Vietnam: National Assembly approves resolution to establish international financial centres (IFCs) in Ho Chi Minh City and Da Nang City

Vietnam will establish international financial centres in Ho Chi Minh City and Da Nang from 1 September 2025, offering tax incentives, land benefits, and flexible dispute resolution to attract global investment. Vietnam’s National Assembly

See MoreVietnam nears US trade deal ahead of tariff deadline

Vietnam seeks to finalise a US trade deal by 9 July 2025 to avoid tariffs while balancing relations with the US and China. Vietnamese Prime Minister Pham Minh Chinh said on 26 June 2025 that Vietnam is close to finalising a trade deal with

See MoreVietnam: National Assembly approves VAT rate reduction, expands scope

Vietnam’s National Assembly has approved an extension of the VAT reduction from 10% to 8% for certain goods and services until 31 December 2026, expanding coverage to include transport, logistics, and IT sectors. Vietnam’s National Assembly

See MoreVietnam: National Assembly approves revised corporate tax law, introduces improved incentives

The amended CIT Law introduces new rules on capital transfers, revised SME rates, and targeted tax incentives. Vietnam’s National Assembly passed Law No. 67/2025/QH15 on 14 June 2025 , a major amendment to the Corporate Income Tax (CIT) Law,

See MoreLithuania, Vietnam sign letter of intent for income tax treaty

Lithuania and Vietnam signed a letter of intent on 12 June 2025 to negotiate their first income tax treaty, which will take effect after finalisation and ratification. Lithuania’s Ministry of Finance has announced that representatives from

See MoreVietnam: Parliament approves gradual tax rise on beer and strong alcohol by 2031

Vietnam plans to raise taxes on beer and strong alcohol to 90% by 2031. Vietnam’s parliament has approved a plan to increase taxes on beer and strong alcoholic beverages to 90% by 2031, up from the current 65%. The tax hike will be phased in

See MoreVietnam launches new tax rules for e-commerce and digital platform sellers

Starting 1 July 2025, Vietnam requires e-commerce platforms to withhold and pay taxes on behalf of sellers. The Vietnamese Government issued Decree No. 117/2025/ND-CP on 9 June 2025, introducing new regulations to manage tax obligations for

See MoreVietnam issues new guidance on e-invoices and tax compliance

Vietnam updated regulations on e-invoices, taxpayer risk assessment, and invoicing procedures for business models, effective 1 June 2025. Vietnam’s Ministry of Finance released Circular 32/2025/TT-BTC on 31 May 2025, offering updated guidance

See MoreVietnam introduces tax, financial incentives to promote private growth

The National Assembly passed Resolution 198/2025/QH15 on 17 May 2025 introducing the incentives. Vietnam’s National Assembly passed Resolution 198/2025/QH15 on 17 May 2025, introducing various tax and financial incentives to support private

See MoreVietnam, US conclude second round of tariff negotiations

Vietnamese Trade Minister Nguyen Hong Dien and US Trade Representative Jamieson Greer led the talks, identifying areas of near consensus and others requiring further discussion. The US and Vietnam concluded their second round of tariff

See MoreSri Lanka, Vietnam to revise tax and investment treaties

Any resulting protocol will mark the first updates since their original agreements from 2005 and 2009. Sri Lanka and Vietnam have agreed to update their 2005 income tax treaty and 2009 Sri Lanka-Vietnam Investment Protection Agreement on 5 May

See MoreLuxembourg: Government Council approves amending protocol to tax treaty with Vietnam

Luxembourg's Government Council approved the ratification of the amending protocol to the 1996 tax treaty with Vietnam on 15 May 2025. The protocol was signed to update the DTA according to the latest OECD standards. Signed on 4 May 2023, it

See MoreUS, Vietnam negotiate amending protocol to income tax treaty

Vietnam's Ministry of Finance announced that the US and Vietnamese officials discussed various updates to the 2015 tax treaty between the two countries, including amending protocols to the agreement on 13 May 2025. The proposed protocol would

See MoreVietnam, Ethiopia to negotiate first tax treaty

Representatives from Ethiopia and Vietnam met on 15 April 2025 to explore opportunities for strengthening bilateral relations. This announcement was made by the Vietnam Government News portal on 16 April 2025. Vietnam and Ethiopia have agreed

See MoreVietnam, Greece negotiating income tax treaty

On 14 April 2025, Vietnam’s Ambassador to Greece, Pham Thi Thu Huong, announced in an interview that Vietnam and Greece are actively negotiating their first bilateral income tax treaty. Negotiations are ongoing for agreements on maritime

See MoreVietnam updates regulations on electronic invoices

Vietnam issued Decree 70/2025/ND-CP to amend regulations under Decree 123/2020/ND-CP on electronic invoices and related documents on 20 March 2025. The changes expand the scope of entities eligible to use electronic VAT invoices, including

See MoreVietnam extends 2025 tax payment deadlines

The Vietnamese government issued Decree No. 82/2025/ND-CP on 2 April 2025, outlining extensions to tax payment deadlines for various taxes including individual income tax, VAT, corporate income tax, and land rental taxes in 2025. These measures

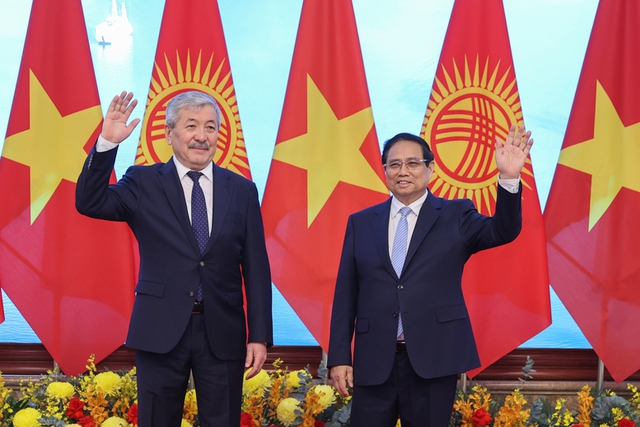

See MoreKyrgyzstan, Vietnam agree to tax treaty negotiations

Kyrgyzstan and Vietnam have agreed to sign a tax treaty and an investment protection agreement (IPA) during the official visit of the Chairman of the Kyrgyz Cabinet of Ministers to Vietnam from 6 to 7 March 2025. This announcement was made by the

See More