Brazil: Federal Supreme Court Justice reinstates financial transaction tax increase

Federal Supreme Court Justice Alexandre de Moraes has reinstated Decree No. 12.499 with retroactive effect from 11 June 2025 after failed government-National Congress conciliation. Brazil's Federal Supreme Court Justice Alexandre de Moraes

See MoreBrazil: AGU appeals suspension of financial transaction tax hike

The AGU argues that the Executive Branch has constitutional authority to adjust IOF rates and claims the National Congress violated the separation of powers by suspending presidential decrees. Brazil's Attorney General's Office (AGU) appealed to

See MoreAustralia: ATO announces FX Rates for year ending June 2025

The ATO has updated its foreign exchange rate guidance, including monthly rates for July 2024 to June 2025. The Australian Taxation Office (ATO) has updated its guidance on foreign exchange rates, incorporating rates for the financial year ending

See MoreBrazil: National Congress scraps financial transactions tax increases

Brazil's National Congress approved the draft legislative decree on 25 June 2025, repealing three presidential decrees that increased IOF tax rates. Brazil's National Congress (both the Chamber of Deputies and Senate) has approved Draft

See MoreRomania announces 2025–28 tax reforms, raises dividend tax

The proposed tax reforms target increased taxes on dividends, reduced incentives, stricter expense deductions, and simplified VAT rates. Romania published its decision approving the 2025-2028 Government Programme in the Official Gazette on 23

See MoreSlovak Republic consults financial transactions tax exemption for foreign entities, entrepreneurs

The draft bill exempts foreign subsidiaries/branches with prior taxable income under EUR 100,000 and individual entrepreneurs from the financial transactions tax. The Slovak Republic’s Ministry of Finance is consulting on a draft bill to narrow

See MoreUK: BoE likely to hold interest rates amid rising oil prices and inflation risks

The Bank of England is likely to keep interest rates at 4.25%, weighing lower domestic inflation against rising oil prices and global uncertainty. The Bank of England (BoE) is expected to keep its Bank Rate steady at 4.25% in its policy

See MoreBrazil revises financial transaction tax rates again

Brazil issued Decree No. 12.499 on 11 June 2025, repealing Decrees 12.466 and 12.467, raising financial transaction tax (IOF) rates on select insurance, credit, and forex transactions. Brazil has published Decree No. 12.499 on 11 June 2025, which

See MoreBrazil: Government to raise tax on interest on equity in fiscal package

Brazil's Finance Ministry plans to increase the income tax on interest on equity (JCP) payments from 15% to 20% as part of a new fiscal package. Brazil's Finance Minister, Fernando Haddad, announced on 10 June 2025 that the government is

See MoreBrazil: Government poised to support 10% reduction in tax breaks

Brazil's government is expected to back a bill proposing a 10% reduction in federal tax breaks, with a 5% cut in 2025 and another 5% in 2026. Brazil's government is likely to support a bill for a 10% cut to federal tax breaks, multiple sources

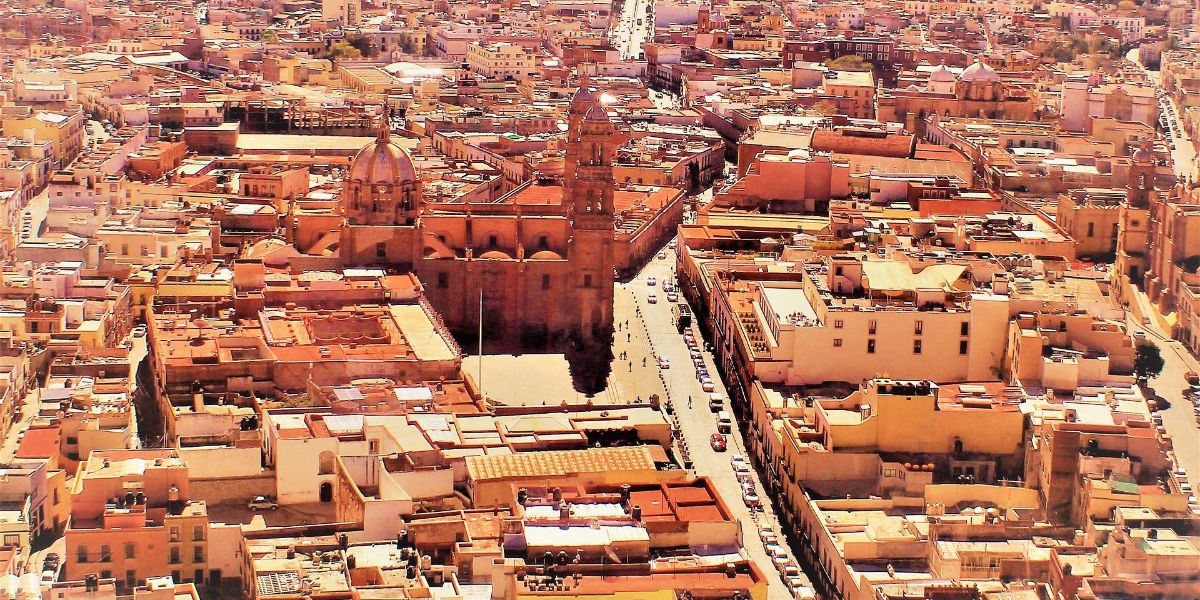

See MoreMexico objects US tax on cross-border remittances

The One, Big, Beautiful Bill (Act), which is now under Senate review, proposes a 3.5% tax on all remittances sent by non-US citizens to foreign countries, regardless of the transfer amount. The US House of Representatives passed the One,

See MoreBrazil: Economic Team to propose final alternative plan for IOF tax increases

Brazil’s government will present an alternative plan for the IOF tax increase within 10 days. Brazil’s Congress lower house speaker, Hugo Motta, said in an X post on 29 May 2025, that the government will present an alternative plan for

See MoreBrazil raises financial transaction tax on select insurance, credit, forex transactions

The Tax on Financial Operations (IOF) is a financial levy applied to individuals and businesses in Brazil, covering a range of financial transactions. Brazil has issued Decree No. 12.466 of 22 May 2025, which increases the financial transactions

See MoreBrazil: MoF scraps higher tax on investments made abroad

Finance Ministry dropped plans for a higher tax on overseas investments on Friday, following criticism that it signalled a return to capital controls. Brazil's Finance Ministry dropped a higher transaction tax on overseas investments on Friday,

See MoreEl Salvador: Congress approves tax on foreign NGO donations

El Salvador's Congress approved a new law, on 20 May 2025, which imposes a 30% tax on transactions from foreign donors to local organisations. The law is set to take effect eight days after its publication in the official gazette. The

See MoreSlovak Republic: Parliament rejects bill to exempt healthcare providers from financial transaction tax

The Slovak Republic’s Parliament has rejected a draft bill to amend the Financial Transaction Tax (FTT) Act on 15 April 2025, which sought to exempt healthcare providers established under special healthcare legislation from FTT. Earlier, the

See MoreSlovak Republic: Parliament rejects bills to exempt social enterprises from financial transaction tax and to lower excise duty on motor fuels

The Slovak Republic’s Parliament voted down two proposed bills seeking to amend the Financial Transaction Tax (FTT) Act and revise the Excise Duty Law on Mineral Oil on 15 April 2025. Financial Transaction Tax (FTT) Act amendment The

See MoreSlovak Republic: Parliament approves draft to amend financial transaction tax

The Slovak Republic Parliament has accepted a draft bill to amend the Financial Transaction Tax (FTT) Act on 15 April 2025. The latest amendment focuses on expanding exemptions for individuals and entities. The proposed amendments seek to exempt

See More