Cameroon releases 2026 Finance Law, includes new rules for digital giants, green levies

Cameroon’s Ministry of Finance issued a circular on the execution of the 2026 Finance Law, providing guidance on its implementation and outlining the key tax measures introduced for the year. The circular outlines the mandatory instructions for

See MoreUS: Treasury, IRS release draft rules for clean fuel production credit under OBBB

The Department of the Treasury and the Internal Revenue Service (IRS) announced on 3 February 2026 the proposed regulations for domestic producers of clean transportation fuel to determine their eligibility for and calculate the clean fuel

See MoreNetherlands: Government coalition outlines 2026–2030 budgetary and tax changes, introduces new business contribution

The Dutch government’s incoming coalition released its agreement for the 2026–2030 term on 30 January 2026, along with an appendix outlining planned budgetary and tax changes. The proposals outline several notable shifts affecting businesses,

See MoreItaly extends investment tax credits for special economic zones, logistics zones

The Italian Revenue Agency announced on 2 February 2026 that it has approved new communication forms and guidelines for accessing tax incentives for investments in the country’s disadvantaged areas, following changes introduced in the 2026 Budget

See MoreEl Salvador announces benefits to encourage business expansions, tax credits range from 10% to 30%

El Salvador’s Legislative Assembly enacted Decree No. 498 on 16 January 2026, which took effect on 24 January 2026, with the aim to stimulate the national economy by offering tax incentives to established companies that increase their local

See MoreIsrael: MoF consults draft law to safeguard R&D tax benefits under global minimum tax rules

Israel’s Ministry of Finance launched a public consultation on 15 December 2025 on a draft memorandum aimed at keeping the country’s tax incentives competitive ahead of the introduction of a qualified domestic minimum top-up tax in 2026. The

See MoreItaly: Revenue agency introduces updated communication form for investment tax credits in simplified logistics zone areas

The Italian Revenue Agency has updated the supplementary communication form, along with the related instructions, for businesses seeking the investment tax credit available under the simplified logistics zone (ZLS) areas on 20 November 2025. The

See MoreUS: California enacts law for IRC provisions conformity, introduces R&D tax credits

California Governor Gavin Newsom signed Senate Bill 711 (SB 711) into law on 1 October 2025, bringing the state’s tax code into conformity with various Internal Revenue Code (IRC) provisions from 1 January 2015 through 1 January 2025. SB 711,

See MoreItaly: Council of Ministers approves 2026 draft state budget, multi-year budget for 2026-28

Italy's 2026 draft budget introduces a new three-year tax credit for businesses in SEZs, extends plastic and sugar tax exemptions until 2026, allocates EUR 100 million for SLZs, and refinances the Nuova Sabatini incentive. Italy’s Council of

See MoreItaly: MoF presents draft budget plan for 2026-28

Italy’s 2026 budget introduces a new three-year tax credit for businesses in SEZs, extends plastic, sugar, and tourist tax exemptions until 2026, allocates EUR 100 million for SLZs, and refinances the Nuova Sabatini incentive. Italy’s

See MoreUS: IRS updates reporting rules for research tax credit (Form 6765)

The updated Form 6765 now includes mandatory sections E and F for all taxpayers, while section G is optional for tax years before 2025 and mandatory starting in 2025. The US Internal Revenue Service (IRS) has introduced a revised Form 6765,

See MoreUS: Tax rule revisions ease concerns for clean energy investors, IRS clarifies tax credit phaseout

The Trump administration’s revised subsidy rules, effective 2 September, narrowed the “under construction” definition for solar and wind projects to qualify for a 30% federal tax credit, requiring substantial physical work while maintaining a

See MoreBrazil launches export support programme, extends incentives for small enterprises

Brazil has extended the REINTEGRA tax credit programme to micro and small exporters, allowing them to recover 0.1%–3% of export revenue in indirect taxes, with a 3% credit rate set for 2025–2026 and a review planned for 2027. Brazil’s

See MoreKorea (Rep.) unveils 2025 tax revision bill, enhances R&D credits

The 2025 tax reform bill aims to bolster strategic industries and welfare by introducing targeted tax credits for R&D, AI, and K-content, while streamlining corporate and capital gains taxes. South Korea’s Ministry of Economy and Finance

