US, Taiwan reach major trade deal on semiconductors and key Taiwanese exports

The US and Taiwan have finalised a significant trade agreement that will reduce tariffs on many Taiwanese exports, boost US technology investment, and strengthen ties between Washington and Taipei amid rising tensions with China. Under the deal,

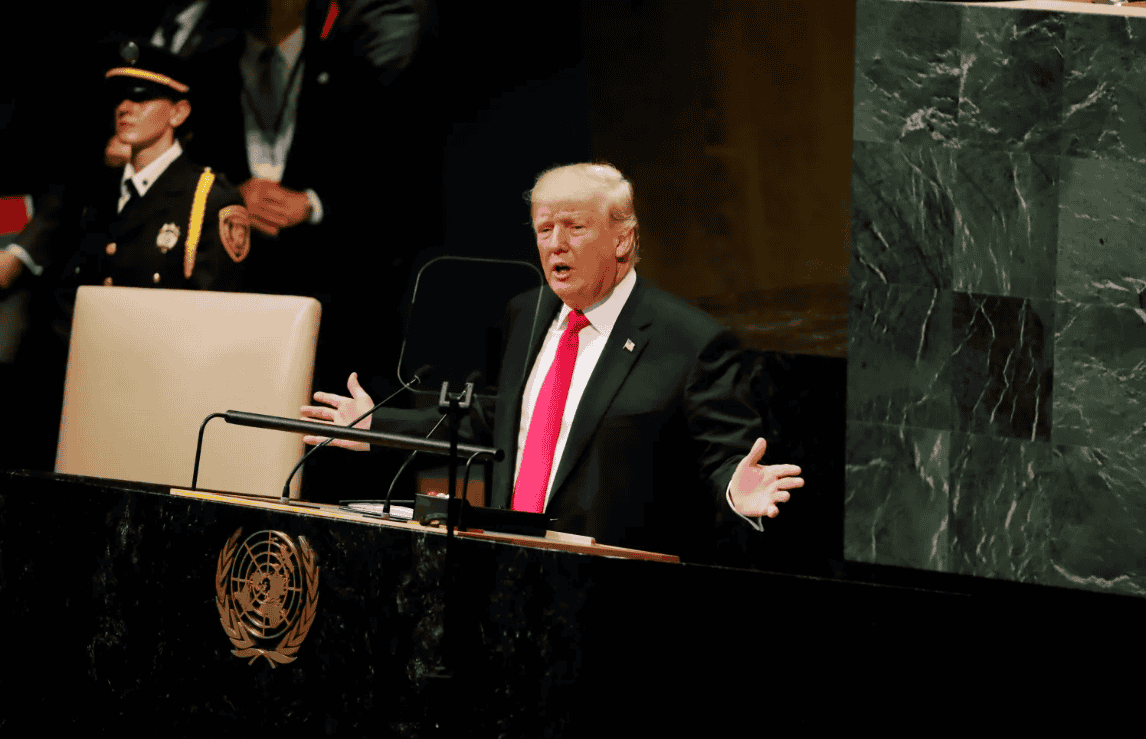

See MoreUS: Trump calls USMCA ‘irrelevant’ to national interests

US President Donald Trump said Tuesday that the U.S.-Mexico-Canada trade pact (USMCA) “is irrelevant” for the US, claiming it mainly benefits Canada, which “needs it.” He used the remarks to push for reshoring manufacturing to the United

See MoreUS: Trump delays critical minerals tariffs, opts for overseas sourcing

President Donald Trump has decided not to impose tariffs on rare earths, lithium, and other critical minerals for now, opting instead to pursue overseas supply arrangements. He has instructed US Trade Representative Jamieson Greer and Commerce

See MoreUS: Trump imposes 25% tariff on AI chips imports

US President Donald Trump has announced a new 25% tariff on selected high-performance artificial intelligence chips, including Nvidia’s H200 processor and AMD’s MI325X, under a national security proclamation issued by the White House on 14

