Croatia, Switzerland sign amending protocol to tax treaty

Croatia and Switzerland signed a protocol on July 18, 2025, amending their 1999 tax treaty to align with international and BEPS standards. Croatia and Switzerland signed an amending protocol to their 1999 income and capital tax treaty on 18

See MoreUkraine clarifies transfer pricing penalty changes effective from March 2025

These amendments, which took effect on 25 March 2025, adjust the penalties applicable to late or missing submissions of TP-related reports and notifications. The Ukrainian State Fiscal Service issued a clarification on upcoming changes to the Tax

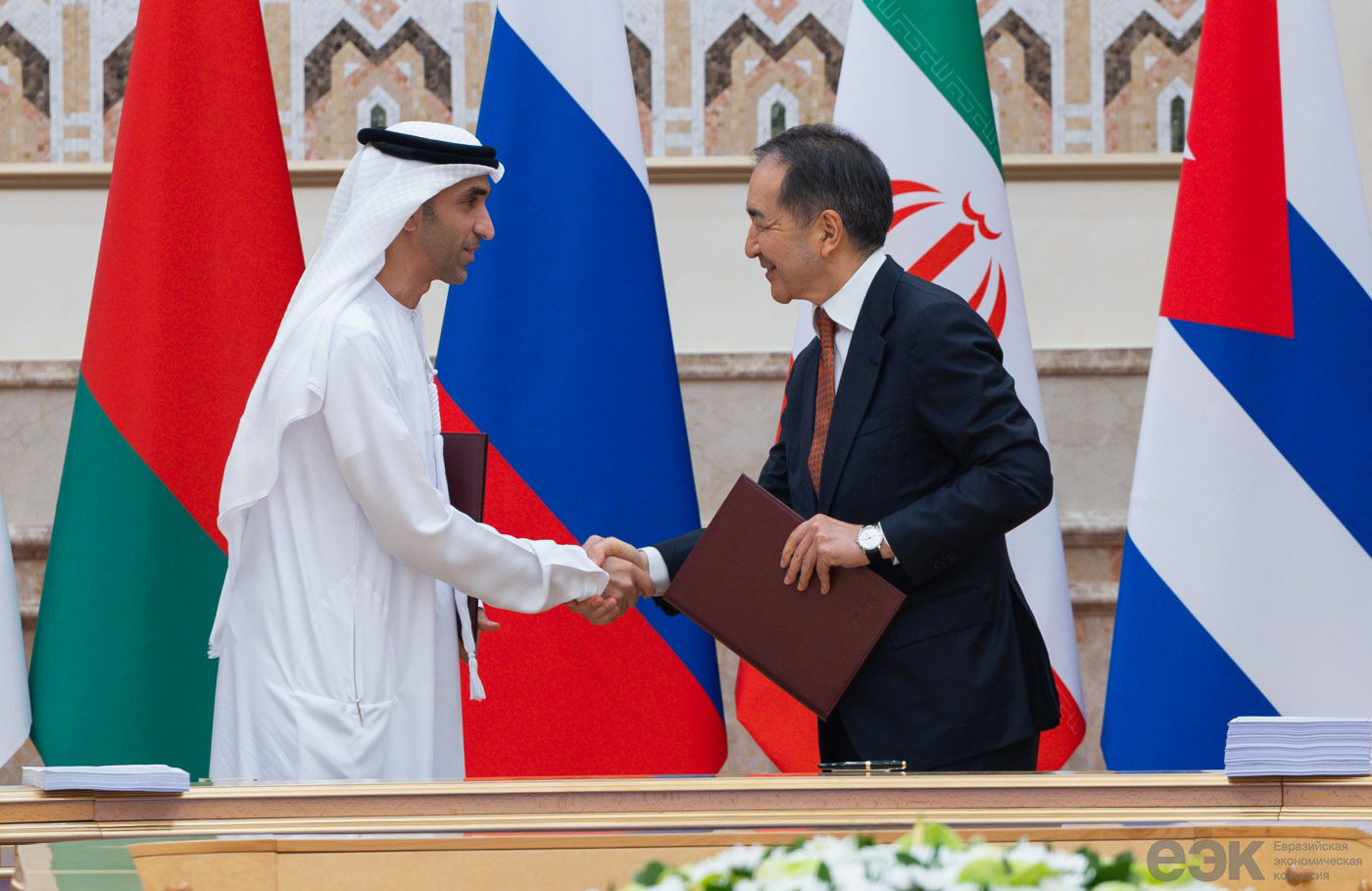

See MoreBelarus, UAE sign free trade in services and investments agreement

The agreement complements the EPA between the Eurasian Economic Union and the UAE, signed on the same day. Belarus and the UAE formalised an agreement in Minsk focusing on free trade in services and investments on 27 June 2025. This agreement