See MoreUS: IRS updates 2025 inflation adjustment and reference price for renewable energy credit

The IRS set the inflation adjustment factor for the Renewable Electricity Production Credit (REPC) at 1.9971 and the reference price for wind-generated electricity at USD 0.031 per kilowatt hour for the 2025 tax year. The US Internal Revenue

See MoreUS: Trump ends clean energy tax credits for wind, solar facilities

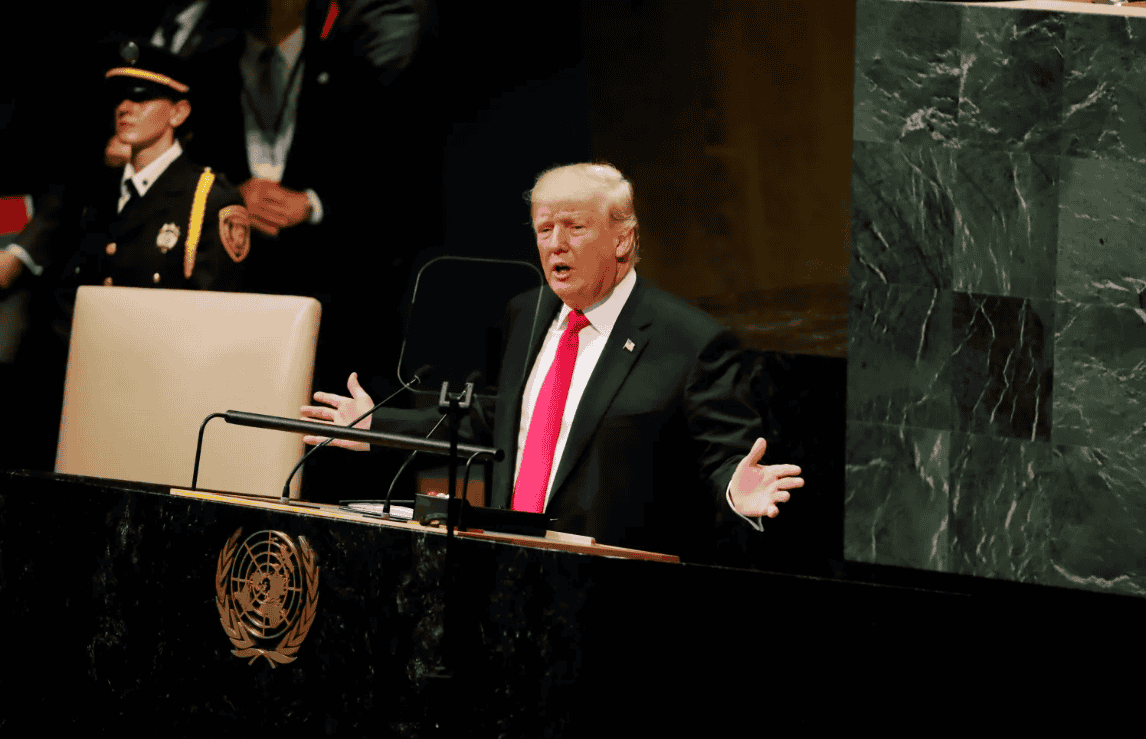

Federal agencies must report their actions to the White House within 45 days. US President Donald Trump signed an executive order directing the Interior Department to review and adjust policies that currently favour renewable energy over other

See MoreUS: Connecticut enacts 2026–27 budget with corporate tax changes, digital media incentive expansion

The H.B. 7287 and H.B. 7166 establish the 2026-2027 state budget and expand the tax credits for digital media and film infrastructure. Connecticut Governor Ned Lamont (D) signed H.B. 7287 and H.B. 7166, which set the 2026-2027 state budget and

See MoreUS to end electric vehicle tax credits on 30 September

The newly passed legislation will terminate the USD 7,500 tax credits for new EVs and USD 4,000 credits for used EVs by 30 September 2025. The US Congress approved the ‘One Big Beautiful Bill’ on 3 July 2024, which ends the USD $7,500 tax

See More