See MoreChina publishes 2026 import and export tariff schedule

The Customs Tariff Commission of the State Council has published China’s revised import and export tariff rates for 2026. The updated tariffs were issued on 31 December 2025 and apply from 1 January 2026. The Import and Export Tariff

See MoreUS: Trump to imposes tariffs on Iran’s trade partners

Alongside military considerations, Trump has moved to sharply increase economic pressure on Iran. He announced on Monday, 12 January 2026, the immediate imposition of a 25% tariff on any country doing business with Iran, a step that could

See MoreUS: Supreme Court to determine fate of Trump’s sweeping global tariffs on 14 January

The US Supreme Court is expected to deliver its latest round of decisions on 14 January 2026 on the legality of President Donald Trump’s global tariff policy. The court noted that its rulings may be announced when the justices convene for their

See MoreThailand revises duty exemption rules for low value goods

Thailand’s Customs Department has issued Customs Department Announcement No. 219/2568 in the Royal Gazette on 11 December 2025, revising the criteria for imports eligible for exemption from customs duty. The changes will significantly narrow

See MoreTaiwan: Taipei Customs to grant goods tax exemption on imported sugar-free beverages with documentation from January 2016

Taiwan’s tax authority, Taipei Customs, announced on 7 January 2026 that the Commodity Tax Act has been amended and passed, exempting sugar-free beverages from commodity tax, effective 1 January 2026. To facilitate compliance by both tax

See MoreUS: Trump Administration postpones tariff hike on furniture, kitchen cabinets

The Trump Administration has postponed the planned 2026 tariff hikes on upholstered furniture and kitchen cabinets to 1 January 2027, according to a proclamation issued on 31 December 2025. This follows the Trump Administration’s earlier

See MoreUS sets initial zero-rate tariffs on Chinese semiconductors

The Office of the United States Trade Representative (US Trade Representative) has issued a Notice of Action titled “China’s Acts, Policies, and Practices Related to the Targeting of the Semiconductor Industry for Dominance,” which was

See MoreWTO: Updated Global Trade Outlook

The October 2025 update of the Global Trade Outlook and Statistics noted that the WTO forecast for world merchandise trade volume growth in 2025 has risen to 2.4% (which is higher than the estimate of 0.9% in the interim outlook in August) 2025.

See MoreChina imposes tariffs on EU dairy imports, heightens trade tensions

China will impose provisional duties ranging from 21.9% to 42.7% on dairy products imported from the European Union, with most exporters facing rates just under 30%. The measures, effective from 23 December 2025, apply to products such as

See MoreTaiwan: Keelung Customs warns importers to declare genuine value, invoices submission

The Keelung Customs Office has urged importers to honestly declare the transaction prices of imported goods and provide authentic invoices to avoid penalties. The warning follows several recent cases in which importers were found to have

See MoreTaiwan: MoF launches anti-dumping probe on imported electromagnetic steel from Korea (Rep.), China

The Ministry of Finance announced an anti-dumping investigation into cold-rolled flat-rolled non-directional electromagnetic steel imported from Korea (Rep.) and mainland China on 15 December 2025. The Customs Administration of the Ministry of

See MoreEU introduces tariffs on low-value e-commerce packages

The EU’s Economic and Financial Affairs Council (ECOFIN) met in Brussels on 12 December 2025, where EU finance ministers discussed financial market integration, simpler regulation, and economic governance. At the ECOFIN meeting, EU finance

See MoreUS to introduce gradual tariffs on Nicaragua following labour rights violations

The US will introduce new tariffs on selected Nicaraguan imports starting 1 January 2026, citing ongoing labour and human rights issues. According to the US Trade Representative (USTR), the duties will be phased in gradually, rising to 10% in

See MoreItaly to impose duties on non-EU parcels, increase financial transaction taxes

Italy is preparing several new tax measures to boost revenue and protect local industries. A EUR 2 levy on small non-EU parcels, aimed at platforms like Shein and Temu, will apply to packages worth up to EUR 150 and is expected to raise over EUR

See More