Finland: Parliament reviews amendments to permanent establishment income allocation rules

Finland’s Parliament is reviewing draft bill HE 164/2025 vp, which proposes amendments to domestic regulations on attributing profits to permanent establishments on 12 November 2025. The proposal suggests amending the Income Tax Act, the Act on

See MoreCzech Republic confirms defence tax covered by double taxation treaty with Japan

The Czech Republic’s Ministry of Finance has announced, on 5 November 2025, that Japan’s recently introduced Special Corporation Tax for Defence will be recognised under the existing double taxation treaty between the two countries. According

See MoreLiberia: Government announces 2026 draft budget, introduces presumptive corporate income tax

Liberia’s Ministry of Finance and Development Planning delivered the draft national budget for 2026, on 11 November 2025, focusing on fostering an inclusive economy, safeguarding stability, and delivering real, tangible improvements for its

See MoreSlovenia updates corporate income tax rules for investment funds

Slovenia has amended its Corporate Income Tax Act (ZDDPO-2V), with the changes published in the Official Gazette No. 85/2025 on 6 November 2025. The revisions introduce new provisions for investment funds and clarify rules for asset transfers and

See MoreUAE: MoF updates administrative penalties for tax violations

The UAE Ministry of Finance has issued a consolidated version of Cabinet Decision No. 40 of 2017, which outlines administrative penalties for tax law violations, as updated by Cabinet Decision No. 129 of 9 October 2025. The updated decision

See MoreFinland: MoF consults on proposed amendments to the minimum tax act for large corporate groups

Finland’s Ministry of Finance has launched a public consultation on proposed changes to the Minimum Tax Act on 11 November 2025 to maintain compliance with the EU Minimum Tax Directive (2022/2523). The legislative change would ensure that

See MoreSlovak Republic publishes legislation to enact DAC9, Pillar 2 administrative guidance

The Slovak Republic published Law No. 291/2025 on 21 October 2025 in the Official Gazette on 10 November 2025, implementing Council Directive (EU) 2025/872 of 14 April 2025 (DAC9). DAC9 introduces rules that allow the central filing of the Top-up

