India, US near deal to slash import tariffs

India and the US near deal to cut tariffs, with energy and agriculture in focus. India and the US are reportedly nearing a trade deal that would cut US tariffs on Indian imports from 50% to about 15–16%. The agreement is expected to focus on

See MoreVietnam: MoF introduces procedures and forms for Pillar 2 minimum tax compliance

The newly approved administrative procedures and forms go into effect on 21 October 2025. Vietnam’s Ministry of Finance (MoF) issued Decision No. 3563/QD-BTC on 21 October 2025, approving the administrative procedures and related forms under

See MoreKazakhstan 2026 tax code: A full reset of the country’s approach to corporate taxation

Kazakhstan’s new Tax Code, coming into force on 1 January 2026, is more than a technical rewrite. It’s a full reset of the country’s approach to corporate taxation, profit allocation, and cross-border oversight. Behind the headlines of

See MoreIsrael, India sign bilateral investment agreement

This is India's first-ever investment agreement with Israel. Israel and India have signed a new bilateral investment agreement aimed at bolstering economic ties and encouraging mutual investments. The agreement, signed in New Delhi by Israel's

See MoreHong Kong: IRD issues updated guidance on Pillar 2 e-filing requirements for in-scope group members

This update is particularly significant for Hong Kong's minimum tax framework, as mandatory e-filing will apply to years of assessment starting on or after 1 April 2025. Hong Kong’s Inland Revenue Department has released updated guidelines on

See MoreAustralia: ATO releases updated guidance on transitional CbC safe harbour rules for global and domestic minimum tax

The updated guidance will help taxpayers determine whether the transitional CBC reporting safe harbour applies and how it may simplify their Pillar Two compliance obligations. The Australian Taxation Office (ATO) has released updated Global and

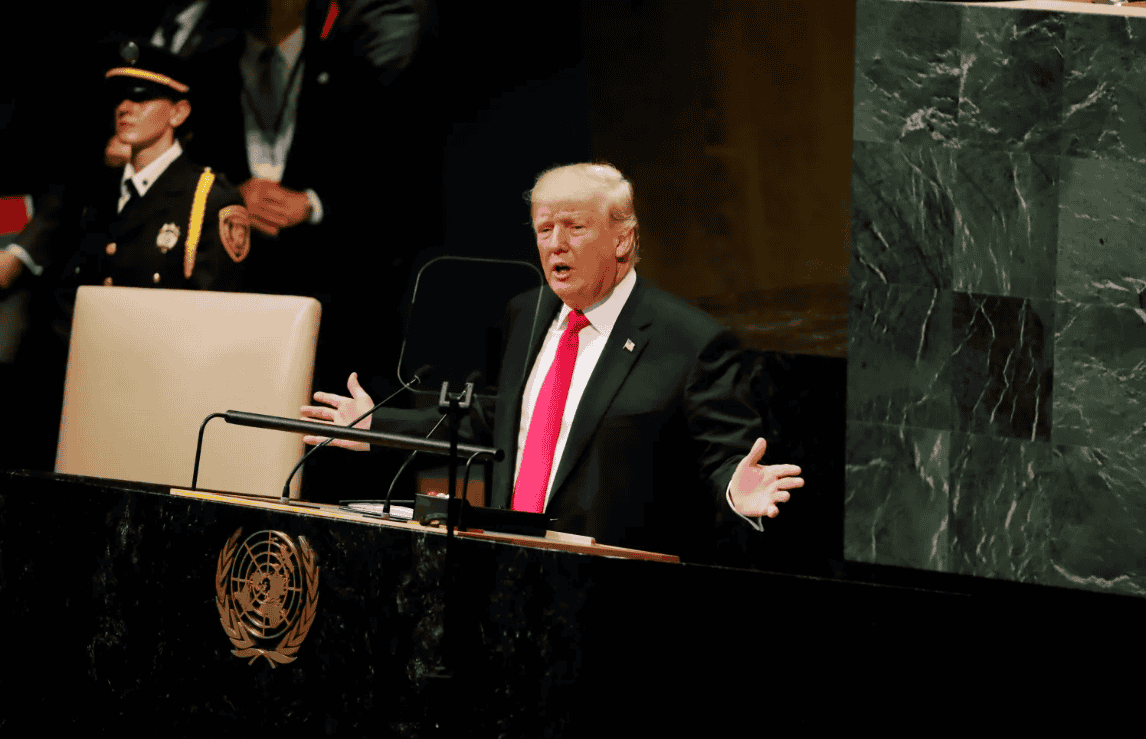

See MoreUS: Trump anticipates trade agreement with China, including soybean exports

