India publishes guidance for Direct Tax Vivad se Vishwas Scheme

India's Central Board of Direct Taxes (CBDT) published a guidance, Circular No. 12 of 2024, on Direct Tax Vivad se Vishwas (DTVSV) Scheme 2024 on 15 October 2024, which was introduced in the 2024 Budget to resolve tax disputes and reduce litigation

See MoreSwitzerland lowers interest rates for federal taxes

The Swiss Federal Finance Department (DFF) has announced a reduction in the interest rates for late, refunded, Advance Tax Payments, effective from 2025. Starting 1 January 2025, the tax arrears, refunds, and conditional payment obligations will

See MoreAzerbaijan joins CIS tax reform and digital innovation talks

Azerbaijan attended a high-profile Coordination Council meeting in Bishkek, Kyrgyzstan, on 7 October 2024. The meeting comprised high-ranking tax officials from the Commonwealth of Independent States (CIS) Armenia, Belarus, Russia, Tajikistan,

See MoreMalaysia likely to introduce subsidy cuts, new taxes in 2025 budget

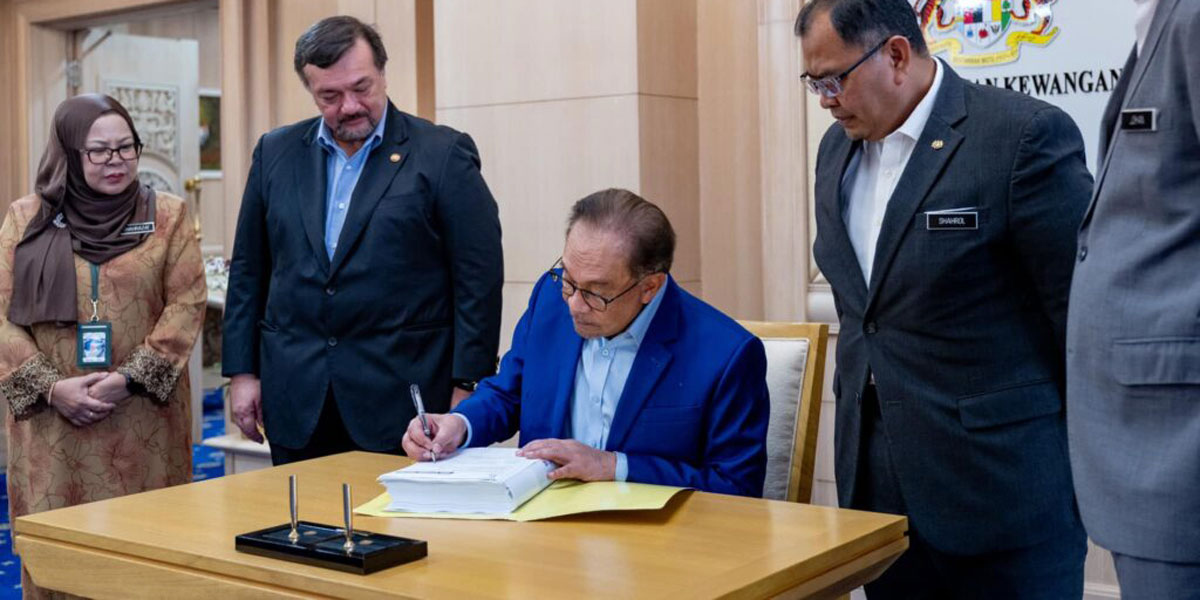

Malaysia’s Prime Minister Anwar Ibrahim will announce the 2025 budget in parliament on Friday, 18 October 2024. Analysts and economists suggest the government is likely to implement additional new taxes and reduce subsidies for its 2025 budget,

See MoreSingapore updates guidance on applying for Certificate of Residence, tax reclaim form

The Inland Revenue Authority of Singapore (IRAS) has released revised guidance on the Applying for a Certificate of Residence and Tax Reclaim Form. The Certificate of Residence (COR) is a letter issued by IRAS to certify that the company is a tax

