Canada: CRA to apply GST/HST on mutual fund trailing commissions from July 2026

The Canada Revenue Agency (CRA) will require mutual fund dealers to collect goods and services tax/harmonised sales tax (GST/HST) on trailing commissions, as they are now considered taxable supplies, starting 1 July 2026. The CRA’s position on

See MoreZimbabwe introduces broad tax changes for 2026, including digital services tax, VAT, mining adjustments

Zimbabwe has introduced a range of tax measures in its National Budget for 2026, which were enacted through the Finance Act 2025 (Act No. 7 of 2025) on 29 December 2025. The Finance Act of 2025 introduces significant amendments to existing tax

See MoreMalaysia: MoF revises SST policies, announces lower rental tax, raw material exemptions, and extended construction relief

Malaysia’s Ministry of Finance released updated policy notices on sales and services tax (SST) on 5 January 2026. The key updates are as follows: Effective 1 January 2026, the service tax on rental and leasing services will be revised to

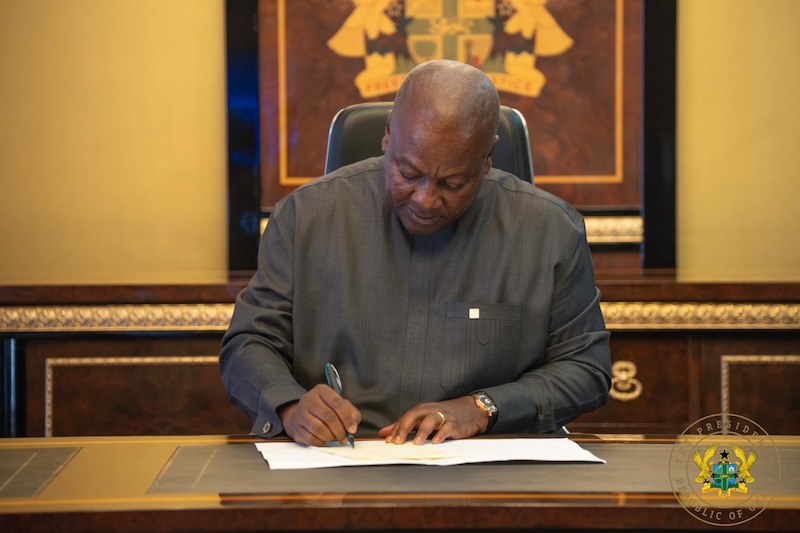

See MoreGhana abolishes COVID-19 health recovery levy

Ghana’s President John Dramani Mahama signed the COVID-19 Health Recovery Levy Repeal Act 2025 into law on 10 December 2025, ending the 1% levy on goods, services, and imports from January 2026. The repeal fulfills a key campaign promise, as

See MoreBrazil: RFB, GST committee issue guidelines for CBS and IBS implementation starting January 2026

Brazil’s tax authority, the Federal Revenue Service (RFB) and the Goods and Services Tax Management Committee (CGIBS) have released guidance on the upcoming Contribution on Goods and Services (CBS) and Goods and Services Tax (IBS) on 2 December

See MoreAustralia: Government consults on 2018 GST reform operations

The Australian government’s Productivity Commission released an issues paper for consultation on how the federal government’s 2018 goods and services tax (GST) reforms are functioning. Australia’s system of federal financial relations

See MoreLiberia: Government announces 2026 draft budget, introduces presumptive corporate income tax

Liberia’s Ministry of Finance and Development Planning delivered the draft national budget for 2026, on 11 November 2025, focusing on fostering an inclusive economy, safeguarding stability, and delivering real, tangible improvements for its

See MoreFrance: National Assembly passes first-reading amendments to the 2026 finance bill, focuses on major corporations

France’s National Assembly introduced several amendments to the Finance Bill for 2026, some of which have been approved during its first reading on 30 October 2025. The changes primarily target large corporations and business groups, introducing

See MoreTurkey: MHP proposes higher digital tax for foreign platforms

RF Report Turkey’s Nationalist Movement Party (MHP), an ally of President Recep Tayyip Erdoğan, has submitted a bill to the parliament that would raise the digital services tax (DST) for foreign companies from 7.5% to 12.5%, while keeping the

See MoreCambodia, Malaysia, Thailand sign agreement to scrap implementation of digital services taxes on US firms

Regfollower Desk The White House recently announced trade agreements with Cambodia, Malaysia, and Thailand, which include commitments from these nations to avoid imposing digital services taxes (DSTs) or similar measures that could unfairly

See MoreMalaysia: Customs department amends service tax rules, introduces new exemptions

Malaysia’s Customs Department will implement revised service tax policies with additional exemptions from 1 July 2025, following the Ministry of Finance’s announcement of expanded SST regulations. Malaysia’s Customs Department has revised

See MoreBrazil issues updated rules for indirect tax reporting

The updated guideline requires taxpayers to include IBS, CBS, and IS amounts in the total value reported on fiscal documents. Brazil has published new guidelines on the reporting of indirect taxes for the 2026 fiscal year, titled, Practical Guide

See MoreCanada announces GST/HST filing deadlines for distributed investment plans

These rules also impose responsibilities on both investors and securities dealers. Canada’s government announced that distributed investment plans, such as mutual fund trusts and investment limited partnerships are required to reach out to

See MoreAustralia: ATO proposes updated GST rules for copyright holders, digital media products

The draft determinations refine GST rules, introducing specific attribution rules for copyright transactions via collecting societies and updating intermediary arrangements for multimedia products, replacing the expiring 2015 version. The

See MoreAustralia: ATO consults on top 100 GST program changes

The deadline to submit comments is 29 September 2025. The Australian Taxation Office (ATO) has opened a consultation on 8 September 2025 regarding updates to its Top 100 Goods and Services Tax (GST) program. These changes are aimed at high

See MoreSingapore: IRAS updates GST guide for businesses

The guide provides an overview of the Goods and Services Tax (GST) in Singapore. It covers three broad categories: GST Concepts and Principles, GST Administration and GST Schemes. The Inland Revenue Authority of Singapore (IRAS) has released the

See MoreUS: Maryland clarifies 3% sales tax rules for multi-state it services

The 3% sales and use tax takes effect on 1 July 2025. The Comptroller of Maryland has released Technical Bulletin (TB) 54, offering comprehensive guidance for buyers and vendors on complying with the expanded 3% sales tax on data, IT, and

See MoreMalaysia exempts imported fruits from sales and service tax

Malaysia exempts imported apples, oranges, mandarin oranges, and dates from sales tax as part of revised sales and service tax changes aimed at easing living costs and supporting small businesses. Malaysia's Ministry of Finance revised the Sales

See More