Cambodia to implement new capital gains tax from September 2025

The new 20% capital gain tax on capital asset sales takes effect September 2025, with specific rules and exemptions for residents and non-residents. The Ministry of Economy and Finance of Cambodia issued Prakas No. 496 on 18 July 2025,

See MoreCambodia expands mandatory e-invoicing to six more ministries

The Ministry of Economy and Finance has extended mandatory e-invoicing to six additional ministries as part of Phase 2 in the national rollout. The Ministry of Economy and Finance (MEF) of Cambodia has issued Circular No. 012, extending the

See MoreSenegal, Vietnam sign trade deals

Senegal and Vietnam have signed memorandums of understanding to boost cooperation in trade and agriculture. Vietnam and Senegal signed multiple cooperation agreements on 23 July 2025 to strengthen ties in trade, agriculture, diplomacy, and

See MoreTaiwan confirms temporary 20% US tariff, highlights ongoing chip tariff talks

Taiwan President Lai Ching-te said the new 20% US tariff on Taiwanese imports is "temporary” and plans to negotiate for a lower rate. Taiwan President Lai Ching-te stated that the U.S. government’s new 20% tariff on Taiwanese imports,

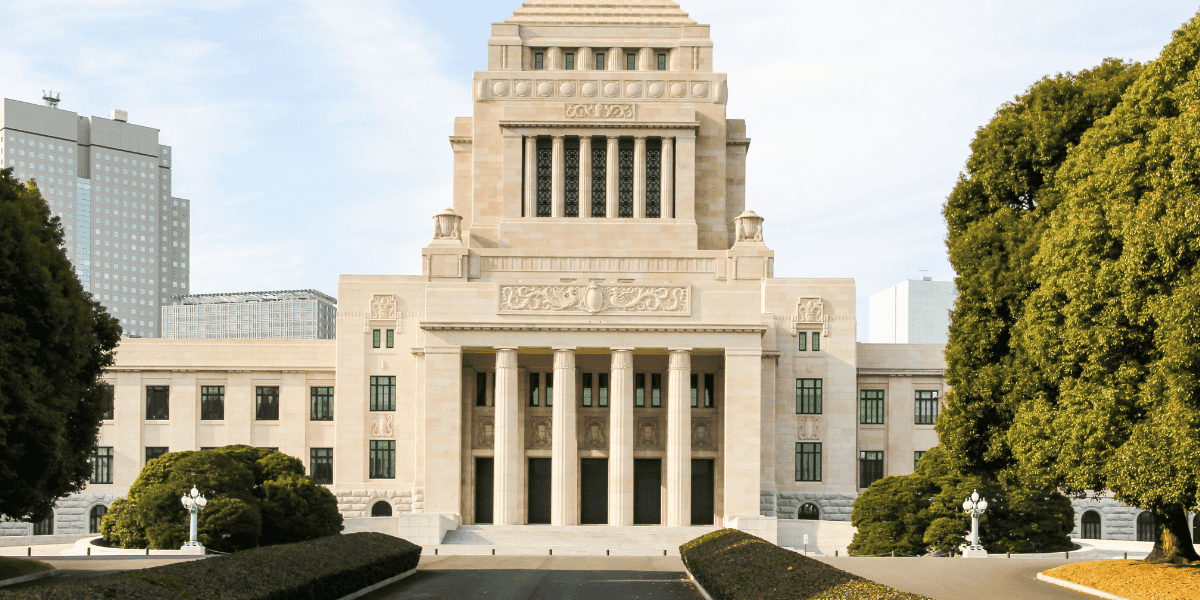

See MoreJapan, Ukraine tax treaty enters into force

The new tax treaty replaces the 1986 tax treaty between Japan and Ukraine. Japan’s Ministry of Finance announced on 2 July 2025 that the new income tax treaty between Japan and Ukraine entered into force on 1 August 2025. The new treaty,

See MoreAustralia: ATO issues guidance on fraudulent GST refund schemes

The alert warns businesses against colluding with related entities to create fake invoices for fraudulent GST refund claims. The Australian Taxation Office (ATO) has issued a new taxpayer alert - TA 2025/2: Arrangements designed to improperly

See MoreAustralia: Productivity Commission proposes corporate tax cuts amongst other tax reforms

The proposal is open for consultation and is set to conclude on 15 September 2025. Australia’s Productivity Commission has published an interim report on 31 July 2025, proposing major changes to the country’s corporate tax framework. The

See MoreUS cuts tariff on Bangladeshi imports to 20%

The US has lowered its tariff on imports from Bangladesh to 20%, down from the previous steep rate of 35%. The US has reduced its reciprocal tariff rate on imports from Bangladesh to 20%, down from the previous 35%, following intense final

See MorePakistan drops digital presence proceeds tax

The DPPT was scrapped just one month after its introduction on 30 July 2025. Pakistan’s government has scrapped the digital presence proceeds tax (DPPT) on foreign entities supplying digital goods and services to Pakistan’s consumers, only a

See MoreAustralia anticipates export boost as Trump maintains 10% US tariff rate

Australia expects a boost in exports to the US following President Trump's decision to keep a 10% minimum tariff. Australia’s Trade Minister Don Farrell said Australian products may become more competitive in the US market, aiding export

See MoreKorea (Rep.): Ministry of Economy and Finance proposes corporate tax hikes, AI investment incentives, QDMTT Pillar Two rules

The proposals will require approval from the National Assembly before they can enter into force. The South Korean Ministry of Economy and Finance released the 2025 tax law amendment proposal, on 31 July 2025, which includes corporate tax hikes,

See MoreBangladesh: Government approves purchase of 220k metric tons of wheat from US to ease trade tensions

This government-to-government deal is part of Bangladesh’s efforts to reduce trade tensions with the US and avoid high tariffs on its exports. Bangladesh has approved the purchase of 220,000 metric tons of wheat from the US for USD 302.75 per

See MoreUS announces 25% tariff on India, cites trade barriers and Russian ties

The new tariffs will enter into force on 1 August 2025. The Trump Administration will impose 25% tariffs on Indian imports, citing India's high tariffs, trade barriers and ongoing defence and energy ties with Russia. US President Donald Trump

See MoreUS: Trump to set 15% tariff on South Korean imports under new trade deal

President Trump announced a reduced 15% tariff on South Korean imports, down from a planned 25%, as part of a new trade deal. US President Donald Trump announced a reduced 15% tariff on imports from South Korea on 30 July 2025, down from the

See MoreKazakhstan adopts transfer pricing law amendments, emphasises ‘substance over form

Kazakhstan’s President signed amendments to transfer pricing regulations on 18 July 2025, introducing new rules effective 1 January 2026 that emphasize substance over form, revise reporting thresholds, define key financial terms, and tighten

See MoreIndonesia to increase tax rates on cryptocurrency transactions

Indonesia will increase taxes on crypto trades and remove VAT for buyers starting August 2025. Indonesia will increase taxes on cryptocurrency transactions starting 1 August 2025 under new regulations issued by the Ministry of Finance. The move

See MoreMalaysia: MoF to scrap high-value goods tax scheme

The planned 5% to 10% tax on high-value goods set for May 2024 has been delayed. Malaysia’s Ministry of Finance announced on 29 July 2025 that it had scrapped its planned high-value goods tax, originally proposed two years ago. The Finance

See MoreUAE issues depreciation rules for fair valued investment properties

The Decision allows depreciation deductions for fair-valued investment properties under new corporate tax rules from 2025. The UAE Ministry of Finance has issued Ministerial Decision No. 173 of 2025, effective for tax periods beginning 1 January

See More