See MoreAndorra: General Council ratifies income tax treaty with UK

Andorra’s parliament has approved the ratification of a new income and capital tax treaty with the UK, set to take effect after ratification is exchanged. The Andorran General Council approved the ratification of the income and capital tax

See MoreBelarus, Zimbabwe tax treaty enters into force

The treaty applies from 1 January 2026. The Belarus Ministry of Taxes and Duties announced that the income and capital tax treaty between Belarus and Zimbabwe came into effect on 2 July 2025. Signed on 31 January 2023, this is the first tax

See MoreBelarus: Tax ministry sets FATCA filing deadline for 2024

The Belarus Ministry of Taxes announced the 12 August 2025 deadline for 2024 FATCA filings under the Belarus-US Model 1B Agreement. The Belarus Ministry of Taxes and Duties announced on 7 July 2025 that the deadline for FATCA filing under the

See MoreEU, Switzerland to amend agreement on automatic financial information exchange

The agreement enables automatic financial account information exchange between EU Member States and Switzerland under the OECD's Common Reporting Standard (CRS). The European Commission has proposed a Council Decision on 10 July 2025 to amend the

See MoreNetherlands ratifies tax treaty between Curacao, San Marino

The tax treaty aims to prevent double taxation and curb tax evasion in cross-border transactions between Curacao and San Marino. The Netherlands has published the Law of 2 July 2025 in its Official Gazette on 10 July 2025, ratifying the first

See MoreUK: HMRC launches compliance campaign on directors’ loans

HMRC is contacting directors over potentially undeclared released loans, with possible implications for both personal and company tax compliance. The UK’s HMRC is contacting company directors who had loans released or written off between April

See MoreJapan, Ukraine tax agreement comes into effect

The Ministry of Finance confirmed the 2024 tax treaty with Ukraine will take effect on 1 August 2025. Japan’s Ministry of Finance announced on 2 July 2025 that the 2024 tax treaty and protocol with Ukraine will come into effect on 1 August

See MoreRussia ratifies new tax treaty with UAE

Russia ratified its new income and capital tax treaty with the UAE, which replaces the limited 2011 agreement. Russia has enacted Federal Law No. 189-FZ on 7 July 2025. The law was published in the Official Gazette on the same day. The

See MoreSwitzerland ratifies tax treaty protocol with Hungary

Switzerland ratified the first protocol amending its 2012 tax treaty with Hungary, effective after the exchange of ratification. Switzerland published Federal Decree No. 2042/2025 in its Official Gazette on 1 July 2025, approving the ratification

See MoreBelgium revises CRS list, adds Armenia and Uganda

The updated CRS exchange list for 2024 now includes Armenia and Uganda. Belgium’s government has published the Royal Decree of 2 July 2025 in Official Gazette No. 2025004947 of 8 July 2025. The Royal Decree updates the list of jurisdictions

See MoreEurasian Economic Union (EAEU), Mongolia sign temporary FTA

The FTA will be valid for three years, with a mutual option to extend for another three years. The Eurasian Economic Union (EAEU), comprising Armenia, Belarus, Kazakhstan, Kyrgyzstan, and Russia, signed a temporary free trade agreement (FTA)

See MoreUK: HMRC introduces strict crypto reporting rules starting 2026

UK crypto traders will face penalties if they fail to provide personal information under HMRC’s updated reporting requirements. The UK's HM Revenue & Customs (HMRC) has published updated guidelines introducing new reporting obligations for

See MoreLatvia, Andorra tax treaty enters into force

Latvia and Andorra's agreement to eliminate double taxation and prevent tax evasion came into effect on 16 June 2025. Andorra announced in the Official Gazette that the income and capital tax treaty between Andorra and Latvia entered into force

See MoreUK Treasury amends Pillar Two rules to allow retrospective HMRC notices

The UK Treasury has amended Multinational Top-up Tax regulations to enable HMRC to issue retrospective notices under the OECD’s Pillar Two rules, effective 24 July 2025. The UK Treasury introduced SI 2025/783 on 30 June 2025, amending the

See MoreUK: Online marketplaces responsible for VAT on sales by foreign sellers

HMRC has confirmed that online marketplaces must account for VAT on goods sold by overseas businesses when the items are located in the UK at the time of sale. The UK’s HM Revenue & Customs (HMRC) issued guidance on 20 June 2025 confirming

See More