Ireland consults tax treatment of interest

Ireland's Department of Finance has announced the initiation of a public consultation regarding the tax treatment of interest on Friday, 27 September 2024. Irish tax legislation includes a number of provisions allowing for the deductibility of an

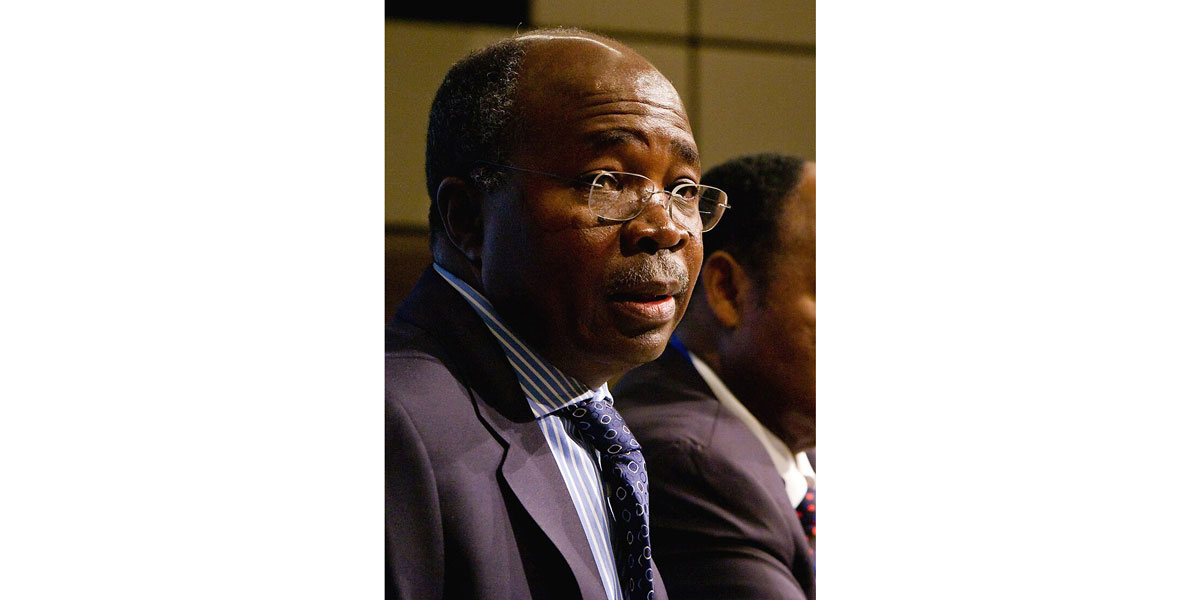

See MoreZambia presents 2025 budget

Zambia’s Minister of Finance and National Planning, Situmbeko Musokotwane, presented the 2025 National Budget to the National Assembly on Friday, 27 September 2024. “The 2025 budget is premised on economic recovery and promoting growth to

See MoreSouth Africa updates corporate income tax return form, allows additional allowance for renewable energy production

The South African Revenue Service (SARS) has updated the corporate income tax return form (ITR14 form), allowing taxable entities to claim section 12BA allowances on 16 September 2024. The 12BA allowance offers a 125% enhanced allowance for

See MoreIreland publishes responses on second feedback statement for introduction of participation exemption for foreign dividends

The Irish Government published the responses collected from the second feedback statement regarding the implementation of a participation exemption regime for foreign dividends on 25 September 2024. It includes potential draft proposals for the

See MoreOECD: Latest Edition of Tax Policy Reforms

On 30 September 2024 the OECD published the latest edition of Tax Policy Reforms: OECD and Selected Partner Economies. This annual publication provides comparative information on tax reforms in a number of countries. The latest report looks at the

See MoreTurkey clarifies electronic notification rules in tax procedure law

Turkey’s Ministry of Treasury and Finance has clarified taxpayers' obligations under the Electronic Notification Process in the Tax Procedure Law (TPL), published General Communiqué No. 568 in the Official Gazette, on Wednesday, 25 September

See MoreSaudi Arabia: ZATCA sets criteria for selecting taxpayers for wave 16 of e-invoicing, compliance starts 1 April 2025

Saudi Arabia’s Zakat, Tax and Customs Authority (ZATCA) announced the criteria for selecting the targeted taxpayers in the Sixteenth Wave for implementing the "Integration Phase" of E-invoicing on 27 September 2024. ZATCA also clarified that

See MoreEcuador mandates new reporting requirements for final beneficiaries and corporate composition

Ecuador's Internal Revenue Service (SRI) has introduced Resolution NAC-DGERCGC24-00000033, outlining the Report of Final Beneficiaries and Corporate Composition (REBEFICS) requirements. It mandates all Ecuadorian companies, as well as foreign

See MoreDominican Republic approves 2025 draft budget, projected 4% increase

The Dominican Republic’s Council of Ministers, presided over by President Luis Abinader, approved the draft General Budget Law for 2025 on 26 September 2024. According to Finance Minister José Manuel Vicente, the government’s plan for

See MoreArgentina: Budget Bill 2025 proposes scrapping foreign currency purchase tax

The Argentine National Executive Branch presented the 2025 Budget Bill to Congress, which made no significant changes to the current tax framework except for eliminating the tax on foreign currency purchases (PAIS tax rate) starting 1 January

See MoreJapan, UAE initiates negotiations for CEPA

Japan’s Ministry of Foreign Affairs announced that it has launched negotiations with Japan for a comprehensive economic partnership agreement (CEPA) on 18 September 2024. “I hope that concluding an ambitious, balanced, and comprehensive EPA

See MoreFinland presents 2025 Budget proposal to the parliament

Finland’s Ministry of Finance submitted its proposal for the 2025 Budget and other related legislative proposals to the Parliament on 23 September 2024. The budget’s central government expenditure amounts to EUR 88.8 billion and revenue to EUR

See MoreIreland releases pre-filing notification forms for R&D corporation tax credit

Irish Revenue has published eBrief No. 239/24, announcing the release of pre-filing notification forms for the R&D Corporation Tax Credit on 13 September 2024. The R&D Corporation Tax Credit pre-filing notification forms in respect of

See MoreUK: HMRC issues new guidance for non-UK companies involved in property sector

The UK tax authority, His Majesty's Revenue and Customs (HMRC), has released new guidance for non-UK resident companies involved in the property sector within the United Kingdom on 17 September 2024. This update is particularly important for

See MoreSpain: Council of Ministers approve crypto-asset reporting framework

The Spanish Council of Ministers approved a draft bill to implement the Amending Directive to the 2011 Directive on Administrative Cooperation (2023/2226) DAC8 – which integrates the OECD's crypto-asset reporting framework (CARF) into the

See MorePoland to present 2024 budget changes due to floods in two weeks

Devastating floods have afflicted Poland since 22 September 2024, prompting the government to introduce changes to the 2024 budget. According to Finance Minister Andrzej Domanski, the government will make necessary changes to the budget within two

See MoreGermany: Tax revenue grows 5.3% in August

Germany's federal and state governments' tax revenue rose 5.3% in August when compared to the same month last year, said the finance ministry on Friday, 20 September 2024. According to the ministry's monthly report, tax revenue collected by

See MoreGreece announces initiatives to boost startup investments and mergers

The Greek government has announced changes to its Golden Visa programme in an attempt to boost the startup ecosystem and provide new investment opportunities. A residence permit (similar to the Golden Visa) will be awarded to non-resident

See More