Armenia, Japan agree to sign tax treaty

Japan and Armenia have agreed in principle on the new income tax treaty between the two countries. The announcement was made in a press release by Japan’s Ministry of Foreign Affairs on 16 October 2024. This follows after Japan announced that

See MoreMauritius gazettes amending protocol to tax treaty with Bangladesh

Mauritius has gazetted the amending protocol (Government Notice No. 182 of 2024) to the 2009 Double Taxation Avoidance Convention (BM DTC) with Bangladesh. The amending protocol was signed by Mauritius on 5 February 2024 and sent to Bangladesh

See MoreLithuania approves income, capital tax treaty with Andorra

The Lithuanian government has approved the income and capital tax treaty with Andorra on 11 September 2024.This agreement aims to eliminate double taxation on income and capital, fostering closer cooperation between the tax administrations of both

See MoreParaguay, Spain income tax treaty enters into force

The income tax treaty between Paraguay and Spain took effect on 14 October 2024. This agreement aims to enhance economic relations, encourage investments, and enhance bilateral cooperation in tax matters between the two countries. It seeks to

See MoreAlgeria joins mutual assistance convention to combat tax evasion

Amel Abdellatif, Tax Commissioner of Algeria signed the Multilateral Convention on Mutual Administrative Assistance in Tax Matters (the Convention), as amended by the 2010 protocol, on 10 October 2024. The Convention must first be ratified

See MoreRomania approves protocol to tax treaty with Malta

Romania’s government approved the amending protocol to the 1995 income tax treaty with Malta on 9 October 2024. Earlier, the two nations signed an amendment protocol to the original income tax treaty on 4 July 2024. The protocol aligns the

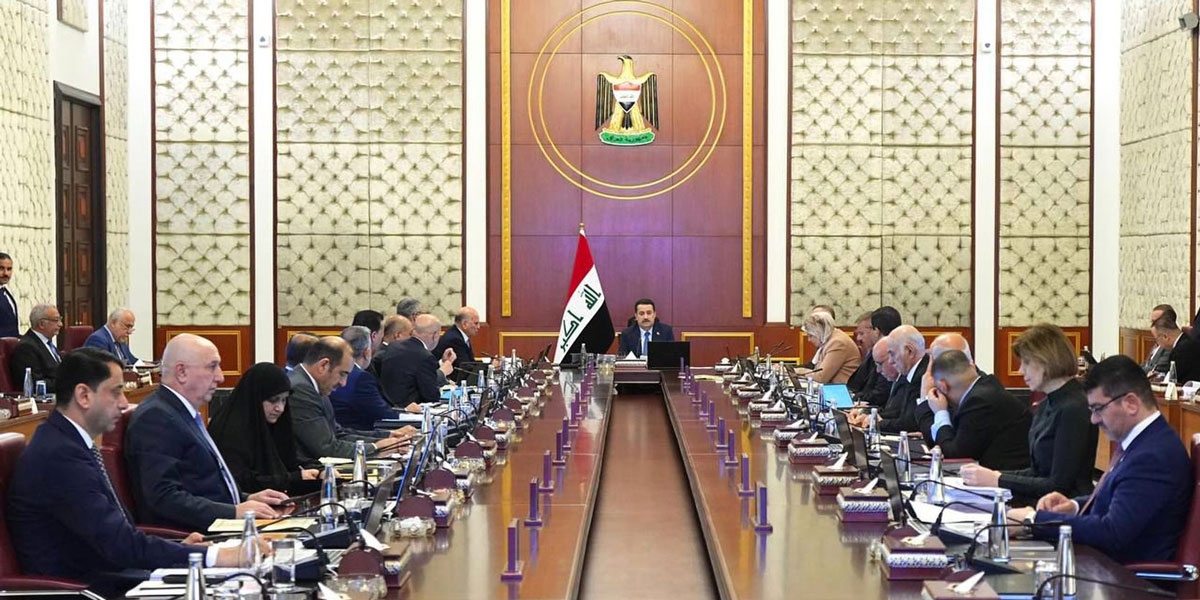

See MoreIraq: Council of Ministers terminate tax treaty negotiations with Croatia

Iraq’s Council of Ministers revoked its authorisation for tax treaty negotiations with Croatia on 1 October 2024. This decision nullifies earlier approvals granted under Decision No. 103 of 2023 and No. 23396 of 2023, which allowed the drafting

See MoreHungary, Serbia sign amending protocol to tax treaty

Hungarian and Serbian have signed an amending protocol to their income and capital tax treaty on 8 October 2024 in Budapest, as reported in a release from the Serbian Ministry of Finance on the same day. The protocol was signed by Norbert Izer,

See MoreIraq to negotiate income and capital tax treaty with Bulgaria

The Iraqi Council of Ministers approved the negotiation and signing of an income and capital tax treaty with Bulgaria on 1 October 2024. The council has authorised the Director General of the General Commission for Taxes to initiate discussions

See MoreJapan, Armenia to negotiate new tax treaty

The Japanese Ministry of Foreign Affairs announced yesterday that tax treaty negotiations between Japan and Armenia are set to begin on 9 October 2024. The two nations will initiate negotiations for the new convention replacing the current tax

See MoreCzech Republic ratifies tax treaty with Montenegro

Czech Republic’s President Petr Pavel enacted the law ratifying the pending income tax treaty with Montenegro on 1 October 2024. The treaty was signed by the two nations on 20 February 2024, aimed at preventing double taxation of income and

See MoreMoldova approves tax treaty protocol with Luxembourg

According to information published on its website, the Moldovan government approved the amending protocol to the Luxembourg-Moldova Income and Capital Tax Treaty (2007) on 2 October 2024. The protocol was signed 25 June 2024 in Luxembourg. It is

See MoreIreland enacts double taxation relief order, ratifying protocol with Jersey

Ireland has officially enacted the Double Taxation Relief (Taxes on Income) (Jersey) Order 2024, paving the way for the ratification of a protocol to its 2009 tax treaty with Jersey. This protocol, signed on 23 November 2023, represents the first

See MoreSaudi Arabia ratifies tax treaty with Qatar

Saudi Arabia's Shura Council ratified the income tax treaty with Qatar on 2 October 2024. Previously, Qatar and Saudi Arabia signed an income tax treaty on Thursday, 30 May, 2024. The treaty, which is a first of its kind between the two Gulf

See MoreSlovak Republic, Kyrgyzstan ratify income tax treaty

The Slovak Republic announced on 2 October 2024 that it had completed the ratification of the 2024 Kyrgyzstan—Slovak Republic Income Tax Treaty. This tax treaty is the first between the two countries to prevent double taxation and tax

See MoreArgentina approves pending tax treaty with Austria

Argentina's Chamber of Deputies approved the laws for the ratification of the pending income and capital tax treaties with Austria on 1 October 2024. This treaty aims to prevent double taxation between the two nations. Signed on 6 December

See MoreIreland ratifies income tax treaty with Oman

Ireland has officially released the Double Taxation Relief (Taxes on Income) (Sultanate of Oman) Order 2024, paving the way for the ratification of an income tax treaty with Oman. Previously covered, Officials from Ireland and Oman signed an

See MoreArgentina approves pending tax treaty with China

Argentina's Chamber of Deputies approved the laws for the ratification of the pending income and capital tax treaties with China on 1 October 2024. This income tax treaty aims to eliminate double taxation on income and capital, ensuring it does

See More