UK: Finance minister plans tax changes to aid small businesses

UK plans tax reforms to boost small business growth. The UK’s finance minister, Rachel Reeves, announced plans to explore reforms to business property taxation on 11 September 2025, aiming to ease expansion for small enterprises and stimulate

See MoreRussia: FTS consults on revising jurisdiction list for CbC report exchange

The deadline for submitting comments is 17 September 2025. Russia’s tax authority, the Federal Tax Service (FTS), has opened a consultation regarding proposed changes to the list of jurisdictions participating in the automatic exchange of

See MoreUkraine: STS clarifies CFC reporting penalties

Ukraine requires annual CFC reports, with penalties waived during martial law if filed within six months after it ends. Ukraine’s State Tax Service (STS) has clarified that, under the country’s controlled foreign company (CFC) rules, a

See MoreSwitzerland: National Council extends TBTF bank withholding tax exemption

Swiss National Council extends TBTF bank withholding tax exemption to 2031. Switzerland's National Council approved an extension of the withholding tax (WHT) exemption on interest from financial instruments issued by systemically important banks,

See MoreCzech Republic, UK advance new tax treaty negotiations

Once in force, the new tax treaty will replace the 1990 tax treaty between the UK and the former Czechoslovakia. Czech and UK officials will hold the second round of income tax treaty negotiations from 16–19 September 2025, following the

See MoreRussia proposes reduced VAT on essential goods

Russia proposes VAT cut on essential food items, children’s products, periodicals, and medical items. The Russian State Duma received draft law No. 1011590-8 on 8 September 2025, proposing a reduction of the value-added tax (VAT) rate from 10%

See MoreRussia: Central Bank maintains foreign cash restrictions amid sanctions

Russia’s central bank maintains foreign cash limits under sanctions. The Bank of Russia maintains restrictions on cash currency in connection with the sanctions in force against our country, which prohibit domestic financial institutions from

See MoreIceland presents 2026 Budget, proposes implementation of Pillar 2 global minimum tax

Iceland’s 2026 Budget introduces the Pillar 2 global minimum tax (IIR and QDMTT), a kilometre-based vehicle tax, and a phased removal of fuel excise duties with higher carbon taxes. Iceland's Finance Minister, Daði Már Kristófersson,

See MoreSwitzerland: National Council approves CARF MCAA, Addendum to CRS MCAA

National Council approves CARF MCAA and CRS MCAA Addendum for enhanced tax information exchange. Switzerland’s National Council (Nationalrat) approved the Multilateral Competent Authority Agreement under the Crypto-Asset Reporting Framework