President Trump expressed confidence in reaching agreements with President Xi during their upcoming South Korea meeting, covering trade issues, including China’s Russian oil imports. U.S. President Donald Trump expressed his optimism on

See MoreSri Lanka: IRD urges taxpayers to urgently updating information

Non-compliance may result in a fine of up to LKR 50,000 under Section 177 of the Inland Revenue Act No. 24 of 2017. The Sri Lankan Inland Revenue Department (IRD) has issued an urgent Notice to Taxpayers, urging all citizens to update their

See MorePhilippines: Government to form task force on tax and regulatory issues

The Department of Finance, in partnership with private sector stakeholders, is leading a multi-sectoral working group focused on improving the country’s investment environment and creating more employment opportunities. According to a

See MoreBangladesh: NBR publishes english version of Income Tax Act 2023

Bangladesh’s NBR publishes English version of Income Tax Act 2023 for clearer guidance to taxpayers. The National Board of Revenue (NBR) issued the Authentic English Text of the Income Tax Act 2023 in the official gazette through SRO

See MoreCanada grants tariff exemptions on select US and Chinese steel, aluminium products

The tariff relief on certain US and Chinese steel and aluminium imports is aimed at supporting local industries and advancing trade negotiations with both countries. Canada has introduced tariff relief measures on certain steel and aluminium

See MorePhilippines: BIR extends e-invoicing compliance deadline

The BIR explained that this extension is necessary due to operational adjustments. The Philippines' tax authority, the Bureau of Internal Revenue (BIR), has issued Revenue Regulations (RR) No. 026-2025 on 5 September 2025, which grants covered

See MoreSingapore: Parliament reviews Finance (Income Tax) Bill 2025, includes new corporate tax relief measures

This legislation proposes numerous amendments to the Income Tax Act (ITA) and the Multinational Enterprise (Minimum Tax) Act (MMTA). Singapore's Parliament is reviewing the Finance (Income Taxes) Bill 2025, which had its first reading on 14

See MoreIndia considers easing imports on Chinese raw materials

India’s Commerce Ministry and NITI Aayog considered relaxing certain tariff and non-tariff restrictions on Chinese imports to secure cheaper raw materials and support industrial growth. India’s Ministry of Commerce and Industry, supported by

See MoreSingapore: Tax Authority issues e-tax guide on submission of income information by commission-paying organisations

IRAS issued SEP income reporting guide, effective from YA 2024. The Inland Revenue Authority of Singapore (IRAS) issued a new e-Tax Guide, Submission of Income Information by Commission-Paying Organisations, on 17 October 2025. The guide

See MoreUS: Trump pledges to keep ‘massive’ tariffs on India until Russian oil imports stop

Trump said Modi had assured him India would stop buying Russian oil, warning New Delhi it would face “massive” US tariffs if it did not comply. US President Donald Trump said on Sunday, 19 October 2025 that Indian Prime Minister Narendra

See MoreAustralia, Ukraine sign income tax treaty

The treaty establishes the first bilateral agreement between Australia and Ukraine and aims to eliminate double taxation on income, capital, fringe benefits, and withholding tax while preventing tax evasion or avoidance. Australia and Ukraine

See MoreAustralia: Victoria government presents Omnibus state tax bill to parliament, seeks to refine existing frameworks for property taxes

The bill proposed various changes, including adjustments to the Commercial and Industrial Property Tax Reform Act 2024, refining the criteria for transactions eligible under the commercial and industrial property tax scheme. The Victorian

See More