Hungary: NAV publishes draft 08E form to simplify insured-relationship reporting from 2026

Hungary’s National Tax and Customs Administration (NAV) has published a draft version of the new 08E form, which will replace the long-standing T1041 reporting form for insured relationships from 1 January 2026. The draft includes updated form

See MoreUS: IRS urges taxpayers to prepare early for 2026 filing season as major new tax law takes effect

The US Internal Revenue Service is encouraging taxpayers to begin preparing now for the 2026 tax filing season, highlighting key steps individuals can take to file accurate returns and avoid delays. In its first “Get Ready” reminder of the

See MoreUS: Treasury and IRS consult on implementing new federal tax credit for donations to scholarship organisations

The US Department of the Treasury and the Internal Revenue Service (IRS) issued Notice 2025-70 on 25 November 2025, stating that it is requesting comments on the implementation of a new tax credit for individuals established under the One, Big,

See MoreUS: IRS, Treasury publishes 2025 tax guidance for tip, overtime income for individuals

The US IRS and the Department of the Treasury issued guidance on 21 November 2025 for individuals eligible to claim the deduction for tips and overtime compensation for the tax year 2025. Notice 2025-69 clarifies for workers how to determine the

See MoreBangladesh: NBR extends 2025-26 PIT income tax return deadline

Bangladesh’s National Board of Revenue (NBR) has announced a one-month extension for filing income tax returns for the 2025-26 tax year. Under a special order issued on 19 November 2025, individual taxpayers now have until 31 December 2025 to

See MoreEstonia gazettes law reducing motor vehicle tax for families with children

Estonia gazetted amendments to the Motor Vehicle Tax Act on 12 November 2025, introducing new tax reductions for parents and guardians. Under the changes, adults with custody of at least one child aged 18 or younger will receive an automatic

See MoreBangladesh: NBR reminds taxpayers of PIT e-return deadlines

Bangladesh’s National Board of Revenue (NBR) has reminded taxpayers to submit their income tax returns through the electronic filing system by 30 November 2025. The authority urged individuals to file early to avoid last-minute congestion on the

See MoreUS: IRS extends tax relief for Missouri taxpayers impacted by storms, floods

The US Internal Revenue Service (IRS), in a release (MO-2025-03) on 17 November 2025, announced tax relief for individuals and businesses in parts of Missouri affected by severe storms, straight-line winds, tornadoes, and flooding that began on 30

See MoreAlgeria: MoF announces extended deadlines for global income tax, wealth tax filing declarations

Algeria’s Directorate General of Taxes under the Ministry of Finance has issued Circular No. 69/MF/DGI/LF.2025 on 10 November 2025, notifying taxpayers and tax offices of updated filing deadlines introduced by the Finance Law for 2025 for filing

See MoreLebanon: MoF extends CIT, income tax deadlines for 2023–24

Lebanon’s Ministry of Finance (MoF) issued Decision No. 899/1 and related measures on 29 October 2025, extending key filing and payment deadlines for corporate income tax (CIT) and income tax obligations for fiscal years 2023 and 2024. The

See MoreBrazil: Senate passes corporate minimum tax, dividend withholding measures

Brazil’s Senate passed Bill 1087/25 on 5 November 2025, which includes various tax measures for companies regarding corporate minimum tax and withholding tax. The tax measures are as follows: Reduction rules for minimum tax Bill 1087/25

See MoreTaiwan introduces business tax rules for influencers

Taiwan's Ministry of Finance's Taipei National Taxation Bureau has announced, on 13 November 2025, the implementation of new tax regulations specifically targeting individuals who earn income through online platforms, commonly known as

See MoreTaiwan: Ministry of Finance clarifies declaration of overseas income for households

The Taipei National Taxation Bureau of the Ministry of Finance in Taiwan stated, on 13 November 2025, that when taxpayers file their individual income tax returns, if the total amount of non-Republic of China (ROC) source income and income from Hong

See MoreMexico: SAT clarifies valid personal deductions for annual tax return

Mexico’s Tax Administration Service (SAT) has reminded taxpayers that they can claim personal deductions in their annual tax return for each fiscal year, provided the expenses meet all applicable requirements. This announcement was made on 10

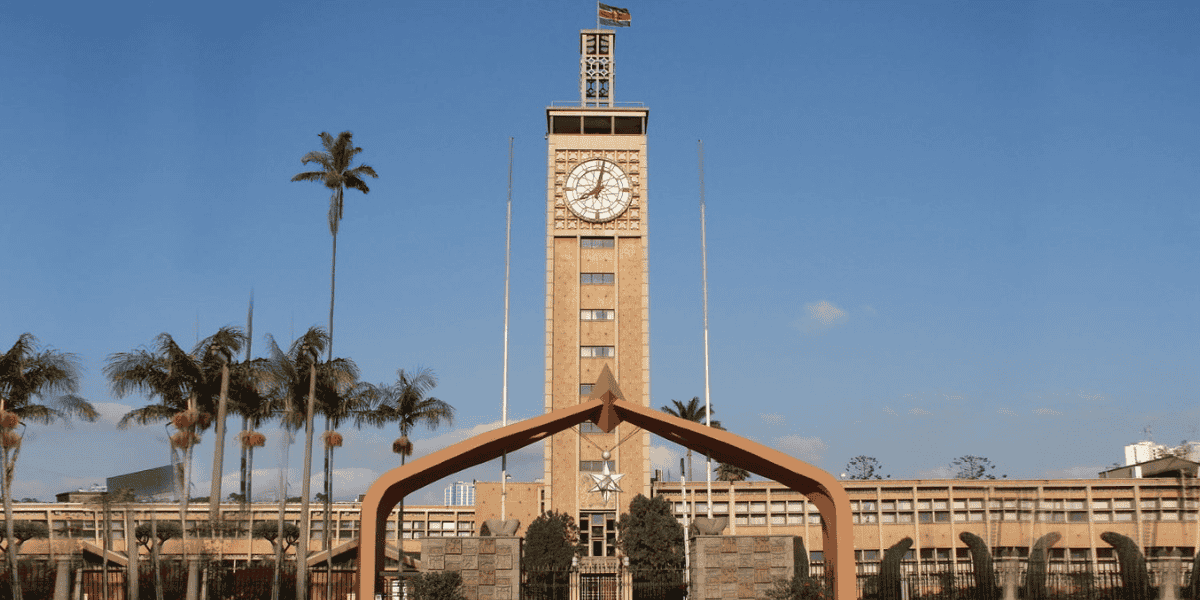

See MoreKenya: KRA to cross-check tax returns against official data sources

The Kenya Revenue Authority announced on 11 November 2025 that, beginning 1 January 2026, it will start cross-checking income and expenses reported in both individual and non-individual tax returns against specific data sources. Validation of

See MoreUS: Treasury Department discontinues direct file option for individual tax returns

The US Department of the Treasury issued a report to Congress in October 2025 regarding the replacement of the Direct File program for individual income tax returns. Initially launched during the 2024 tax filing season in 12 states, the program

See MoreArgentina: ARCA revises tax, customs payment terms

The Argentine Tax Authority (ARCA) has revised the conditions of the payment facility for outstanding tax and customs obligations, established initially under General Resolution No. 5711/2025 in June 2025. This announcement was made on 22 October

See MoreUS: Minnesota revises tax forms due to One Big Beautiful Bill Act (OBBBA) nonconformity

The US State of Minnesota has updated its draft tax forms and instructions for 2024 and 2025 to reflect federal tax changes from the One Big Beautiful Bill Act (OBBBA) passed in July 2025. However, as of 1 May 2023, Minnesota's tax code conforms

See More