US: Senate fails to pass Taiwan double-tax relief bill

The US Senate failed to pass the legislation (H.R. 7024) featuring the US-Taiwan Expedited Double-Tax Relief Act on 1 August 2024. This legislation, known as the Tax Relief for American Families and Workers Act of 2024, aims to establish tax

See MoreRomania suspends tax treaty with Russia

Romania’s government passed a memorandum to suspend the 1993 income and capital tax treaty with Russia on 14 August, 2024. This decision follows after the Russian Ministry of Foreign Affairs, in a press release on 15 March 2023, declared to

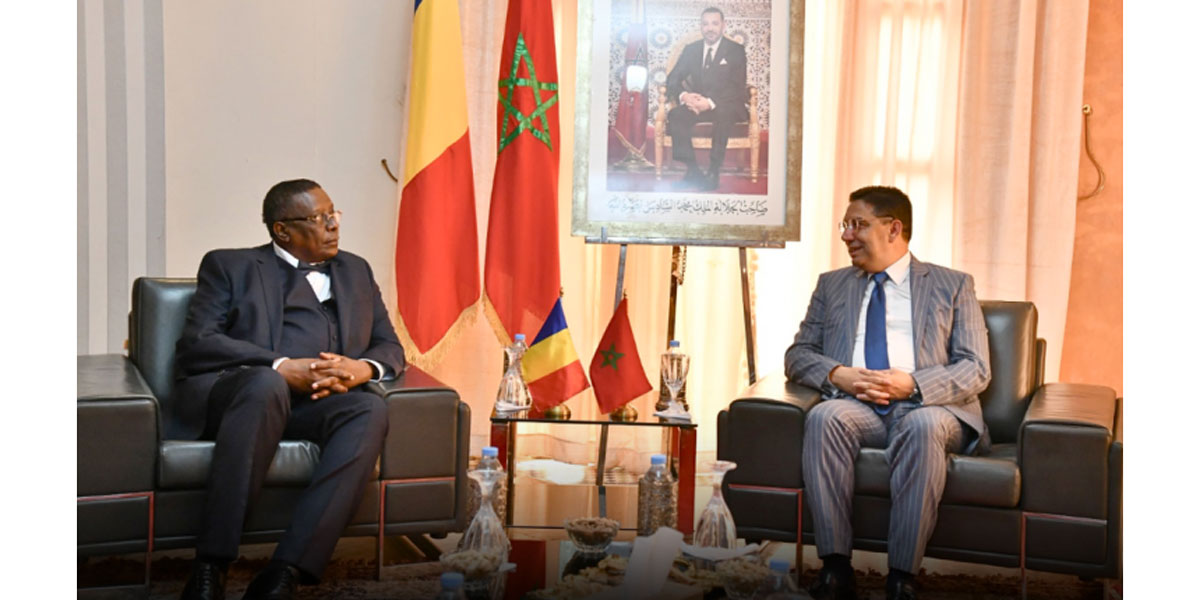

See MoreMorocco, Chad sign income tax treaty

Morocco and Chad have signed an income tax treaty on 14 August, 2024. This agreement is the first between the two nations. The tax treaty was signed by Minister of Foreign Affairs, African Cooperation and Moroccan Expatriates, Nasser Bourita, and

See MorePanama, Brazil negotiate income tax treaty

Panama's Ministry of Economy and Finance, in a release, stated that officials from Panama and Brazil convened, on 12 August 2024, to discuss the negotiation of an income tax treaty. Panama’s General of Revenue, Camilo Valdés Mora, and the

See MoreAndorra, Latvia approve signing of tax treaty

The Executive Council of the Principality of Andorra has approved signing an income tax treaty with Latvia following the conclusion of negotiations in January 2024. The tax treaty, the first between the two nations, aims to establish a convention

See MoreAndorra ratifies tax treaty with South Korea

The Principality of Andorra has announced the ratification of the income tax treaty with South Korea, the notice was published in the Official Gazette on 6 August 2024. The agreement aims to eliminate double taxation involving income taxes and

See MoreMontenegro ratifies tax treaty with Luxembourg

Montenegro published the law ratifying its pending income tax treaty with Luxembourg in the Official Gazette on 5 August, 2024. Earlier, the Parliament of Montenegro announced the passage of the law to ratify the income and capital tax treaty

See MoreUkraine, Mauritius to negotiate first income tax treaty

Officials from Ukraine and Mauritius met to discuss strengthening cooperation and agreed to start negotiations for an income tax treaty, according to a release published by the Ukrainian government. “Today in Port-Luis, I was honoured to be

See MoreAndorra ratifies income, capital tax treaty with Lithuania

Andorra has announced that it has ratified its income and capital tax treaty with Lithuania in its Official Gazette on 6 August, 2024. The treaty is set to take effect once the necessary ratification instruments are exchanged, with its provisions

See MoreFinland revises guidance on avoiding double taxation for legal entities

Finland’s tax administration announced that it released an updated version of its guidance (Guidance number VH/3968/00.01.00/2024) aimed at eliminating international double taxation for legal entities on 1 August, 2024. The instructions apply

See MoreTurkey, Mauritius begin income tax treaty negotiations

Turkey's Revenue Administration announced that the first round of negotiations for an income tax treaty with Mauritius took place via video conference between 30 July to 1 August, 2024. The negotiations, which were held under Deputy Chairman of

See MoreUK, Ecuador sign first income tax treaty

The United Kingdom and Ecuador signed their first ever income tax treaty on 6 August 2024. The agreement must now be ratified by both countries before it can enter into force. A tax treaty is a bilateral agreement between two countries to resolve

See MoreNew Zealand ratifies pending tax treaty with Slovak Republic

New Zealand published the Double Tax Agreements (Slovak Republic) Order 2024 on 29 July, 2024. The order, which comes into force on 29 August 2024, gives effect to the agreement between New Zealand and the Slovak Republic for the elimination of

See MoreNew Zealand publishes double tax agreement order for Austria

New Zealand has published the Double Tax Agreements (Austria) Order 2024, which facilitates the ratification of the protocol to the 2006 income tax treaty with Austria. This protocol, signed on 12 September 2023, marks the first amendment to the

See MoreKenya to revise tax treaties with Zambia, Germany, Iran

Kenya’s government has shown interest in restarting negotiations to revise its 1968 tax treaty with Zambia, the 1977 tax treaty with Germany, and the 2012 tax treaty with Iran. This follows after the Kenyan government decided to align its tax

See MoreUS: IRS clarifies mutual agreement procedure relief requirements under tax treaty with Germany

The IRS Office of Chief Counsel (OCC) issued a letter on 11 April, 2024, addressing an inquiry regarding the 1989 US-Germany income tax treaty. The letter outlines the requirements for obtaining tax relief under Article 25 (Mutual Agreement

See MoreMontenegro ratifies tax treaty with Luxembourg

The Parliament of Montenegro announced the passage of the law to ratify the income and capital tax treaty with Luxembourg on 31 July 2024. This treaty, signed on 29 January 2024, marks the first formal tax agreement between the two nations. This

See MoreSpain, Paraguay tax treaty enters into force

The Spain and Paraguay tax treaty will enter into force on 14 October 2024. Signed on 25 March 2023, the treaty will generally take effect on 14 October 2024 for other taxes and on 1 January 2025 for taxes assessed both on and off a fiscal year

See More