Slovak Republic enacts public finance consolidation measures for 2026

The 2026 public finance package introduces a sharply increased minimum corporate tax for large companies, raises VAT on high-sugar and high-sodium foods, and limits VAT deductions on motor vehicles to 50% between 2026 and 2028. Regfollower

See MoreHungary: Parliament reviews Autumn Tax Package measures

Hungary’s draft autumn tax package, presented on 14 October 2025, proposes adjustments across corporate, VAT, insurance, retail, and advertisement taxes—including R&D incentives, global minimum tax compliance, reduced VAT on beef,

See MoreLatvia: Government approves 2026 budget

The 2026 budget aims to boost revenue through excise taxes while easing living costs via a temporary VAT reduction on essential foods from July 2026. Latvia’s government has approved the 2026 state budget measures on 14 October 2025 and the

See MoreEU releases report on member states’ departures from standard VAT rates

The report mentions that three countries—Luxembourg, Ireland, and Italy—account for 75% of the 64 identified VAT rate deviations, while the remaining 25% are spread across seven other EU nations. The European Commission (EC) has published a

See MoreBelgium introduces VAT bill on service supply rules and margin scheme for arts, antiques

The draft VAT bill updates rules on the place of supply for specific services, the profit margin scheme for art and antiques, and VAT rates, partly implementing EU Directive 2022/542. The Belgian government has introduced a draft VAT bill to the

See MoreLatvia: Finance minister outlines key priorities in 2026 draft budget, initiates discussions with social partners

The 2026 budget proposes diversifying revenue sources through higher gambling and excise taxes, while supporting investment and easing living costs with tax law amendments and a temporary VAT cut on basic foods starting July 2026. Latvia's

See MoreIreland presents 2026 Budget, proposes increased R&D tax credits

Minister for Finance Paschal Donohoe said the Budget aims to boost productivity, protect jobs, and strengthen Ireland’s economic foundations. Ireland's Department of Finance has released the Budget 2026, which was presented on 7 October 2025,

See MoreEuropean Commission releases reports on member states’ VAT rate exemptions

This report reviews how Member States apply VAT rate derogations, revealing an uneven distribution. The European Commission has released a report examining the VAT rate exemptions utilised by EU Member States, accompanied by annexes detailing

See MoreSlovak Republic: Parliament approves third consolidation package of tax reforms, includes higher corporate taxes

Key tax changes include higher corporate and investment taxes, along with increased consumption taxes, including higher VAT on specific food products, and increased tax on online gaming. The Slovak Republic’s National Council gave its approval

See MoreZambia: Government presents 2026 budget, proposes VAT refund incentives for energy sector

The national budget for 2026 proposes amendments to key tax laws to enhance revenue, provide targeted relief, promote equity, support economic formalisation, and align with international standards. Zambia’s Minister of Finance and National

See MoreCroatia: Government consults streamlined VAT rules ahead of 2026 e-invoicing rollout

The consultation is set to conclude on 18 October 2025. Croatia’s Ministry of Finance has amended the Value Added Tax Act (VAT) to align it with the Fiscalization Act, which mandates e-invoicing for domestic B2B transactions starting 1 January

See MoreRussia: MoF presents various tax reforms, includes VAT increases as part of 2026 budget package

The budget proposals include a standard VAT rate hike from 20% to 22%, and the simplified VAT threshold will drop from RUB 60 million to RUB 10 million, amongst others. Russia’s Ministry of Finance has submitted a series of draft laws to the

See MoreSweden: Government proposes simplified business and capital taxation in 2026 budget

The proposed tax measures include business tax credits and simplified forestry and shipping rules, temporary VAT cuts and fraud controls, changes to excise taxes on alcohol and tobacco, permanent tax-free EV workplace charging, and reduced energy

See MoreFinland: Government presents 2026 budget to parliament, proposes reduced corporate taxes

The 2026 budget proposal lowers corporate and CO2 fuel taxes while tightening crypto reporting, adjusting VAT, and raising taxes on vehicles, tobacco, alcohol, and soft drinks. Finland’s government has presented the 2026 budget proposal (HE

See MoreRomania gazettes revised VAT reporting requirement

Order No. 2194/2025 has been issued approving the revised format of Romania’s Statement 394 for reporting goods, services, and acquisitions. Romania has published Order No. 2194/2025 in Official Gazette No. 852 of 17 September 2025. This

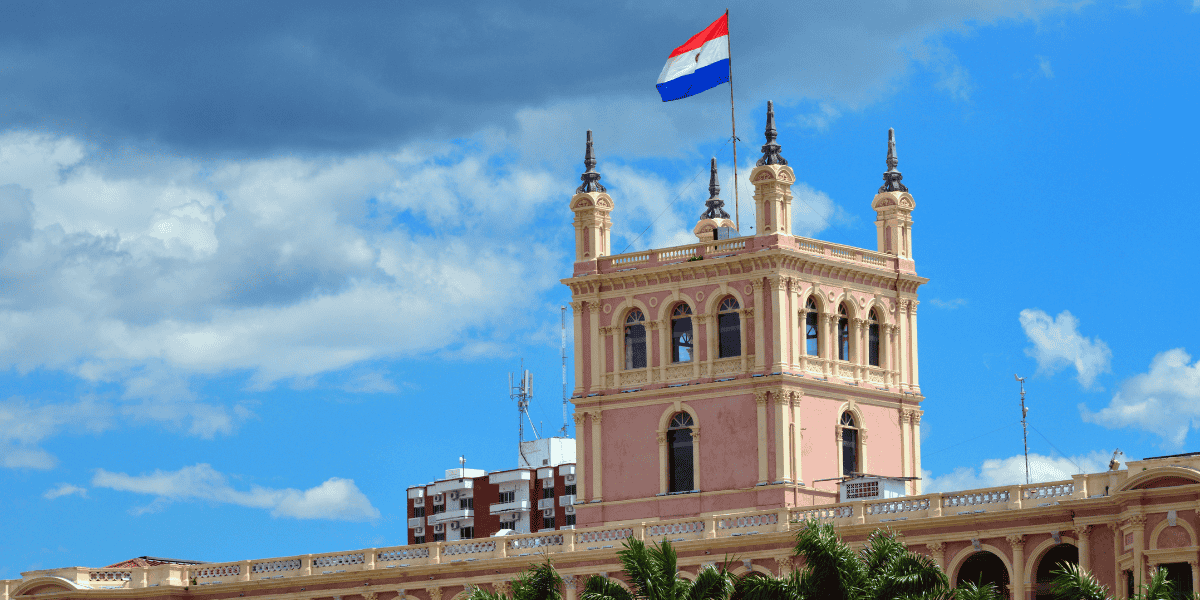

See MoreParaguay introduces tax incentives for electronics manufacturing, digital equipment

Paraguay’s Law No. 7546/2025 boosted investment and jobs in electronics and digital equipment. Paraguay has enacted Law No. 7546/2025, published on 8 September 2025 and effective from 9 September 2025, to promote investment and formal

See MoreSweden: Government considers reducing VAT on dance events in 2026 budget

The government plans to reduce the VAT rate for admission to dance events to 6% from the existing 25%. The Swedish government, in a press release on 13 September 2025, announced plans to lower the VAT rate for dance events as part of its 2026

See MoreRomania gazettes new VAT return form to reflect updated rates

The updated form with the new VAT rates will be required for the VAT return due on 25 September 2025. Romania’s government has published Order No. 2.131 of 2 September 2025 in the Official Gazette on 8 September 2025, approving the update to

See More