Italy to impose duties on non-EU parcels, increase financial transaction taxes

Italy is preparing several new tax measures to boost revenue and protect local industries. A EUR 2 levy on small non-EU parcels, aimed at platforms like Shein and Temu, will apply to packages worth up to EUR 150 and is expected to raise over EUR

See MoreAustria: Nationalrat approves Tax Amendment Act 2025

Austria’s National Council (Nationalrat) approved the Tax Amendment Act 2025 (Abgabenänderungsgesetz 2025) on 10 December 2025, introducing extensive changes across federal tax and administrative laws. The legislation amends a wide range of

See MoreSlovak Republic: Parliament approves mandatory e-invoicing, e-reporting

The Slovak Republic Parliament approved a draft law on 9 December 2025, introducing measures to tackle tax evasion, close the VAT gap, and implement the EU Directive 2025/516 on VAT in the digital era (ViDA). The law establishes mandatory electronic

See MoreArgentina: ARCA updates VAT withholding rules for digital platforms

Argentina’s tax authority (ARCA) has issued General Resolution 5794/2025, which updates the special VAT withholding rules for transactions conducted through digital platforms, initially established under General Resolution 5319/2023. The core

See MoreTurkey extends withholding provisions related certain capital market earnings until 2030

Turkey’s President has extended the tax withholding rules on certain capital market earnings for another five years. The decision was made under Presidential Decree No. 10680, published in the Official Gazette on 11 December 2025 (No.

See MoreUAE: Ministry of Finance revises excise tax rules on sweetened beverages

The UAE’s Ministry of Finance has announced the issuance of Cabinet Decision No. (197) of 2025 on selective goods, the tax rates or amounts imposed on them, and the method for calculating the selective price on 11 December 2025. The resolution

See MorePeru: SUNAT updates fine reduction rules for late tax filings

Peru’s Tax Authority (SUNAT) has amended the gradual reduction of fines for taxpayers who fail to file certain income tax returns through Resolution No. 000355-2025/SUNAT, published in the Official Gazette on 29 November 2025 and effective from 30

See MoreCroatia: Parliament adopts streamlined VAT rules, mandatory e-invoicing from January 2026

Croatia’s Parliament approved amendments to the VAT Act concerning e-invoicing. The final version of the amendments was adopted on 5 December 2025. Key legislative actions include extending the reduced 5% VAT rate for specific supplies, such as

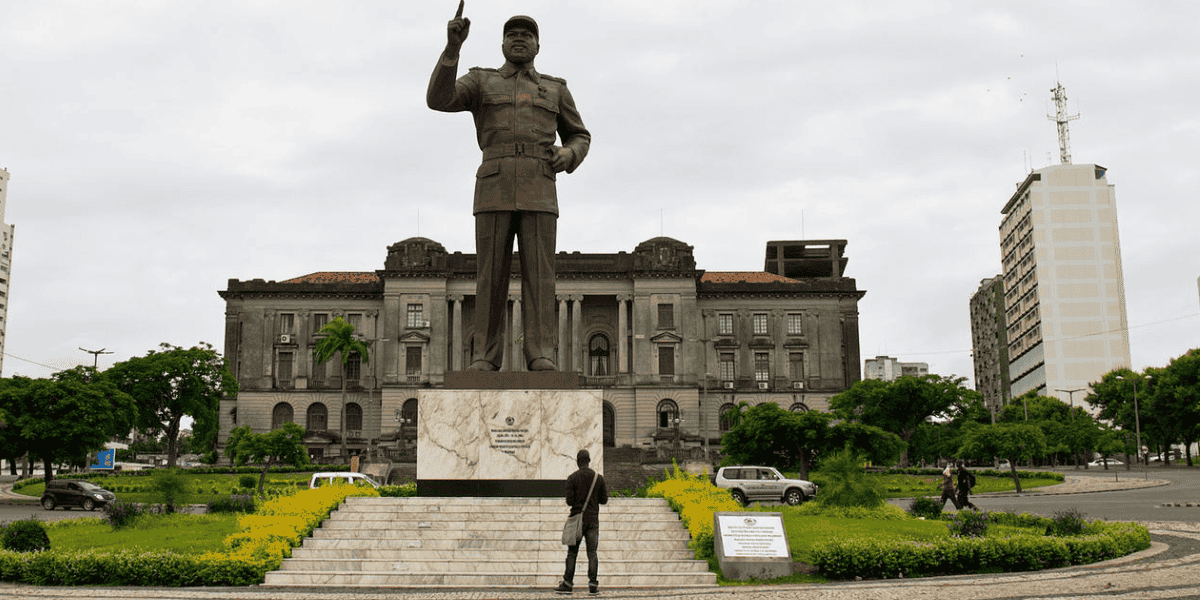

See MoreMozambique: Government adopts amendments to VAT law

Mozambique’s government adopted a draft Value Added Tax (VAT) law during the 41st Session of the Council of Ministers on 2 December 2025. The VAT law is designed to modernise and streamline the electronic submission of invoices and similar

See MoreUAE: MoF clarifies fines for e-invoicing non-compliance

The UAE’s Ministry of Finance (MoF) announced the issuance of Cabinet Resolution No. (106) of 2025 regarding violations and administrative fines resulting from non-compliance with the legislation regulating the Electronic Invoicing System, as part

See MoreCroatia: Parliament adopts Pillar 2 amendments, aligns with OECD GloBE framework

Croatia’s parliament adopted amendments to the Bill on Amendments to the Global Minimum Corporate Tax Act on 5 December 2025, to bring the national rules entirely in line with the OECD GloBE framework and the requirements of EU Directive

See MoreAustralia: ATO consults transfer pricing considerations for inbound distribution models

The Australian Taxation Office (ATO) has initiated a consultation on a draft update to Practical Compliance Guideline PCG 2019/1, concerning transfer pricing considerations for inbound distribution arrangements. This includes updated profit

See MoreSri Lanka: Inland Revenue Department issues reminder for November AIT, WHT, APIT payments

Sri Lanka’s Inland Revenue Department issued a notice on 10 December 2025 for taxpayers to settle Advance Income Tax (AIT), Withholding Tax (WHT) and Advance Personal Income Tax (APIT) withheld in November 2025 by 15 December 2025. Taxpayers

See MoreColombia: Senate Committee rejects 2026 tax reform

Colombia’s Senate announced that its Fourth Commission voted down the government’s proposed 2026 tax reform during the third joint session of Congress’s Economic Commissions, with 4 votes in favour and 9 against. This announcement was made

See MoreOman: OTA consults on draft e-invoicing data dictionary

Oman’s Tax Authority (OTA) has released a draft electronic invoicing (e-invoicing) data dictionary for consultation on 1 December 2025. This is part of preparations for the country’s e-invoicing rollout in August 2026. The data dictionary,

See MoreIreland launches public consultation on modernised withholding tax regime

The Irish Department of Finance and Revenue has opened a joint public consultation on the modernisation of Professional Services Withholding Tax (PSWT) and Relevant Contracts Tax (RCT), the expansion of withholding tax to the platform economy, and

See MoreUAE: FTA issues administrative exceptions VAT guide

The UAE’s Federal Tax Authority (FTA) issued the Administrative Exceptions VAT Guide on 5 December 2025. The guide explains how registrants can apply for VAT administrative exceptions, which provide concessions allowed under the VAT Law and its

See MoreCyprus: Council of Ministers extends zero VAT rate on essential goods

The Cyprus Council of Ministers issued Decree No. 337/2025 on 21 November 2025, which extended the temporary zero VAT rate on certain essential goods through 31 December 2026. The products included under this measure are baby milk, infant

See More