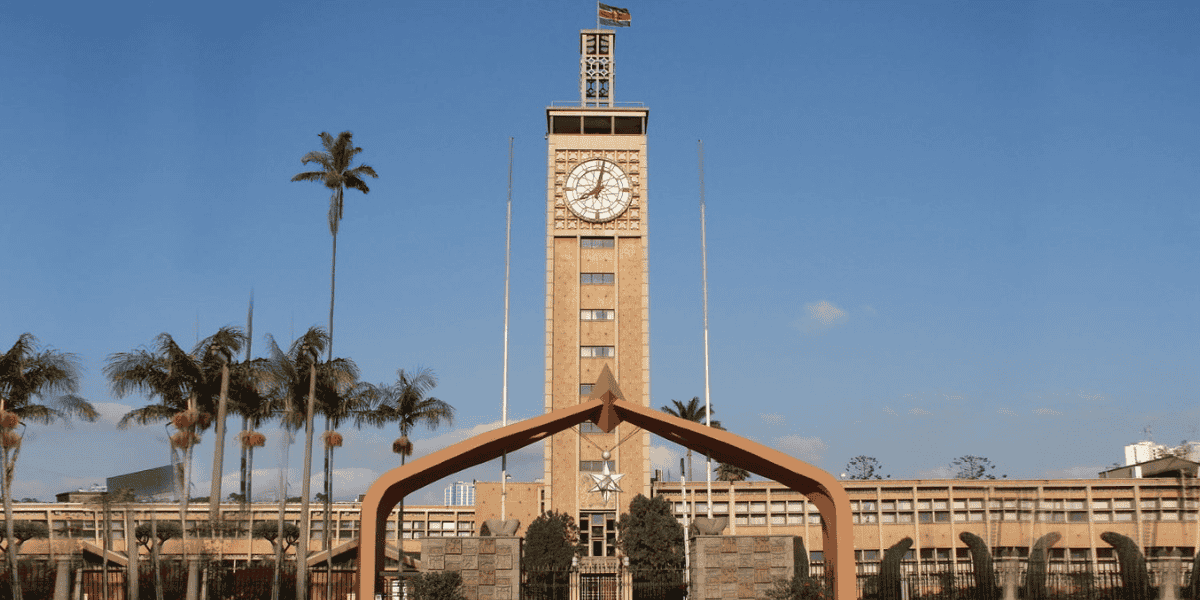

See MoreKenya: KRA to cross-check tax returns against official data sources

The Kenya Revenue Authority announced on 11 November 2025 that, beginning 1 January 2026, it will start cross-checking income and expenses reported in both individual and non-individual tax returns against specific data sources. Validation of

See MoreBrazil: RFB extends deadline for tax settlement programs

Brazil’s Federal Revenue Service (RFB) has extended the deadline for taxpayers to join tax settlement programs under Public Notices RFB No. 4/2025 and 5/2025 on 10 November 2025. The extension was formalised by Ordinance RFB No. 600/2025,

See MoreBrazil to make electronic tax domicile mandatory for all companies from 2026

As part of the Consumption Tax Reform (RTC), Brazil’s Federal Revenue Service announced that all legal entities will be required to use the Electronic Tax Domicile (DTE) as their official communication channel beginning 1 January 2026. Under

See MoreNetherlands: Government proposes aligned DAC9, DAC8 implementation date

The Netherlands government has submitted an amendment aligning the effective date of the DAC9 implementation bill (Directive 2025/872) with the bill introducing DAC8 (Directive 2023/2226). The updated amendment was released on the Ministry of

See MoreAustralia: ATO clarifies hybrid mismatch rules, updates guidance reflecting adoption of Pillar 2 framework

The Australian Taxation Office (ATO) has revised its guidance on the Hybrid Mismatch rules, clarifying how the provisions operate and when they are triggered on 4 November 2025. The key updates relate to Australia’s adoption of the Pillar Two

See MoreKenya: KRA launches automated payment plan for tax liabilities

The Kenya Revenue Authority has released a public notice announcing the rollout of automated payment plans for outstanding tax liabilities on 10 November 2025. Roll-out of Automated Payment Plan for Tax Liabilities The Kenya Revenue Authority

See MoreMalaysia: IRB issues guidance on taxation of asset-backed securitisations

The Inland Revenue Board of Malaysia has issued Public Ruling No. 3/2025 on 4 November 2025, clarifying the tax treatment of Asset-Backed Securitisation (ABS) transactions, including those related to sukuk structures. The ruling offers

See MoreItaly: MoF issues decree on global minimum tax return, payments

Italy’s revenue agency has announced, on 10 November 2025, that the Ministry of Finance’s Decree of 7 November 2025 has been issued, establishing the filing and payment requirements for the global minimum tax, including the Income Inclusion Rule

See MoreGermany: Bundestag approves draft law to implement DAC8 crypto reporting rules

Germany’s lower house of parliament (Bundestag) approved the draft law (KStTG) on 5 November 2025, aimed at implementing the EU’s DAC8 directive on the taxation of digital financial products, including crypto assets. Under the draft law,

See MoreArgentina: ARCA revises tax, customs payment terms

The Argentine Tax Authority (ARCA) has revised the conditions of the payment facility for outstanding tax and customs obligations, established initially under General Resolution No. 5711/2025 in June 2025. This announcement was made on 22 October

See MoreNigeria: FIRS calls on major taxpayers to adopt e-invoicing, electronic fiscal systems

Nigeria's Federal Inland Revenue Service (FIRS) issued a follow-up public notice on 6 November 2025, noting the steady progress recorded since the commencement of the National e-Invoicing and Electronic Fiscal System (EFS) on 1 August 2025. A

See More