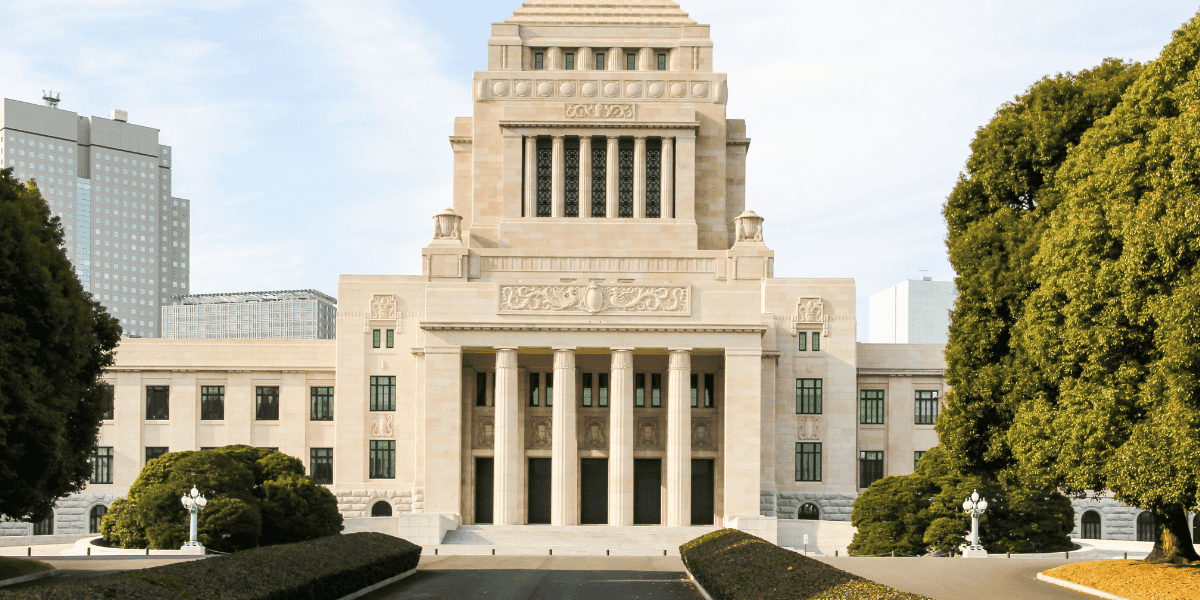

US reduces tariffs on Japanese auto imports to 15% in new trade deal

The US and Japan struck a trade deal, which lowers tariffs on Japanese auto imports to 15%. In return, Japan committed to a USD 550 billion investment in the US, including Boeing planes, defence spending, and increased agricultural and rice

See MoreUS to possibly settle for 15% tariffs on EU imports

The EU and the US are reportedly nearing a trade agreement to impose a 15% tariff on EU goods imported into the US. According to EU diplomats, the EU and the US are moving towards a trade agreement that would impose a 15% tariff on EU goods

See MoreIndonesia to reduce tariffs, ease trade barriers in US trade deal

Indonesia and the US have reached a trade agreement that eliminates tariffs on over 99% of US goods and reduces non-tariff barriers. In return, the US lowered tariffs on Indonesian products to 19%, alongside significant purchases of US jets, energy,

See MoreColombia: Council of State rules that there is no legal deadline for sending electronic messages confirming receipt of invoices

The ruling focused on the interpretation of Article 616-1 of the Tax Code, particularly regarding the electronic acknowledgement messages confirming receipt of the electronic sales invoice and the goods or services acquired in credit

See MoreBangladesh sends position paper to US, seeks tariff relief in final round of negotiations

Commerce ministry seeks to launch final round of tariff talks from 26 July; seeks 5–10-year transition period for labour and environmental reforms. Bangladesh formally submitted its position paper to the Office of the United States Trade

See MoreUS reduces reporting requirements for small businesses, freelancers, payment platforms

Recent tax law changes under President Trump's tax package reduce IRS reporting requirements for small businesses and freelancers, easing administrative burdens but potentially increasing income underreporting and widening the tax gap. Recent

See MoreUS: Trump administration considers eliminating capital gains tax on home sales

Under current law, US residents can exclude up to USD 250,000 in capital gains from taxable income when selling their primary residence. US President Donald Trump announced on 22 July 2025 that his administration is considering eliminating

See MoreIndonesia: Chief Economic Minister says 19% US tariff may take effect before 1 August

Trump imposed a 19% tariff on Indonesian goods as part of a new trade agreement, effective 1 August Indonesia's Chief Economic Minister, Airlangga Hartarto, announced on 21 July 2025 that the 19% tariff on Indonesian goods entering the US could

See MoreVenezuela: Economy ministry issues requirements for tax refunds in special economic zones

The Ministry of Economy and Finance issued guidelines for tax refunds in SEZs, which require certification, tax compliance, and adherence to administrative procedures. Venezuela’s Ministry of Economy and Finance issued Resolution No. 014-25 on

See MoreBrazil: Federal Supreme Court Justice reinstates financial transaction tax increase

Federal Supreme Court Justice Alexandre de Moraes has reinstated Decree No. 12.499 with retroactive effect from 11 June 2025 after failed government-National Congress conciliation. Brazil's Federal Supreme Court Justice Alexandre de Moraes

See MoreCanada expands steel quotas, imposes surtax on Chinese imports amid rising global tariffs

Canada is implementing various trade defences, which include a CAD 1 billion investment in the industry, CAD 70 million in worker retraining, enhanced financing, tightened procurement, and the launch of a CAD 500 million fund to support the

See MoreChile issues VAT registration rules for foreign B2C sellers

The resolution introduces VAT registration for foreign sellers and platforms handling low-value B2C goods from October 2025. The Chilean tax authority SII) issued Resolution No. 84 on 10 July 2025, establishing registration procedures for foreign

See MoreColombia clarifies tax on indirect transfers of free trade zone branches

The Ruling clarifies tax rules for indirect transfers of Free Trade Zone branches, excluding preferential rates. The Colombian tax authority (DIAN) issued Ruling 7858 int 924 on 18 June 2025, clarifying the taxation of indirect transfers

See MoreUS: IRS offers tax relief to New Mexico flood and storm victims

The tax filing and payment deadline has been extended to 2 February 2026 for New Mexico taxpayers. The US Internal Revenue Service (IRS) has issued NM-2025-03 on 16 July 2025, in which it announced tax relief for individuals and businesses in

See MoreBrazil: Senate approves tax treaty with Poland

The treaty becomes effective three months after the exchange of ratifications and applies from 1 January of the following year. Brazil's Senate (upper house of the National Congress) approved the ratification of its first income tax treaty with

See MoreColombia: Government considers tax hike to fund 2026 budget

The government is considering tax reform to raise COP 26 trillion for its 2026 budget. Colombia’s government is considering a tax reform proposal aimed at generating COP 26 trillion, primarily through tax increases, to support the 2026

See MoreCosta Rica issues transition guidelines for new digital tax system

The resolution outlines the guidelines for disabling current tax platforms to transition to the new “TRIBU-CR” system, which will take effect on 4 August 2025. Costa Rica’s Tax Administration (DGT) issued Resolution No. MH-DGT-RES-0011-2025

See MoreMexico updates final lists of taxpayers linked to fake transactions

The updated lists of taxpayers suspected of issuing invalid invoices due to non-existent transactions require affected parties to provide proof or amend tax returns within 30 days. Mexico’s Tax Administration (SAT) has revised the final lists

See More