Morocco: 2025 draft finance law introduces new tax rules for joint ventures and economic groups

Morocco’s Ministry of Finance released the draft Finance Law 2025 on 19 October 2024, proposing various measures for corporate income tax, focusing on taxing joint ventures and economic interest groups. Corporate tax rules change for joint

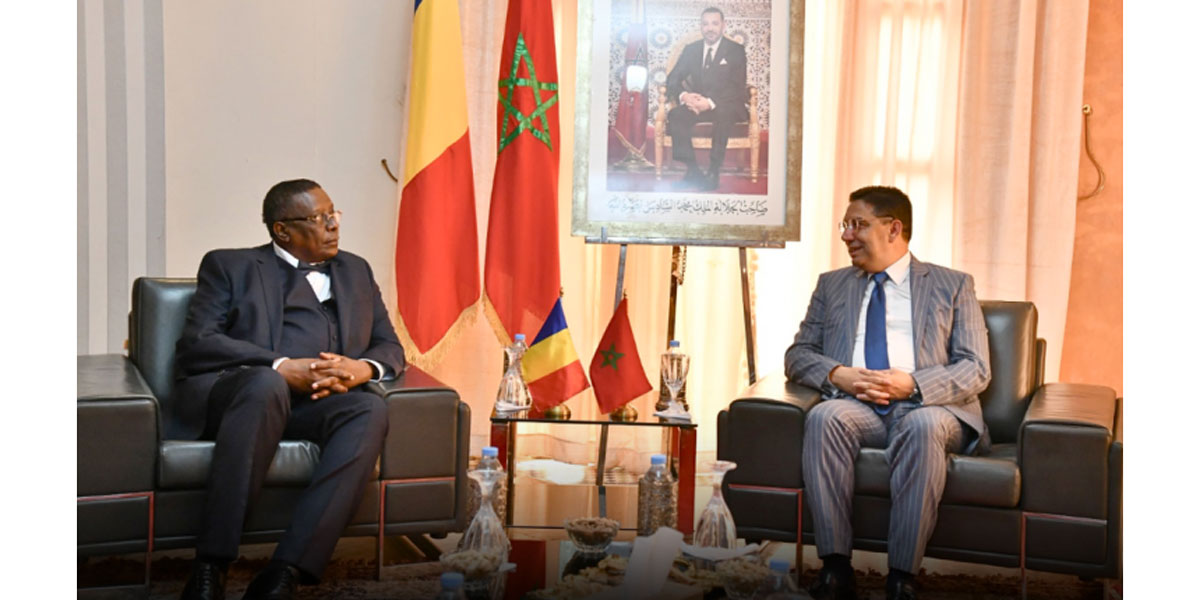

See MoreMorocco, Chad sign income tax treaty

Morocco and Chad have signed an income tax treaty on 14 August, 2024. This agreement is the first between the two nations. The tax treaty was signed by Minister of Foreign Affairs, African Cooperation and Moroccan Expatriates, Nasser Bourita, and

See MoreMorocco releases latest CbC reporting guidance

The Moroccan General Directorate of Taxation (DGI) has recently released latest Country-by-Country (CbC) reporting guidance. Morocco implemented CbC reporting obligations starting from 1 January 2021, in accordance with the Finance Law for 2020.

See MoreMorocco delays approval of Multilateral Automatic Exchange of Information Agreements

In a recent session, held on 20 July 2023, the Moroccan House of Representatives made the decision to postpone the approval of the Multilateral Competent Authority Agreement on Automatic Exchange of Country-by-Country Reports (CbC MCAA), as well as

See MoreMorocco enacts Finance Law 2023 for corporate tax reform

Morocco enacted Finance Law No. 50-22 for the Fiscal Year 2023 and it was published in the official Bulletin No. 7154 bis of 23 December 2022. The key tax measures are summarized as follows: Corporate tax rates The Finance Law 2023 has

See MoreMorocco suspends CbC reporting requirement temporarily

On 16 December 2022, the Moroccan tax authority published an announcement, which temporarily suspending the requirement to file a country-by-country (CbC) report for companies that are part of multinational enterprises (MNEs) operating in Morocco

See MoreMorocco publishes Finance Law for FY 2022

On 26 October 2021, the Ministry of Finance (MoF) has published the draft Finance Law for 2022. The measures of the Finance Law will generally apply from 1 January 2022. The key measures of the law includes the reduction of the top rate of

See MoreMorocco publishes guidance on mutual agreement procedure

The Ministry of Finance (MoF) of Morocco has published guidance on the mutual agreement procedure (MAP), which provides a dispute resolution procedure to resolve tax treaty related disputes. MAP is designed to relieve double taxation, typically

See MoreMorocco declares maximum interest rate 1.63% on shareholder loans

On 18 March 2021, Morocco has published Ministerial Decree 423.21 in the Official Gazette regarding the reduction of maximum interest rate for loans granted by direct shareholders from 2.23% to 1.63% for FY 2021. Interest expense on loans will

See MoreMorocco revises TP documentation penalty

On 18 December 2020, the Ministry of Finance of Morocco has published the Finance Law for 2021 in the Official Gazette, apply from 1 January 2021. Morocco's Finance Law 2021 introduced new transfer pricing (TP) documentation

See MoreMorocco: Finance Law 2021

On 18 December 2020, Morocco's Ministry of Finance has published the Finance Law for 2021 in the Official Gazette. The measures of the Finance Law generally apply from 1 January 2021. Key measures are summarized as follows: Social

See MoreMorocco approves BEPS MLI

On 16 November 2020, the House of Representatives of Morocco approved the law for the ratification of the multilateral convention to implement double taxation agreement (DTA) related measures to prevent base erosion and profit shifting (MLI).

See MoreOECD: Morocco joins the inclusive framework on BEPS

On 9 March 2019 the OECD announced that Morocco has joined the Inclusive Framework on base erosion and profit shifting (BEPS). This means that a total of 129 countries and jurisdictions are taking part in the Inclusive Framework. The countries

See MoreMorocco: Council of Ministers approve DTA with Zambia

On January 22, 2018, the Council of Ministers of Morocco has approved the income tax treaty with Zambia. The treaty provides for the avoidance of double taxation and the allocation of taxing rights over various categories of income. It was signed on

See MoreMorocco: Parliament adopts draft Budget for 2018

The Ministry of Economy and Finance of Morocco was announced on December 13, 2017 that the parliament adopted the draft Finance Law for 2018. The draft budget 2018 was presented to the Parliament on October 20, 2017. So, the draft measures will

See MoreMorocco: Draft Budget for 2018

The draft budget 2018 was presented to the Parliament on October 20, 2017. This draft Law is available in French language. The Economic and Finance Minister, Mr. Mohamed Boussaid, held a press conference regarding the Finance Bill 2018 on October

See MoreMorocco ratifies amended DTA protocol with Bahrain

On 30 August 2017, Morocco has ratified the amending protocol of Double Taxation Agreement (DTA) with Bahrain and that was signed on 22 April

See MoreMorocco ratifies DTA with Ethiopia

On 30 August 2017, Morocco has ratified the Double Taxation Agreement (DTA) with Ethiopia and that was signed on 19 November

See More