Mexico: SAT clarifies proof of tax status not required for electronic invoices

Mexico’s Tax Administration Service (SAT) has confirmed, on 20 January 2026, that the Proof of Tax Status (Constancia de Situación Fiscal, CSF) is not mandatory for issuing electronic invoices (CFDI). Any issuer who conditions the issuance of a

See MoreFrance: Government publishes list of approved e-invoicing platforms

The French government has published a list of the first 101 platforms approved for use under the country’s electronic invoicing (e-invoicing) and electronic reporting reform. The list, issued on 16 January 2026 by the Directorate General of Public

See MorePoland confirms phased rollout of mandatory KSeF e-invoicing from February 2026

Poland is preparing to roll out its National e-Invoicing System (KSeF), a digital platform for issuing, sending, receiving, and storing structured invoices. The Ministry of Finance and the National Revenue Administration (KAS) outlined the

See MoreRomania implements 2026 tax reforms: Limits deductions for IP, consulting fees

Romania has published Law No. 239/2025 and Emergency Ordinance No. 89/2025, which introduce a 1% cap on deductions for payments to non-resident related parties for intellectual property and management or consulting services. The limit applies to

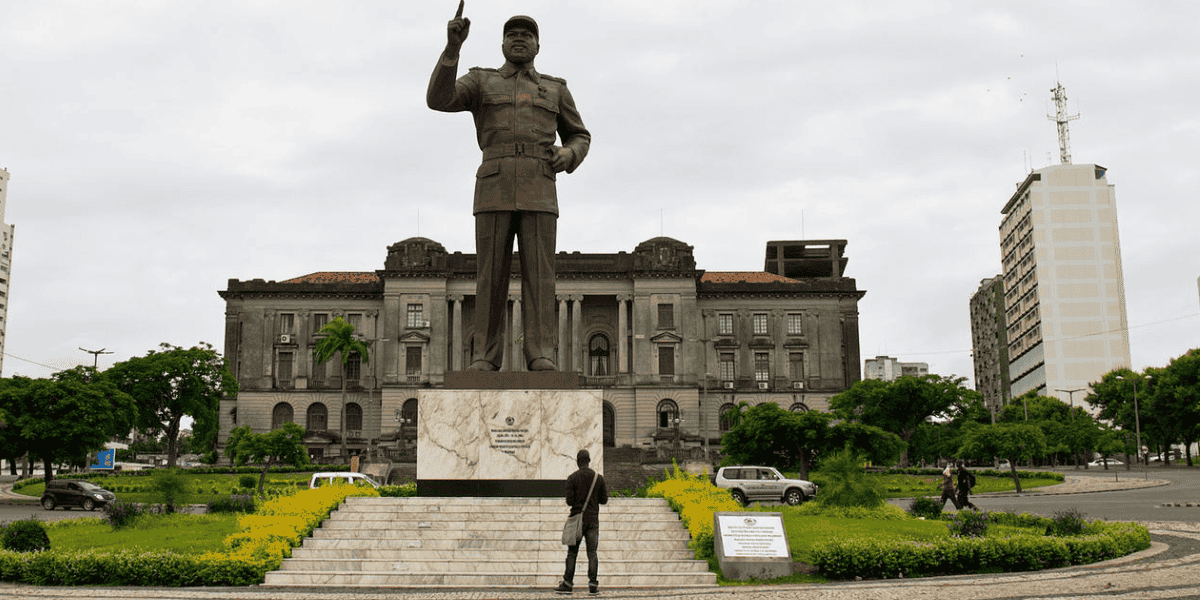

See MoreAngola: MoF introduces mandatory e-invoicing for large companies from 2026

Angola’s Ministry of Finance (MOF) has confirmed that electronic invoicing (e-invoicing) will become mandatory for large companies from 1 January 2026, with the obligation extending to all companies in 2027. The announcement was made on 9

See MoreTaiwan: MoF reminds businesses that prices must include VAT, uniform invoices are mandatory

Taiwan Northern Area National Taxation Bureau of the Ministry of Finance (MOF) stated that when business operators sell goods or services, the listed prices of taxable items must include value-added tax (VAT). Uniform Invoices must be issued in

See MoreBelgium announces VAT e-Invoicing measures from 2026

Belgium’s tax authority (SPF Finances) announced on 19 December 2025 that all Belgian companies subject to VAT must use electronic invoicing with each other from 1 January 2026. The draft law includes several measures concerning this mandatory

See MorePoland: MoF implements rules for national electronic invoicing system

Poland’s Ministry of Finance announced four implementing regulations governing the use of the National e-Invoicing System (Krajowy System e-Faktur – KSeF) on 16 December 2025. 1. Cases Exempt from Structured Invoices The regulation of 7

See MoreSri Lanka: IRD postpones adoption of new VAT invoice format

The Inland Revenue Department (IRD) has announced, on 12 December 2025, that the effective date for the new VAT Tax Invoice format has been postponed. Following requests from numerous VAT registered persons, the Commissioner General of Inland

See MoreMozambique: Government adopts amendments to VAT law

Mozambique’s government adopted a draft Value Added Tax (VAT) law during the 41st Session of the Council of Ministers on 2 December 2025. The VAT law is designed to modernise and streamline the electronic submission of invoices and similar

See MoreUAE: MoF clarifies fines for e-invoicing non-compliance

The UAE’s Ministry of Finance (MoF) announced the issuance of Cabinet Resolution No. (106) of 2025 regarding violations and administrative fines resulting from non-compliance with the legislation regulating the Electronic Invoicing System, as part

See MoreOman: Tax Authority updates e-invoicing FAQs ahead of phased rollout

The Oman Tax Authority (OTA) has released an updated set of Frequently Asked Questions (FAQs) on e-invoicing, providing detailed guidance on the country’s electronic invoicing framework. The e-invoicing rollout, initially planned for 2024, was

See MorePoland: Parliament adopts 2026 Budget Act, increases bank tax rates

Poland’s Ministry of Finance announced, on 5 December 2025, that the lower chamber of parliament (Sejm) had adopted the Budget Act for 2026, introducing wide-ranging tax changes set to reshape the country’s fiscal landscape next year. The

See MoreUK: Parliament considers Finance Bill containing 2025 budget proposals

The UK Parliament is currently reviewing the Finance (No. 2) Bill (Bill 342 for 2024–26), which was introduced to the House of Commons on 4 December 2025. The bill has completed its first reading and outlines the key tax and financial measures

See MoreBelgium: SPF Finances introduces a three-month grace period for e-invoicing from January 2026

Belgium’s tax authority (SPF Finances) announced on 2 December 2025 that businesses subject to VAT will have a 3-month grace period to comply with the new electronic invoicing requirement. This rule, which officially takes effect on 1 January

See MoreOman: OTA issues draft e-invoicing data dictionary

The Oman Tax Authority (OTA) has released the draft e-invoicing data dictionary to selected taxpayers ahead of the August 2026 rollout. It defines standard data elements, validation rules, and code lists for all transaction types across B2B, B2C,

See MoreUAE details fines for e-invoicing violations

The UAE Ministry of Finance has detailed penalties for violations of the country’s Electronic Invoicing System under Cabinet Decision No. 106 of 2025. The Decision, approved by the UAE Cabinet and presented by the Minister of Finance, follows a

See MoreUK: Government releases 2025 budget, mandates VAT e-invoicing from 2029

The UK government published Budget 2025 on 26 November 2025, introducing various measures to improve digital tax administration. One key measure is the requirement for all VAT invoices to be electronic from 1 April 2029. The shift to e-invoicing

See More