September 11, 2025

Under Greek law, preferential tax regimes are those with a corporate tax rate equal to or less than 60% of...

September 11, 2025

Certain businesses in metropolitan areas must use the real tax method from 2026. The Turkish government issued Presidential Decision No....

September 11, 2025

OECD updated BEPS Action 5 rules with new peer review terms and XML Schema for 2027. The OECD released a...

September 11, 2025

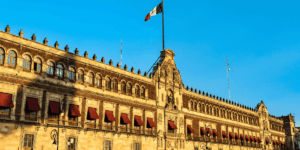

Mexico plans tariff hikes on cars, steel, toys and textiles from China and other Asian countries. Mexico plans to raise...

September 11, 2025

Estonia launches a new motor vehicle tax from 1 January 2025, covering various vehicles with rates based on age, weight,...

September 11, 2025

National Treasury has retracted its proposal to amend the definition of “hybrid equity instrument” in section 8E of the Income...

September 10, 2025

Portugal delists Hong Kong, Liechtenstein, and Uruguay from its tax blacklist. Portugal has issued Ordinance No. 292/2025/1 on 5 September...

September 10, 2025

Taiwan’s Ministry of Finance has set a new TWD 600,000 annual sales threshold for offshore electronic service providers to register...

September 10, 2025

Russia proposes VAT cut on essential food items, children’s products, periodicals, and medical items. The Russian State Duma received draft...

September 10, 2025

Russia’s central bank maintains foreign cash limits under sanctions. The Bank of Russia maintains restrictions on cash currency in connection...

September 10, 2025

National Council approves CARF MCAA and CRS MCAA Addendum for enhanced tax information exchange. Switzerland’s National Council (Nationalrat) approved the...

September 9, 2025

The IPA agreement aims to lower investment risks between the two countries. Iran and Oman signed an Investment Protection Agreement...

September 9, 2025

The agreement will take effect upon the exchange of ratification documents. The Greek Parliament passed legislation ratifying an exchange of...

September 9, 2025

UAE issues Ministerial Decision No. 229 of 2025 on Free Zone corporate tax activities, effective from 1 June 2023. The...

September 9, 2025

IRAS updated its FAQs on 28 August 2025 to clarify GST registration requirements for businesses.= The Inland Revenue Authority of...

September 9, 2025

Korea (Rep.) and Bangladesh began CEPA talks in Seoul to strengthen trade and economic ties. Korea (Rep.) and Bangladesh began...

September 9, 2025

Revenue updates guidance on Irish Real Estate Funds. Irish Revenue has released eBrief No. 166/25 on 5 September 2025, announcing...

September 9, 2025

Taiwan’s Ministry of Finance clarifies that foreign taxpayers can now apply for income tax treaty benefits up to ten years...