Cameroon releases 2026 Finance Law, includes new rules for digital giants, green levies

Cameroon’s Ministry of Finance issued a circular on the execution of the 2026 Finance Law, providing guidance on its implementation and outlining the key tax measures introduced for the year. The circular outlines the mandatory instructions for

See MoreUS: Treasury, IRS release draft rules for clean fuel production credit under OBBB

The Department of the Treasury and the Internal Revenue Service (IRS) announced on 3 February 2026 the proposed regulations for domestic producers of clean transportation fuel to determine their eligibility for and calculate the clean fuel

See MoreNetherlands: Government coalition outlines 2026–2030 budgetary and tax changes, introduces new business contribution

The Dutch government’s incoming coalition released its agreement for the 2026–2030 term on 30 January 2026, along with an appendix outlining planned budgetary and tax changes. The proposals outline several notable shifts affecting businesses,

See MoreItaly extends investment tax credits for special economic zones, logistics zones

The Italian Revenue Agency announced on 2 February 2026 that it has approved new communication forms and guidelines for accessing tax incentives for investments in the country’s disadvantaged areas, following changes introduced in the 2026 Budget

See MoreEl Salvador announces benefits to encourage business expansions, tax credits range from 10% to 30%

El Salvador’s Legislative Assembly enacted Decree No. 498 on 16 January 2026, which took effect on 24 January 2026, with the aim to stimulate the national economy by offering tax incentives to established companies that increase their local

See MoreFrance gazettes special budget law for 2026, ensures uninterrupted functioning of government operations

France’s government has published Law No. 2025-1316 of 26 December 2025 in the Official Gazette on 27 December 2025, authorising the State to continue collecting existing taxes to ensure the uninterrupted functioning of government operations until

See MoreIsrael: MoF consults draft law to safeguard R&D tax benefits under global minimum tax rules

Israel’s Ministry of Finance launched a public consultation on 15 December 2025 on a draft memorandum aimed at keeping the country’s tax incentives competitive ahead of the introduction of a qualified domestic minimum top-up tax in 2026. The

See MoreLuxembourg implements 2026 Budget Bill

Luxembourg has enacted the 2026 budget bill following its adoption by parliament. The full budget bill was published in the Official Gazette on 19 December 2025. The government has finalised the Law of 19 December 2025, introducing targeted

See MoreUS: Florida updates rules on corporate income tax conformity, addbacks

The Florida Department of Revenue has released TIP 25C01-01 on 1 December 2025, providing explanation on how Florida’s updated static conformity to the federal Internal Revenue Code, now effective from 1 January 2025, affects corporate income tax,

See MoreItaly: Revenue Agency restricts DTA tax credits for assignees to monetisation

Italy’s Revenue Agency clarified on 4 December 2025 that companies acquiring tax credits arising from the conversion of Deferred Tax Assets (DTA) cannot use these credits to offset or transfer them further and can only monetise them through

See MoreItaly: Revenue Agency sets banking foundations tax credit for 2025

Italy’s Revenue Agency has announced that banking foundations will receive a tax credit of 18.1982% for 2025 through the provision of 3 December 2025. The rate was calculated based on the ratio of available resources, equal to EUR 10 million,

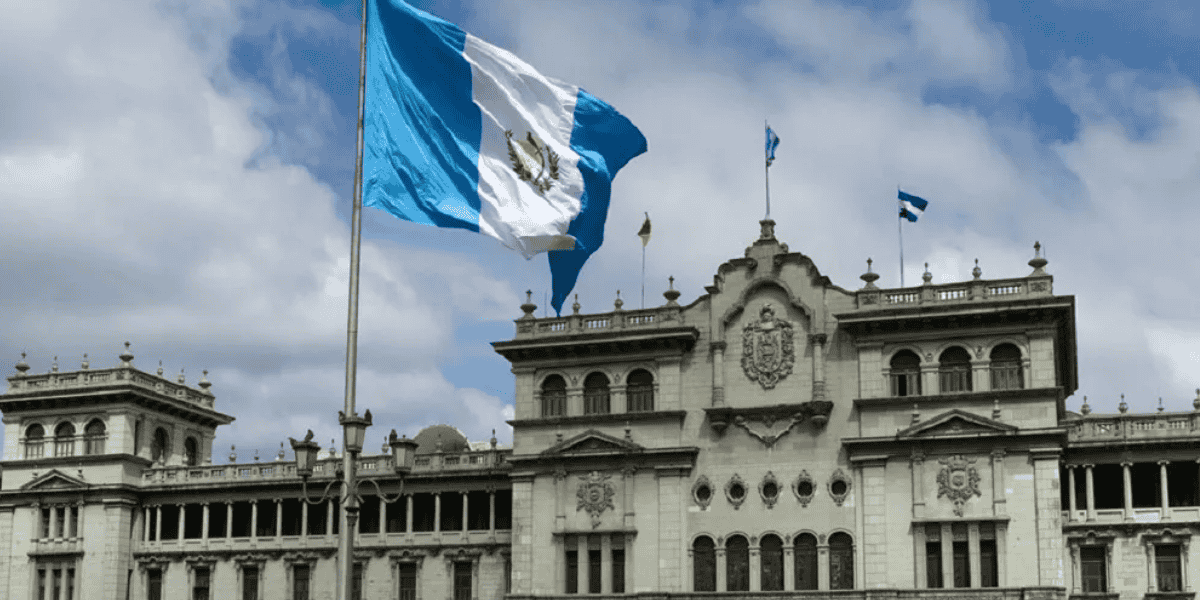

See MoreGuatemala revises regulations on tax credit offsets, refund procedures

Guatemala issued Decree No. 17-2025 in the Official Gazette, introducing amendments to the Tax Code, the Value Added Tax Law, and the Law on Legal Provisions for Strengthening Tax Administration. Decree 17-2025 establishes a new law intended to

See MoreCanada: Quebec government proposes various tax measures in 2025 fall economic update

Quebec’s Finance Minister presented the 2025 Fall Economic Update on 25 November 2025, outlining proposed tax measures affecting both businesses and individuals. The 2025 Fall Economic Update does not introduce any corporate or personal tax

See MoreItaly: Revenue Agency reminds taxpayers about deadline for transition 5.0 tax credit applications

Italy’s Revenue Agency has announced on 24 November 2025 that it published Decree no. 175/2025 in the Official Gazette as of 21 November 2025, in which it notified that companies have until 27 November 2025 to submit applications for the

See MoreAustralia: ATO cautions taxpayers on emerging barter credit tax risks

The Australian Taxation Office (ATO) released a notice on 17 November 2025, cautioning taxpayers to avoid tax schemes that use barter credits. ATO warns about barter credit tax scheme The Australian Taxation Office (ATO) is warning the

See MoreBrazil: Congress greenlights budget cuts, limits corporate tax credits

Brazil’s Congress approved a bill on 18 November 2025 aimed at curbing public spending and tightening rules on companies' use of tax credits. Among its key provisions, the law bars tax credit compensations that are not linked to a company's

See MoreItaly: Revenue agency introduces updated communication form for investment tax credits in simplified logistics zone areas

The Italian Revenue Agency has updated the supplementary communication form, along with the related instructions, for businesses seeking the investment tax credit available under the simplified logistics zone (ZLS) areas on 20 November 2025. The

See MoreCanada: Ontario unveils 2025 tax measures, maintains unchanged corporate tax rates

Ontario's Finance Minister released the 2025 Fall Economic Statement, also known as the “2025 Ontario Economic Outlook and Fiscal Review,” on 6 November 2025. It maintains corporate tax and personal income tax unchanged while introducing several

See More