UAE: Ministry of Finance revises excise tax rules on sweetened beverages

The UAE’s Ministry of Finance has announced the issuance of Cabinet Decision No. (197) of 2025 on selective goods, the tax rates or amounts imposed on them, and the method for calculating the selective price on 11 December 2025. The resolution

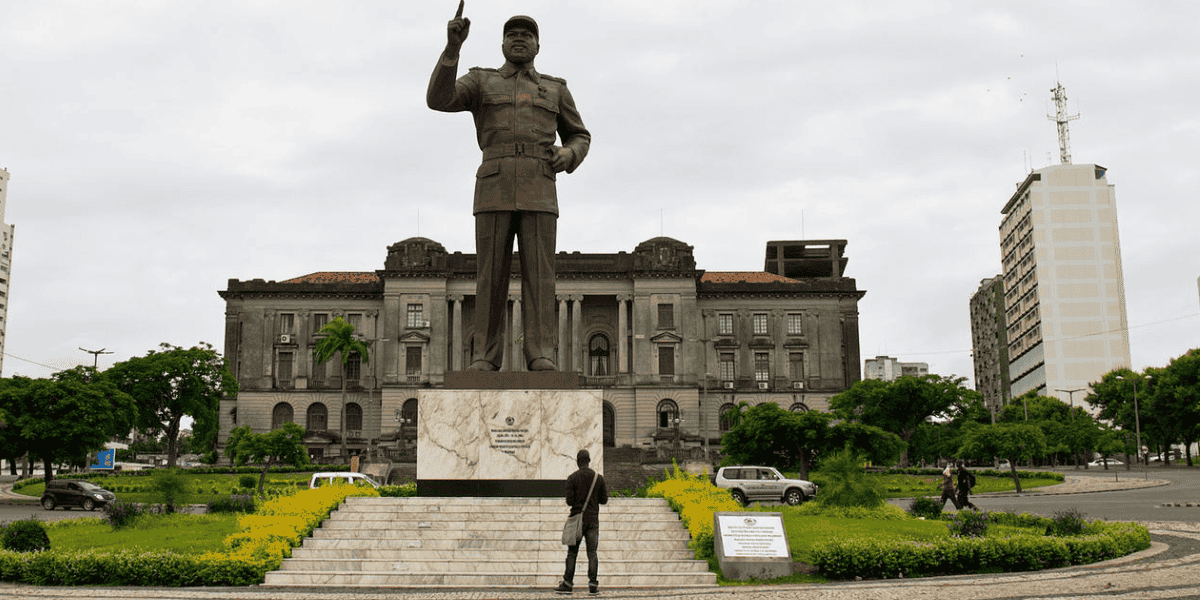

See MoreMozambique: Government adopts amendments to VAT law

Mozambique’s government adopted a draft Value Added Tax (VAT) law during the 41st Session of the Council of Ministers on 2 December 2025. The VAT law is designed to modernise and streamline the electronic submission of invoices and similar

See MoreUAE: MoF clarifies fines for e-invoicing non-compliance

The UAE’s Ministry of Finance (MoF) announced the issuance of Cabinet Resolution No. (106) of 2025 regarding violations and administrative fines resulting from non-compliance with the legislation regulating the Electronic Invoicing System, as part

See MoreOman: OTA consults on draft e-invoicing data dictionary

Oman’s Tax Authority (OTA) has released a draft electronic invoicing (e-invoicing) data dictionary for consultation on 1 December 2025. This is part of preparations for the country’s e-invoicing rollout in August 2026. The data dictionary,

See MoreUAE: FTA issues administrative exceptions VAT guide

The UAE’s Federal Tax Authority (FTA) issued the Administrative Exceptions VAT Guide on 5 December 2025. The guide explains how registrants can apply for VAT administrative exceptions, which provide concessions allowed under the VAT Law and its

