US: IRS announces suspension of tax treaty with Russia

The US IRS has released Announcement 2024-26 regarding the suspension of the 1992 tax treaty with Russia. The suspension will take effect on 16 August, 2024, for taxes withheld at source and in respect of other taxes, and will continue until the two

See MoreCzech Republic: Supreme Court rules on royalty beneficial ownership

The Czech Republic’s Supreme Administrative Court issued a ruling on the concept of beneficial ownership concerning royalty payments. The case centred around Avon Cosmetics Limited, a UK company based in Northampton, which granted sublicenses

See MoreNetherlands: Parliament approves Curacao-Malta tax treaty

On 11 June, 2024, the Dutch House of Representatives approved the pending income tax treaty between Curacao and Malta. Member of Parliament and Curacaoan Minister for Foreign Affairs Bruins Slot, along with Curacaoan Secretary of State for Fiscal

See MoreUS: Treasury confirms suspension of tax treaty with Russia

On 17 June 2024, the US Department of Treasury announced that the United States had provided formal notice to the Russian Federation to confirm the suspension of the operation of Paragraph 4 of Article 1 and Articles 5-21 and 23 of the Convention

See MoreSwitzerland approves tax treaty protocol with Germany

On 14 June 2024, the Swiss Federal Council announced it adopted the dispatch on the protocol of amendment to the double taxation agreement (DTA) with Germany. The protocol adapts the DTA to various changes in the needs of the contracting states and

See MoreSwitzerland approves pending tax treaty with Angola

On 14 June, 2024, the Swiss Federal Council announced the dispatch of the approval of a double taxation agreement (DTA) with Angola. The agreement will create legal certainty for the further development of bilateral economic relations and tax

See MoreArmenia, Hong Kong to sign tax treaty

On 14 June 2024, Armenia’s government announced it approved plans to sign an income tax treaty with Hong Kong. If signed, this tax treaty will be the first between the two nations. The treaty aims to eliminate double taxation of income and prevent

See MoreIceland, Andorra tax treaty enters into force

As per a notice published in Andorra's Official Gazette, the income and capital tax treaty between Andorra and Iceland took effect on 10 May, 2024. The treaty, the first between the two nations, was signed on 28 February, 2023. The agreement

See MoreArgentina, Tunisia end tax treaty negotiations

According to a release from Argentina's Ministry of Foreign Affairs, International Trade, and Worship, officials from Argentina and Tunisia convened on 11 June 2024 to discuss an income tax treaty. Foreign Minister Diana Mondino and the

See MoreSpain confirms end of tax treaty with Kyrgyzstan

Spain’s Council of Ministers, through a statement, convened and approved an agreement recognising Kyrgyzstan's notice of termination of the 1985 tax treaty between Spain and the former Soviet Union on 11 June, 2024. This agreement was signed in

See MoreJapan, Kyrgyzstan considers negotiating tax treaty

As per a statement from the Ministry of Economy and Commerce of Kyrgyzstan, representatives from Japan and Kyrgyzstan met on 5 June, 2024, to discuss enhancing bilateral collaborations, which includes talks regarding an income tax

See MoreAustria, Russia suspends tax treaty

Austria's Ministry of Finance has issued a new Decree, on 30 May, 2024, superseding a previous Russian notice from December, 2023, regarding the suspension of the 2000 income and capital tax treaty. The decree reiterates the provisions affected

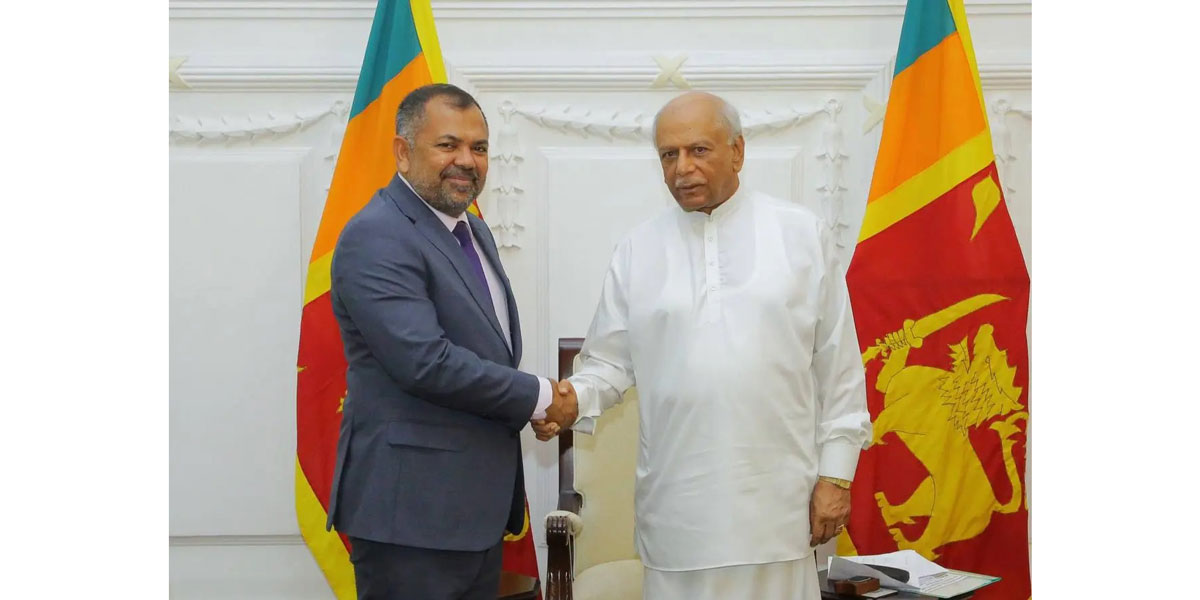

See MoreSri Lanka, Maldives to sign tax treaty

Officials from Sri Lanka and the Maldives met to discuss strengthening bilateral relations and cooperation, including the signing of an income tax treaty, on 6 June 2024. This follows after the Maldives ' Minister of Foreign Affairs, Moosa

See MoreIvory Coast, Korea (Rep.) fast-track tax treaty talks

Representatives from Ivory Coast and South Korea convened on 3 June, 2024, to enhance their bilateral ties, focusing on expediting talks for an income tax treaty. These negotiations, initiated in 2018, mark a step towards fostering economic

See MoreSwitzerland ratifies tax treaty with Slovenia

The Swiss Council of States, the upper house of parliament, approved the ratification of the 1996 income and capital tax treaty with Slovenia on 30 May, 2024. The protocol implements the minimum standards for double taxation agreements. Signed

See MoreUkraine: Parliament ratifies income tax treaty with Japan

The Ukraine parliament has approved the ratification of the pending income tax treaty with Japan on 5 June, 2024. It will come into effect 30 days after the exchange of ratification instruments, with application commencing from 1 January of the

See MorePakistan, Kuwait formalises MOU on avoidance of double taxation

Pakistan and Kuwait have agreed to formalise Memorandum of Understandings (MoUs) for collaboration in various areas. During the 5th Session of the Pakistan-Kuwait Joint Ministerial Commission; held from 28 – 30 May, 2024, in Kuwait; both

See MoreCzech Republic, UAE ratifies income tax agreement

The Czech Ministry of Finance, recently ratified the tax treaty with the United Arab Emirates. Effective starting 29 May 2024, the agreement aims to prevent double taxation. By reducing tax uncertainty and promoting fair taxation, the treaty will

See More