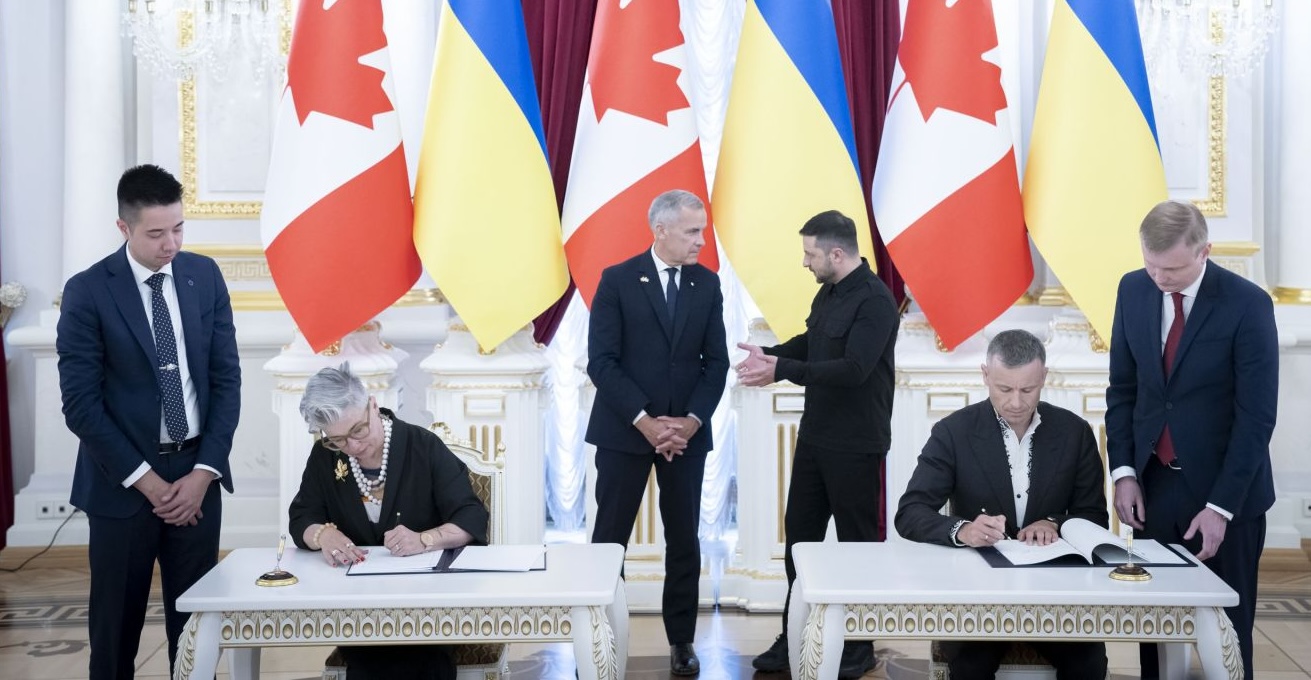

See MoreCanada, Ukraine sign agreement on mutual administrative assistance in customs matters

This agreement aims to address customs violations amid growing bilateral trade between the two countries. Canada and Ukraine signed an agreement on mutual administrative assistance in customs matters on 24 August 2025. The signing took place

See MoreUK: Treasury consults on draft amendments to money laundering regulations

The deadline for sending feedback is 30 September 2025. The UK Treasury launched a consultation on 2 September 2025 on the draft Money Laundering and Terrorist Financing (Amendment and Miscellaneous Provision) Regulations SI 2025. Feedback is

See MoreSwitzerland signs up for GIR MCAA

Switzerland signed the GIR MCAA, joining 15 other jurisdictions to facilitate standardised GloBE information exchange for MNE Groups. According to an OECD update released on 4 September 2025, Switzerland signed the Multilateral Competent

See MoreRomania: Chamber of Deputies approves tax treaty with Andorra

The tax treaty is between the two jurisdictions, aiming to prevent double taxation and combat tax evasion between Romania and Andorra. Romania’s Chamber of Deputies (lower house of parliament) has approved its first income and capital tax

See MoreEcuador updates dividend tax rules and NPO reporting requirements

Ecuador revises dividend taxes and non-profit reporting rules, effective 22 August 2025. Ecuador has introduced new rules on dividend taxation and non-profit organizations, effective 22 August 2025. The law applies to income accrued from 1

See MoreUK: Budget scheduled for 26 November 2025

UK’s Chancellor sets Budget for 26 November, highlighting key economic and social measures. Today, Wednesday 3 September, UK Chancellor Rachel Reeves confirmed that the Budget will be presented on Wednesday, 26 November. In a video message,

See MoreNetherlands: Council of Ministers approves tax treaty between Curacao and Suriname

The treaty will be submitted to the Dutch parliament (Staten-Generaal) and the parliament of Curacao for approval. The Netherlands Council of Ministers has approved the 2024 Curacao-Suriname Income and Capital Tax Treaty on 29 August

See MoreNetherlands: Council of Ministers approves tax treaty between Curacao and Cyprus

The treaty seeks to eliminate double taxation and prevent tax evasion in cross-border transactions involving taxpayers from the Netherlands, Curacao, and Cyprus. The Netherlands Council of Ministers approved the first-ever income tax treaty

See MoreDenmark announces 2026 Finance Bill, proposes reduced electricity and excise tax reliefs

The 2026 Finance Bill includes an electricity tax cut, excise duty removal on food products, VAT abolition on books, and tax adjustments for rural properties. Denmark’s government presented the 2026 Finance Bill on 29 August 2025, proposing tax

See More