See MoreQatar: GTA launches ‘Tabadol’ portal for CbC reports

Qatar’s General Tax Authority (GTA) announced the launch of the “Tabadol” portal for submitting Country-by-Country Reports (CbCR) for the 2024 fiscal year, along with notifications for 2025, on 10 December 2025. The submission deadline is

See MoreQatar, Uruguay sign income tax treaty

Qatar's General Tax Authority (GTA) announced, on 7 December 2025, that Qatar and Uruguay signed an income tax treaty. The agreement was signed by HE Ali bin Ahmed Al Kuwari, Minister of Finance of the State of Qatar, and HE Mario Lopetegui,

See MoreJordan, Switzerland income tax treaty enters into force

The income tax treaty between Jordan, Switzerland entered into force on 4 December 2025. Signed on 13 December 2023, the agreement aims to prevent double taxation on income and curb tax evasion between Jordan and Switzerland. It applies to

See MoreBahrain: NBR updates VAT guidance for real estate sector

Bahrain’s National Bureau for Revenue (NBR) has published Version 1.5 of its VAT Real Estate Guide, dated 18 November 2025, providing updated guidance on Value Added Tax in the Kingdom’s real estate sector. The update clarifies the VAT

See MoreSouth Africa: SARS updates average exchange rates for major currencies

The South African Revenue Services (SARS) released updated Average Exchange Rates on 5 December 2025, providing essential data for calculations. The update includes rates for the Australian dollar, Canadian dollar, Euro, Hong Kong dollar, Indian

See MoreOman: Tax Authority updates e-invoicing FAQs ahead of phased rollout

The Oman Tax Authority (OTA) has released an updated set of Frequently Asked Questions (FAQs) on e-invoicing, providing detailed guidance on the country’s electronic invoicing framework. The e-invoicing rollout, initially planned for 2024, was

See MoreKenya: National Assembly ratifies income tax treaty with Singapore

Kenya’s National Assembly approved the ratification of a new income tax treaty with Singapore on 3 December 2025. This agreement, signed on 23 September 2024, replaces the 2018 treaty, which never came into effect. The tax treaty aims to

See MoreTunisia mandates electronic submission of tax returns, transfer pricing declaration

Tunisia’s tax administration, the Directorate General of Taxes, issued a notice on 11 November 2025, informing taxpayers, who are required to file tax returns, and legal entities, who are required to submit the annual transfer pricing declaration,

See MoreAlgeria gazettes mutual assistance convention

Algeria published in the Official Gazette the decree ratifying the OECD–Council of Europe Convention on Multilateral Convention on Mutual Administrative Assistance in Tax Matters (the Convention) as amended by the 2010 protocol on 30 November

See MoreAlgeria revises stamp duties, vehicle taxes effective from January 2025

Algeria’s Ministry of Finance has issued Circular No. 73/LF25 on 23 November 2025, detailing revisions to various stamp duties and taxes as part of the 2025 Finance Law. The circular addresses the increase in the minimum perception of stamp

See MoreIsrael: Cabinet approves 2026 state budget amid controversy

The Israeli cabinet approved the 2026 state budget on 5 December 2025 after prolonged negotiations and internal disputes over allocations. The key tax measures and policy changes are as follows: Corporate and Banking Taxes New measures

See MoreTunisia: Ministry of Finance announces deadline for 2024 CbC reporting

Tunisia’s tax administration has issued a notice reminding taxpayers of their obligation to submit Country-by-Country (CbC) reports for the 2024 fiscal year by 31 December 2025, in accordance with the conditions set out in the Code of Tax Rights

See MoreUAE: MoF publishes domestic minimum top-up tax guidance, FAQs

The UAE Ministry of Finance has released guidance and FAQs regarding the Domestic Minimum Top-up Tax, effective from 1 January 2025. Domestic Minimum Top-up Tax in the UAE (the "UAE DMTT") is applied to Constituent Entities that are members of

See More