transferred directly to a designated VAT account. Italy's Department of Finance has released updated lists of companies required to comply with

See MoreUN Tax Committee begins 31st session to advance model convention, treaty manual update, and extractive industry taxation

The UN Committee of Experts opened its 31st session in Geneva on 21 October 2025 to discuss updates to the Model Tax Convention, revise the treaty negotiation manual, and address extractive industry taxation, forming subcommittees for the first two

See MoreBulgaria: Council of Ministers approves CRS MCAA addendum to include crypto-asset reporting

Bulgaria approved the CRS MCAA Addendum on 21 October 2025, expanding reporting to include crypto-assets under the OECD’s CARF, with exchanges set to begin by 2027. The Bulgarian Council of Ministers approved the Addendum to the 2024

See MoreSri Lanka: IRD urges taxpayers to urgently updating information

Non-compliance may result in a fine of up to LKR 50,000 under Section 177 of the Inland Revenue Act No. 24 of 2017. The Sri Lankan Inland Revenue Department (IRD) has issued an urgent Notice to Taxpayers, urging all citizens to update their

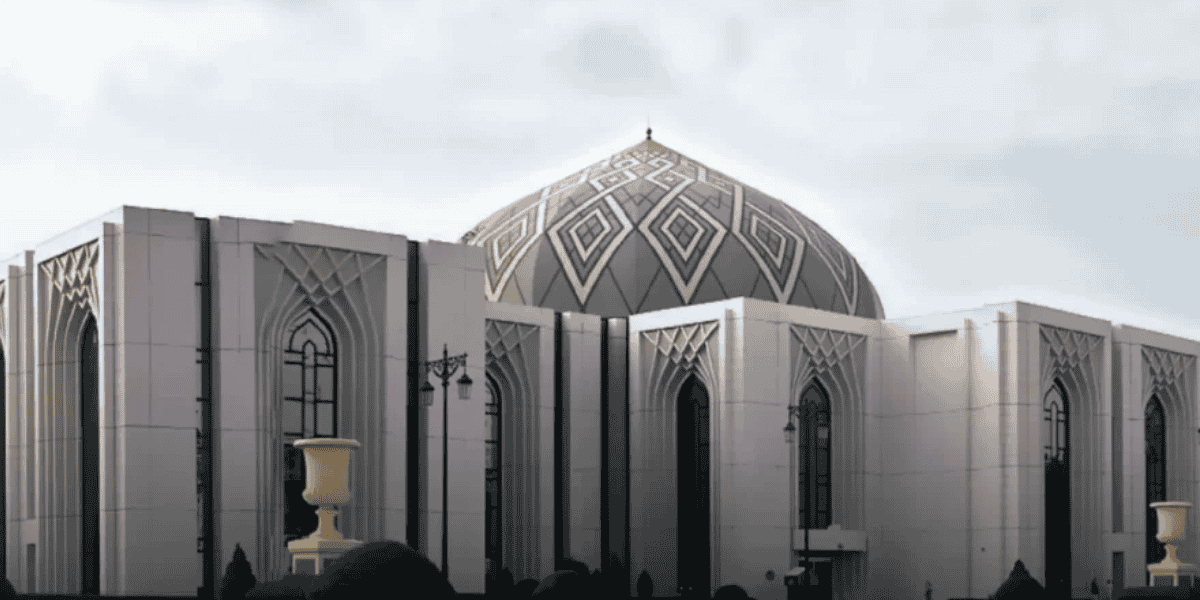

See MoreSaudi Arabia: ZATCA urges businesses to file Q3 VAT returns

ZATCA urged Saudi businesses to file Q3 VAT returns on time. The Saudi Arabian Zakat, Tax and Customs Authority (ZATCA) has urged businesses subject to Value Added Tax (VAT), with annual goods and services revenues exceeding SAR 40 million, to

See MoreKenya: KRA announces fringe benefit, deemed interest rates for Q4 2025

The Kenya Revenue Authority has announced the applicable market and deemed interest rates for the final quarter of 2025, outlining the corresponding withholding tax obligations for employers under the Income Tax Act. The Kenya Revenue Authority

See MorePhilippines: Government to form task force on tax and regulatory issues

The Department of Finance, in partnership with private sector stakeholders, is leading a multi-sectoral working group focused on improving the country’s investment environment and creating more employment opportunities. According to a

See MoreHungary: Parliament reviews Autumn Tax Package measures

Hungary’s draft autumn tax package, presented on 14 October 2025, proposes adjustments across corporate, VAT, insurance, retail, and advertisement taxes—including R&D incentives, global minimum tax compliance, reduced VAT on beef,

See MoreHungary: Government presents DAC8, DAC9 implementation bill to parliament

The legislation aims to align Hungarian law with EU directives by regulating crypto-asset reporting and implementing global minimum tax rules. Hungary’s government has presented Bill No. T/12802 on the implementation of DAC8 and DAC9 in the

See MoreBolivia: SIN extends agricultural unified tax system obligations deadline for 2024 fiscal year

The deadline was extended because agricultural associations requested more time. Bolivia’s tax authority (SIN) has issued Resolution RND 102500000039 on 10 October 2025, granting an extension for obligations related to the Unified

See MoreEU officially issues regulation to streamline, enhance the carbon border adjustment mechanism (CBAM)

The amended Regulation is the final step in the formal adoption process, signed by the European Parliament and the Council and a key step towards fostering a more competitive and sustainable business environment while effectively addressing climate

See More