See MoreUK: Starmer rejects claims of 39% capital gains tax hike

British Prime Minister Keir Starmer has rejected claims that capital gains tax could rise to 39% in this month’s budget, calling the speculation "wide of the mark," in an interview with Bloomberg Television at an investment summit in

See MoreIreland publishes Finance Bill 2024: Implements taxation changes announced on Budget Day

Ireland's Minister for Finance, Jack Chambers TD, has published the Finance Bill 2024 and Explanatory Memorandum following the Government's approval earlier in the week. The Bill enacts key measures from Budget 2025, alongside a series of

See MoreIndia introduces key amendments to CGST rules

The Indian Ministry of Finance has issued Notification No. 20/2024 on 8 October 2024, implementing significant amendments to the Central Goods and Services Tax (CGST) Rules, 2017. Key changes in CGST Rules Removal of IGST refund restrictions:

See MoreIndia consults Income Tax Act, 1961

India's Central Board of Direct Taxes (CBDT) has initiated a public consultation to conduct a comprehensive review of the Income Tax Act, 1961. The announcement was made on 7 October 2024. In the Budget 2024-2025 speech, the Finance Minister

See MoreDominican Republic unveils fiscal reform plans

The Dominican Republic introduced a draft Law on Fiscal Modernization aimed at modernising its tax system and increasing revenue on 8 October 2024. The reform is reviewing tax incentives for sectors like tourism and cinema, and it will introduce

See MoreUN Tax Committee publishes transfer pricing guidelines for agriculture, pharma industry

The UN Committee of Experts on International Cooperation in Tax Matters published advanced unedited versions of guidance on transfer pricing for agricultural products and transfer pricing in the pharmaceutical industry on 23 September

See MoreNorway proposes changes to exit taxes in 2025 Budget

Norway’s government has proposed amendments to the exit tax regulations in the National Budget 2025, which was announced on 7 October 2024. In practice, the current exit tax rules function as a tax loophole. The Government wants to close this

See MoreFrance: Finance Bill 2025 proposes new corporate and personal income tax regime

The French government presented the Finance Bill 2025 during a press conference in Paris on Thursday, 10 October 2024, with the goal of reducing the deficit from 6.1% of GDP this year to 5% next year. To achieve this, the government plans to

See MoreOECD: Tax Arbitrage Through Closely Held Businesses

On 7 October 2024 the OECD published a taxation working paper with the title Tax arbitrage through closely held businesses: Implications for OECD tax systems, written by Tom Zawisza, Sarah Perret, Pierce O’Reilly and Antonia Ramm. The working

See MoreKenya consults proposed income tax treaty with Iceland

Kenya has initiated a public consultation on the proposed income tax treaty with Iceland. The announcement was made in a public notice by the National Treasury on 2 October 2024. The consultation is set to conclude on 7 November 2024. The

See MoreUSA: FinCEN updates FAQs on beneficial ownership information under CTA

The Financial Crimes Enforcement Network (FinCEN) USA has updated FAQs regarding Beneficial Ownership Information (BOI) under the Corporate Transparency Act (CTA) on 3 October 2024. The FAQs aim to provide clarification regarding the reporting

See MoreTurkey clarifies application and payment periods for restructuring public receivables in earthquake-affected areas

The Ministry of Treasury and Finance Turkey has issued General Communiqué No. 7 on Law No. 7440 to clarify the application and payment periods for the restructuring of public receivables in earthquake-affected areas on 4 October 2024. Law No.

See MoreSouth Africa lowers interest rate for interest-free, low-interest loans

The South African Revenue Service (SARS) has lowered the interest rate Table 3 for interest-free or low-interest loans from 9.25% to 9.00%, effective from 1 October 2024, following the Reserve Bank’s Monetary Policy Committee’s decision to

See More