UK: HMRC updates guidance on Pillar 2 top-up taxes reporting, registration

HMRC has refreshed its guidance on registering and reporting Pillar 2 Top-up Taxes, clarifying who can file, what information is needed, and when returns are due. UK HMRC updated their guidelines on “How to report Pillar 2 Top-up Taxes” and

See MoreSwitzerland clarifies application of hybrid arbitrage arrangements under transitional CbCR Safe Harbour

SFTA confirmed that OECD guidance on hybrid arbitrage arrangements under the transitional CbCR safe harbour applies in Switzerland only to transactions entered into after 18 December 2023. The Swiss Federal Tax Administration (SFTA) has issued

See MoreUK considers replacing stamp duty with new property tax

UK Treasury considers replacing stamp duty with a new levy on homes over GBP 500,000, aiming for more stable revenue from fewer transactions. The UK Treasury is reportedly considering a major shift in property taxation, exploring the replacement

See MoreParaguay, UK negotiate to advance income tax treaty

Paraguay and the UK met to advance an income tax treaty and strengthen economic cooperation. Officials from Paraguay and the UK met on 12 August 2025 to discuss a broad agenda of bilateral issues, with particular attention on advancing an income

See MoreAndorra ratifies income and capital tax treaty with UK

Andorra has officially ratified its income and capital tax treaty with the UK, following approval by its General Council. Andorra published a notice in its Official Gazette on 13 August 2025 confirming the ratification of the income and capital

See MoreNorway intensifies VAT audits and enforcement for online businesses

Norway’s tax authorities' audits of 150 foreign digital service providers recovered nearly NOK 4.9 billion in VAT, penalties, and post-registration filings between 2016 and 2025. Norway’s tax administration (Skatteetaten), in a press

See MoreUK: HMRC announces reduced late payment, repayment interest rates

HMRC announced revised interest rates on late and early tax payments, effective 27 August 2025. HMRC published updated interest rates for late and early payments on 8 August 2025, following the Bank of England’s 7 August decision to lower the

See MoreBahrain, Russia sign mutual customs assistance agreement

The customs cooperation agreement is aimed at enhancing trade facilitation and border security between the two countries. Bahrain and Russia signed an agreement on mutual administrative assistance in customs matters on 18 June 2025. The

See MoreSwitzerland adds Tunisia to CbC report exchange list

Switzerland updates the CbC report list, including Tunisia as reciprocal from January 2024. Switzerland has updated its list of jurisdictions for the exchange of Country-by-Country (CbC) reports under the Multilateral Competent Authority

See MoreSwitzerland to face 39% tariff as trade talks with the US falter

Switzerland faces 39% US tariffs on exports starting 7 August 2025. Switzerland is likely to face 39% US tariffs on its exports after the country’s President Karin Keller-Sutter failed to secure a trade deal with the US, which is set to take

See MoreUS implements tariffs on one-kilo gold bars

The US has imposed tariffs on imports of one-kilo gold bars, potentially affecting Switzerland. According to the Financial Times report on 7 August 2025, the US has imposed tariffs on imports of one-kilogram gold bars, citing a July 31 letter

See MoreSwitzerland clarifies top-up tax treatment of residual tax on distributions

Switzerland confirms treatment of residual tax on distributions for top-up tax calculations effective from 1 January 2024. The Swiss Federal Tax Administration released Communication-026-E-2025-e on 24 July 2025, clarifying the treatment of

See MoreUK: HMRC publishes internal guidance on multinational, domestic top-up taxes

HMRC has published internal guidance on the UK’s Multinational and Domestic Top-up Taxes, aligned with the OECD’s Pillar Two rules. UK’s tax, payments and customs authority (HMRC) published its Internal Manual on the Multinational Top-up

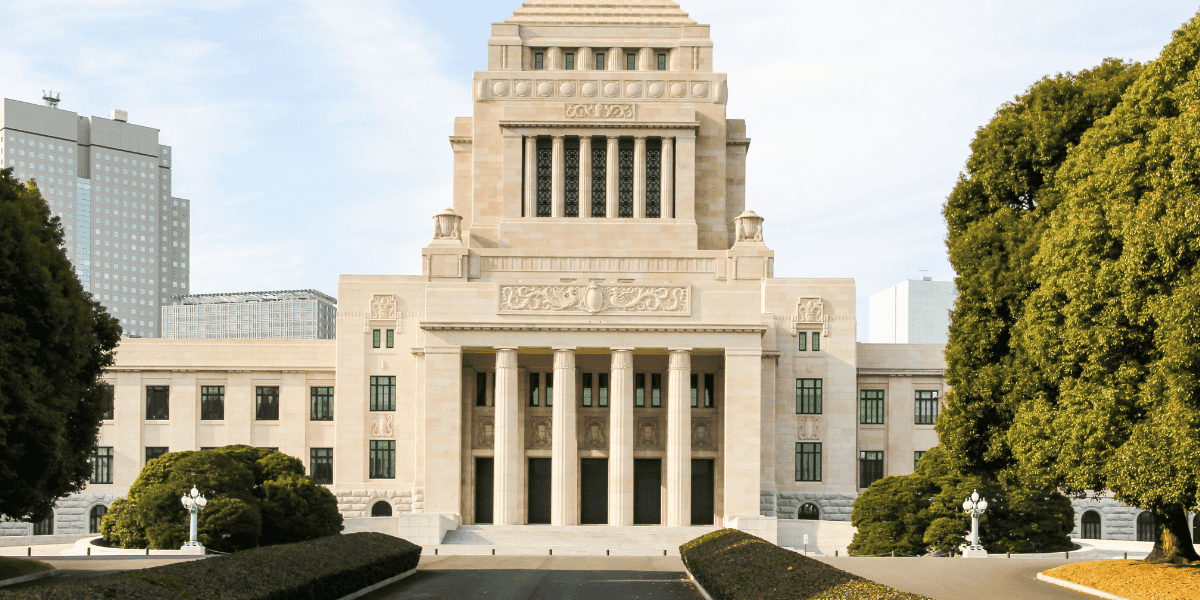

See MoreJapan, Ukraine hold first round of investment pact revision negotiations

Japan and Ukraine held their first round of negotiations to revise the 2015 Investment Protection Agreement from 29 to 31 July 2025. Japan and Ukraine held the first round of negotiations to revise their 2015 Investment Protection Agreement

See MoreVietnam considers revising tax treaty and IPA with Switzerland

Vietnam seeks to revise its 1996 tax treaty and investment pact with Switzerland to reflect recent changes and boost bilateral economic ties. Vietnam expressed interest in revising the Switzerland–Vietnam Income and Capital Tax Treaty (1996)

See MoreUK unveils digital tax strategy roadmap with focus on e-invoicing

The UK aims to modernise its tax and customs systems through a digital strategy centred on e-invoicing and improved compliance. The UK’s tax, payments, and customs authority, HM Revenue and Customs (HMRC), has set out its “digital by

See MoreSwitzerland signals willingness to revise US offer in response to heavy tariffs

Switzerland plans to revise its trade offer following the US announcement of 39% import tariffs amid rising economic concerns. The Swiss government is preparing to revise its offer to the US following the announcement of 39% import tariffs set

See MoreJapan, Ukraine tax treaty enters into force

The new tax treaty replaces the 1986 tax treaty between Japan and Ukraine. Japan’s Ministry of Finance announced on 2 July 2025 that the new income tax treaty between Japan and Ukraine entered into force on 1 August 2025. The new treaty,

See More